Most multifamily investors get torn between the decision to invest in a new home or purchase an old home. The allure of the new construction comes with a high initial investment, while the prospect of renovating old construction makes them fear the costs and mid-rentals.

We look at the various aspects of old and new constructions when it comes to multifamily investment and the pros and cons of both types of properties.

What to Expect?

- Deciding Between New Homes and Old Homes for Multifamily Real Estate Investing

- Advantages of Investing in New Home Multifamily Real Estate

- Advantages of Investing in Old Home Multifamily Real Estate

- Important Factors to Consider: New Homes vs. Old Homes Construction

- Risks and Rewards Multifamily Real Estate Investing

New Homes vs. Old Homes: The Unending Debate

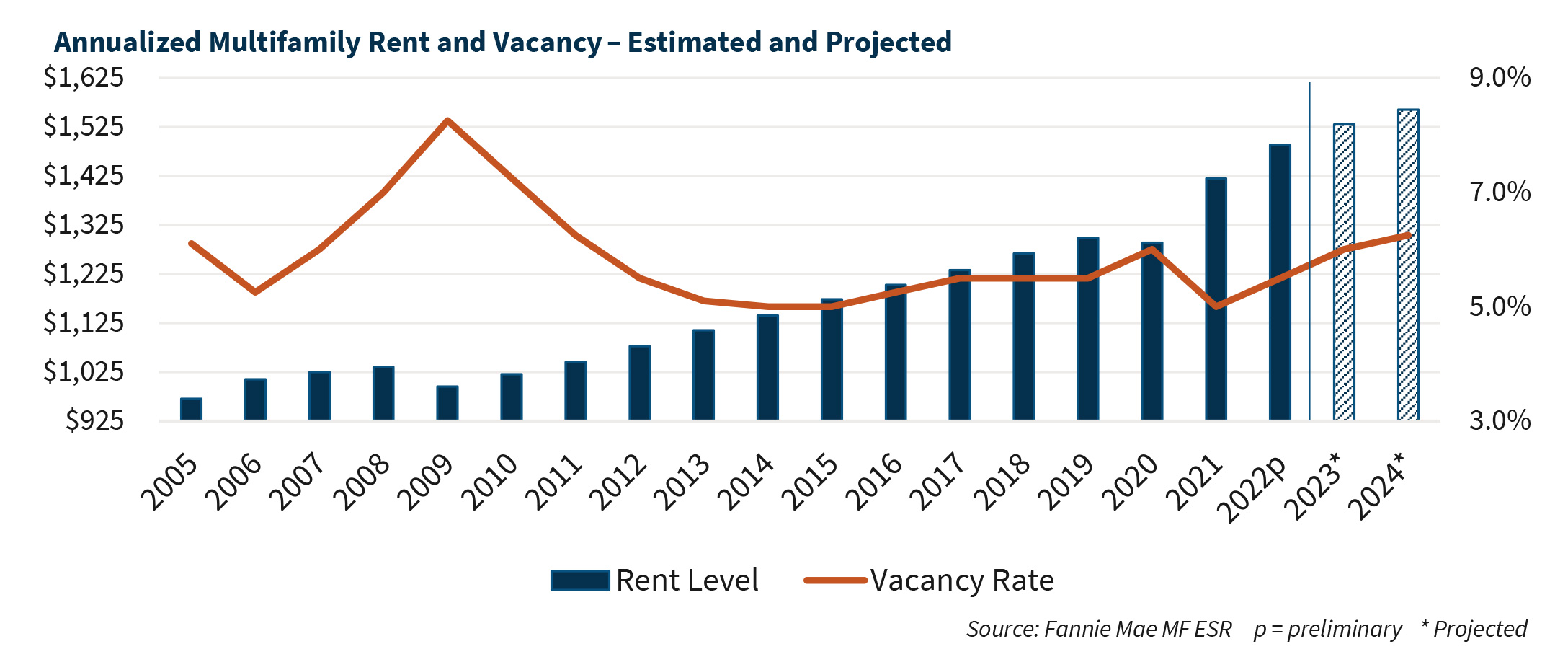

Image Source: Fannie Mae

Be it a multifamily real estate investing decision for beginners or seasoned investors, it is never an easy choice.

The selection you make should depend on various factors like location, demand, rental income, budget, etc. In a nutshell, make an informed and not an emotional decision. The choice you make will determine the outcome and long-term returns.

Studies and surveys show that people have moved away from emotional buying to informed buying considering financial, economic, and social factors. Here are the various factors and trends that demonstrate this:

|

Factor |

Trends/Statistics |

| Affordability | 58% of homebuyers cited affordability in 2020 (NAR). |

| Mortgage Rates | The average rate reached a historic low of 2.65% in Jan 2021. |

| Employment | 62% prioritized budget due to pandemic uncertainties. |

| Home Prices | Median prices rose by 15.8% YoY in 2021 (Fed). |

| Lifestyle Changes | 34% prioritized larger homes or outdoor space in 2021. |

| Information Access | Buyers empowered by social media and online platforms. |

New Home Multifamily Real Estate Investing Advantages

For easy understanding, let’s break it into various aspects of new homes vs. old homes. We first look at the benefits of investing in new construction in any of the various multifamily investment properties:

1. Appealing Aesthetics and Amenities

New multifamily properties are instantly appealing, no matter if you are an investor or a tenant. The reason is not hard to understand. They come with the latest amenities, have a gleaming finish, and offer comfortable living.

Be it 24×7 CCTV surveillance, state-of-the-art appliances, or luxurious amenities like swimming pools, play areas for kids, and clubhouses, new multifamily properties have them all.

2. Lower Maintenance Costs

As a Multifamily Real Estate Investor, you should always calculate or factor in the cost of maintenance. This may take a big chunk out of your rental income and affect the bottom line or cash flow.

According to a study by the National Apartment Association (NAA), the average maintenance cost for multifamily properties built before 1990 is approximately $550 per unit per year.

In contrast, newer construction properties (built after 2010) have significantly lower maintenance costs, averaging around $250 per unit per year, according to data from the Urban Land Institute (ULI).

An analysis conducted by RealPage, a real estate software and data analytics company, found that maintenance expenses for older multifamily properties increased by 8% between 2018 and 2020.

In contrast, maintenance expenses for newer construction properties remained relatively stable during the same period, experiencing only a 2% increase.

If you have an average multifamily property with 100 units, the total annual maintenance cost outlay that you will have to make for a pre-1990 construction would amount to $55,000. For a post-2010 construction property with the same number of units, the total annual maintenance cost outlay that you will have to make would be significantly lower at $25,000.

Less maintenance means fewer headaches for you and, most importantly, lower ongoing costs. As an investor looking at long-term gains, this can be a game-changer for you.

3. Energy-Efficient and Eco-Sustainability

Newer properties are often designed with energy-efficient features, attracting environmentally conscious tenants. You may also benefit from potential tax incentives for eco-friendly investments. Check with your multifamily real estate investment company or financial advisor.

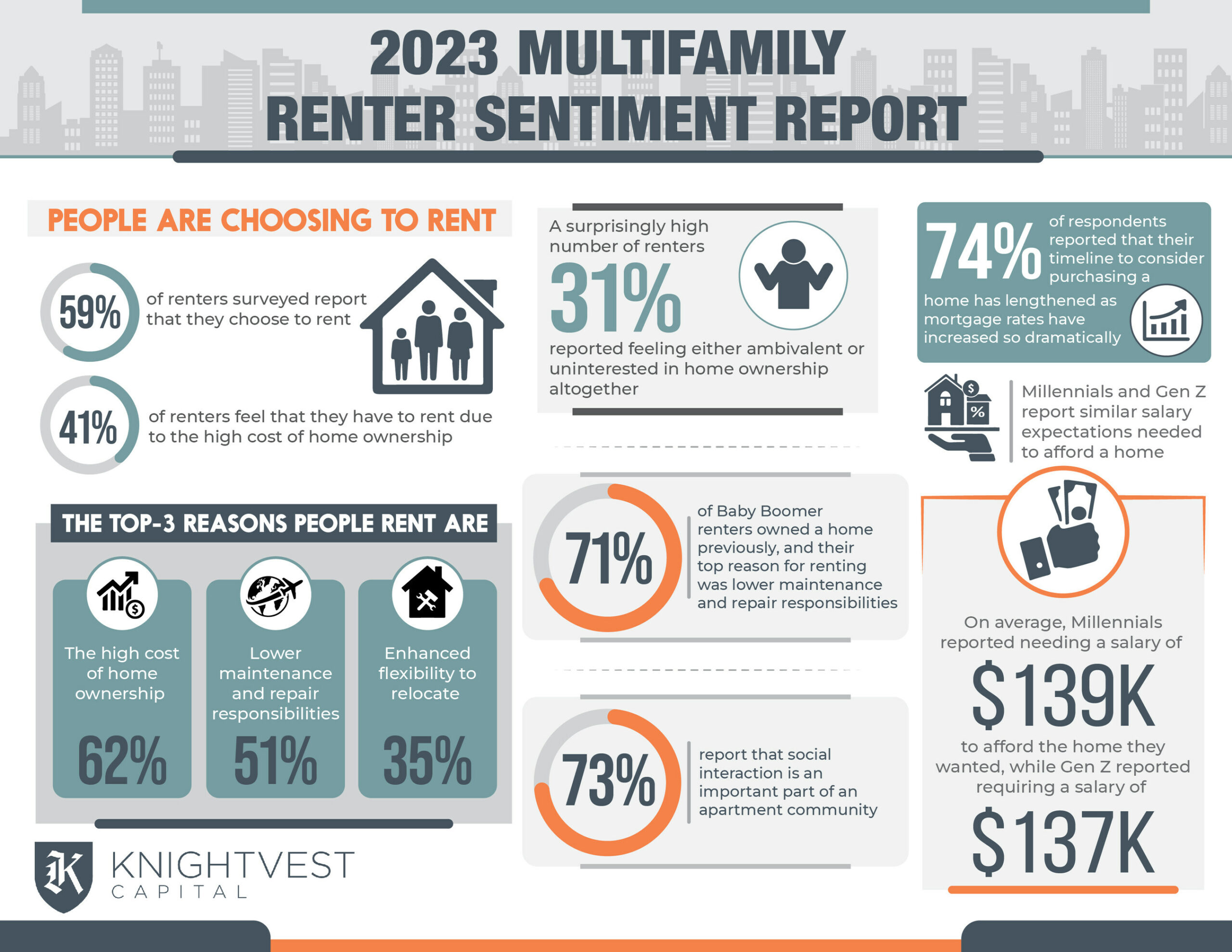

2023 Knightvest Multifamily Renter Sentiment Report Infographic

Image Source: Knightvest Capital

4. Higher Rental Income

As an investor, you want the best returns from your investment. This is where a new construction scores heavily over the old. A brand-new property with modern amenities can command higher rents.

Tenants are often willing to pay a premium for the comfort and convenience that comes with the latest in residential living.

|

Rank |

State |

Average Monthly Rent |

|

1 |

Hawaii |

$2,418 |

|

2 |

California |

$1,958 |

|

3 |

District of Columbia |

$1,901 |

|

4 |

New Jersey |

$1,850 |

|

5 |

Massachusetts |

$1,811 |

Source: Forbes

This table shows the rent prices for new multifamily properties in various cities and states across the US. Here are some of the reasons that the multifamily properties with new construction command higher rent:

- Modern Amenities

- High-Quality Construction

- New Technology Integration

- Sustainable Features

- Advanced Security Systems

- Ample Parking Spaces

- In-unit Amenities

- Contemporary Architectural Designs

- Wide Community Spaces

- Professional Management

- Regulatory Compliance

- Customization Options

- Brand-new Appliances

- Lifestyle Amenities

5. Low/No Repair Cost

Always factor in the cost of repairs and renovation when you are buying Multifamily Real Estate. With new construction, there is no immediate need for extensive repairs. Your property is ready to occupy or use from day one.

This allows you to focus on the business of making money rather than fixing leaks and cracks. You save time, dollars, and energy that are better utilized elsewhere.

Old Home Multifamily Real Estate Investing Advantages

1. Architectural Appeal

Old homes and property tell stories and appeal to people. Tenants are often attracted to the charm of intricate details and unique architecture. They value the history that whispers through the walls and acts as a powerful magnet. For those who want to live there and build a life, it is not just a property but a piece of living history.

Here are some examples that showcase how the architectural appeal of old constructions contributes to higher rent:

In London, areas like Kensington and Chelsea are known for their stunning Victorian and Georgian architecture. The historical significance and architectural charm of these buildings attract tenants who are willing to pay a premium for the opportunity to live in such prestigious addresses.

Closer home, neighborhoods like the West Village and Brooklyn Heights in New York City feature rows of brownstone townhouses with elegant stoops and intricate brickwork. These charming properties offer a unique blend of old-world charm and modern amenities, making them highly desirable among renters.

Or take Paddington and Surry Hills in Sydney, which have heritage-listed properties that feature charming facades, high ceilings, and period details that attract tenants who appreciate the blend of vintage charm and contemporary living.

2. Higher Post-Renovation Value

Don’t be deterred by the peeling wallpaper or the cracks in the walls. Trust us, the place may be worth a goldmine. To top that, renovating and upgrading an older property can only increase its value over time. It also acts as a magnet for a wide range of tenants seeking a blend of classic charm and modern comforts.

3. Lower Buying Cost

The price tag matters – for every buyer, and as an investor, you are no exception. Generally, older properties come with a more budget-friendly upfront or buying price. However, this is only for ordinary properties. Older homes when situated in desirable locations within sought-after neighborhoods can command a significant premium. This can result in accelerated appreciation of property value, benefiting you as an investor.

If you are an investor looking to test the multifamily waters, older properties offer a more accessible entry point. For seasoned investors looking to diversify their real estate and investment portfolio, these properties offer more value at a lower price.

4. Stability and Durability

Old doesn’t necessarily mean delicate. Many older properties were built with craftsmanship that withstands the test of time. While they may need a facelift or repairs, they often have a solid structure that modern constructions strive to match.

New Homes vs. Old Homes – Factors to Consider

Now that we’ve looked at and understood the pros and cons of both new and old construction, how do you make the decision? Here are some key factors that you must consider to make an informed decision about making a Multifamily Real Estate Investment.

1. Investment Goals

What’s the endgame?

Define your investment goals as the starting point. As an investor, are you looking for quick returns, long-term stability, or a mix of both?

Your goals would decide whether you should go for a new construction or an older construction.

2. Risk Tolerance

Risk is the name of the game, as every seasoned investor knows. The higher the risk, the higher the reward and vice-versa. Assess your risk tolerance, for investing not just in Multifamily Real Estate but in every type of investment.

New properties might offer shiny promises, while the charm of older properties lies in their ability to weather economic storms with solid and steady returns. If you are averse to higher risks, make an investment that offers the least risk with steady returns.

3. Market Trends and Demand

What’s the market saying? Carefully analyze the current trends and demand for Multifamily Real Estate in your target area. Sometimes, it’s not about old or new construction; it’s about what the market craves and demands. Here are the top and bottom cities by demand for Multifamily Real Estate :

|

Top Metros |

Share |

| 1. New York-Newark-Jersey City, NY-NJ-PA | 79.30% |

| 2. Seattle-Tacoma-Bellevue, WA | 73.60% |

| 3. Boston-Cambridge-Newton, MA-NH | 72.40% |

| 4. San Francisco-Oakland-Berkeley, CA | 69.90% |

| 5. Hartford-East Hartford-Middletown, CT | 66.90% |

| 6. Los Angeles-Long Beach-Anaheim, CA | 65.60% |

| 7. Miami-Fort Lauderdale-Pompano Beach, FL | 65.20% |

| 8. Washington-Arlington-Alexandria, DC-VA-MD-WV | 64.00% |

| 9. San Diego-Chula Vista-Carlsbad, CA | 62.40% |

| 10. Minneapolis-St. Paul-Bloomington, MN-WI | 61.60% |

| 11. Salt Lake City, UT | 60.50% |

| 12. San Antonio-New Braunfels, TX | 58.00% |

| 13. Baltimore-Columbia-Towson, MD | 57.00% |

| 14. Denver-Aurora-Lakewood, CO | 56.90% |

| 15. Richmond, VA | 56.80% |

|

Bottom Metros |

Share |

| 1. Oklahoma City, OK | 13.60% |

| 2. Memphis, TN-MS-AR | 19.00% |

| 3. Fresno, CA | 19.60% |

| 4. Cleveland-Elyria, OH | 22.00% |

| 5. Buffalo-Cheektowaga, NY | 23.70% |

| 6. Sacramento-Roseville-Folsom, CA | 24.40% |

| 7. Tulsa, OK | 25.00% |

| 8. Riverside-San Bernardino-Ontario, CA | 25.60% |

| 9. New Orleans-Metairie, LA | 25.60% |

| 10. Providence-Warwick, RI-MA | 26.50% |

| 11. Birmingham-Hoover, AL | 26.60% |

| 12. Las Vegas-Henderson-Paradise, NV | 29.60% |

| 13. Charlotte-Concord-Gastonia, NC-SC | 30.10% |

| 14. Cincinnati, OH-KY-IN | 33.60% |

| 15. Tucson, AZ | 34.60% |

Source: Construction Coverage

You can also consult a real estate consultant with experience in multifamily investment. They have reports on current trends and can offer you professional advice on the risks and potential benefits of your investment.

4. Budget Constraints

Money talks – as they say. As a smart investor, who makes decisions on facts not emotions, be realistic when you assess your budget constraints. You may have put your heart on it, but beware that the new property might demand a higher initial investment. You must also consider an older property as a viable alternative. It can offer a budget-friendly entry point for you in the multifamily investment game.

5. Long-Term Vision

Peering into the crystal ball, what do you see? You don’t have to be a soothsayer for that – just be practical. Consider your long-term vision for the investment.

New properties might dazzle in the beginning, but older properties often age like fine wine, gaining value over time. It may add more to your portfolio and financial returns over the years than a new property.

Multifamily Real Estate Investing – Risks and Rewards

Based on the discussion regarding the nuances of investing in real estate, specifically in the context of multifamily properties, here are the key points outlined:

- Beyond Numbers: Real estate investment, particularly in multifamily properties, encompasses more than just financial calculations. It involves weighing both the potential risks and rewards.

- Old vs. New Debate: The comparison between investing in old versus new multifamily properties is a longstanding one, each presenting its own set of challenges and opportunities.

- New Construction Attractiveness: Investing in new multifamily constructions is appealing due to the high demand in the market, however, this option comes with high initial costs.

- Benefits of Old Construction: Old constructions can offer good long-term investment opportunities. They provide a chance to connect with existing families, potentially ensuring loyalty and steady cash flow. These properties, however, have their own set of disadvantages like higher maintenance costs and outdated infrastructure.

- Financial and Emotional Decision: The choice between investing in new or old properties involves financial considerations as well as a “leap of faith.”

- Alignment with Goals and Vision: The ultimate aim is to select a property that not only meets your investment objectives but also fits your long-term vision for growth and engagement in the real estate market.

The decision between a new home and an old property is a financial choice you make. It is also a leap of faith at the heart of multifamily investing. Ultimately, it is about finding a property that aligns not just with your investment goals but also with your long-term vision.

Investing for Future

When it comes to multifamily investing, there’s no one-size-fits-all. You will have to balance numbers with emotions, and innovation with tradition.

It is always a good idea to check with seasoned multi-family investment companies that have a large portfolio of properties and clients. They can do the market research and provide you with the required market data to make an informed choice.

Disclaimer: Please note any information provided in this article is intended solely for educational purposes. It does not constitute financial advice for any investor. You are advised to consult with a qualified financial professional before making your investment decisions.