Source: Caisgroup

1. Introduction

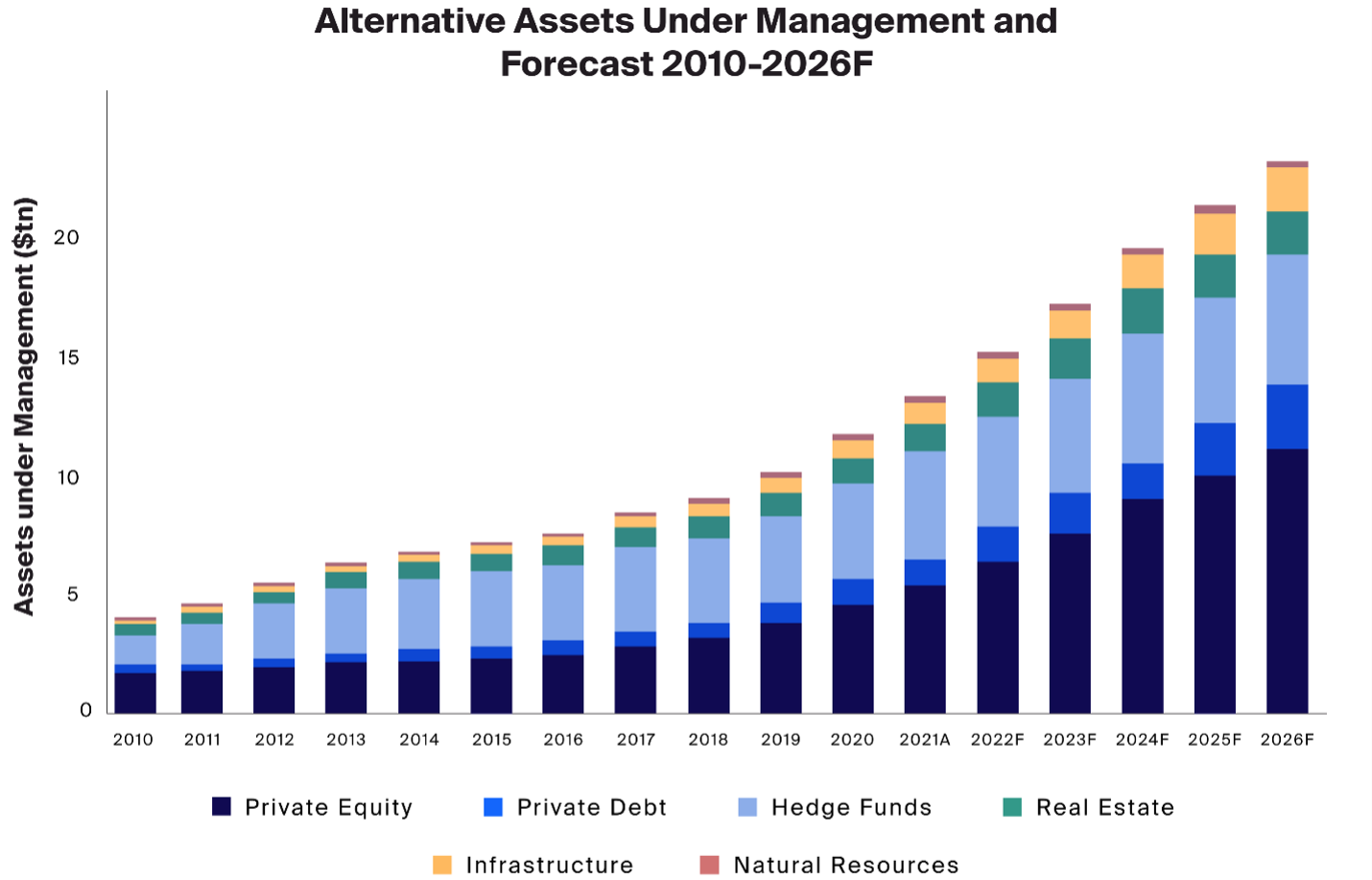

Alternative investments have gained significant popularity in recent years, contributing to a growing market estimated at over $13 trillion globally.

Unlike traditional investments, such as stocks, bonds, and cash, alternative investments encompass a wide range of assets, including real estate, private equity, hedge funds, commodities, collectibles, cryptocurrencies, and infrastructure investments.

Take the example of Peter Thiel, co-founder of PayPal, who invested $500,000 in Facebook in 2004 through his venture capital firm, Founders Fund. When Facebook went public in 2012, Thiel's investment was worth over $1 billion.

Similarly, a case of Chateau Lafite Rothschild in 1982 was purchased for around $5,000 in the early 2000s. By 2021, its value had surged to approximately $60,000, demonstrating the lucrative nature of investing in collectibles.

Key Takeaways

- Alternative investments include assets outside stocks, bonds, and cash that offer unique opportunities and potential returns.

- Diversifying your portfolio with alternative investments can reduce risk and enhance stability.

- You can diversify with different types of alternative assets such as real estate, private equity, hedge funds, and infrastructure investments.

- Benefits include high return potential, portfolio diversification, inflation hedging, and access to unique market opportunities.

- Always be aware of the challenges associated with alternative assets such as liquidity concerns, high fees, complexity, and market volatility.

- Thorough research and consulting with alternative investment advisors are crucial for making informed investment decisions.

- Employ strategies like proper portfolio allocation, risk management, and long-term perspective, to maximize the success of alternative investments.

- Utilize investment platforms and analytical tools, and start with modest allocations to gain experience before scaling up your alternative investment exposure.

1.1 What are Alternative Investments?

Alternative investments are financial assets that are outside the realm of traditional categories like stocks, bonds, and cash.

You can invest in tangible assets like real estate and commodities, as well as financial instruments like hedge funds, private equity, and cryptocurrencies.

Unlike traditional investments, these alternative assets often have a lower correlation with standard markets, and provide you diversification benefits and a potential for higher returns.

You can also check the CFA Institute's detailed report on alternative investments, including their characteristics and differences from traditional assets, refer.

1.2 Importance of Diversification

Diversification is a fundamental investment principle aimed at reducing your risk by spreading investments across various asset classes.

By incorporating alternative investments into your portfolio, you can achieve better diversification and reduce exposure to market volatility.

For instance, during the 2008 financial crisis, while global equity markets plummeted, certain commodities like gold saw significant gains.

Alternative investments provide you with unique opportunities and can act as a hedge against inflation and market downturns, ensuring that you have more stable long-term returns.

2. Exploring Types of Alternative Assets

These are the various types of alternative assets that you can invest in basis your preference and risk appetite, such as:

2.1 Real Estate

Real estate is a popular form of alternative investment, which offers you both capital appreciation and income generation.

Residential Real Estate: You can invest in residential properties, such as single-family homes, apartments, or condominiums, which provide rental income and long-term capital appreciation.

For example, properties in high-demand areas like San Francisco and New York have historically appreciated significantly, providing substantial returns on investment.

Commercial Real Estate: You can also consider investing in office buildings, shopping centers, industrial properties, and multifamily housing.

These commercial real estate investments of yours can generate higher rental yields along with tax advantages.

For instance, investing in commercial real estate in growing cities like Austin or Nashville has yielded impressive returns due to economic growth and increasing demand for office and retail spaces.

An Introduction to Alternative Investments - CAIS Group provides an insightful overview of various alternative assets, including real estate, private equity, and hedge funds, which can help you understand the risk and return profiles of these investments.

2.2 Private Equity

Source: Seekingalpha

With private equity, you invest directly in private companies, often through venture capital or buyouts.

Venture Capital: Venture capital funds invest in early-stage companies with high growth potential. For instance, Sequoia Capital's early investment in Google yielded extraordinary returns when the company went public.

Buyouts: Buyout firms acquire established companies, aiming to improve their operations and profitability before selling them at a higher value.

The Carlyle Group's acquisition of Hertz and subsequent sale for a substantial profit illustrates the potential of buyout strategies.

2.3 Hedge Funds

With hedge funds, you need to employ diverse strategies to generate returns, often aiming to perform well in various market conditions.

Long/Short Equity: In this strategy, you take long positions in undervalued stocks and short positions in overvalued stocks.

Market Neutral: Market-neutral strategies aim to balance long and short positions to reduce market risk. With these funds, you focus on generating alpha from stock selection rather than market movements.

2.4 Commodities

Commodities are tangible assets that include precious metals and agricultural products.

Precious Metals: Investing in gold, silver, and other precious metals provides you with a hedge against inflation and currency fluctuations. During economic uncertainty, gold prices often rise, offering you much-needed stability.

Agricultural Products: Consider investing in agricultural commodities like wheat, corn, and soybeans. These can provide you with both diversification and protection against inflation. The global demand for food products makes this a potentially lucrative investment.

2.5 Collectibles

Collectibles include rare and valuable items such as art, wine, and antiques.

Art: The art market can offer you significant returns. For example, the value of works by renowned artists like Banksy has skyrocketed, providing substantial profits for early investors.

Rare Wines and Spirits: Investing in rare wines and spirits can yield you impressive returns. A bottle of The Macallan 1926, for example, was sold for over $1.9 million in 2019, highlighting the potential of this niche market.

2.6 Cryptocurrencies

Cryptocurrencies are digital assets that utilize blockchain technology.

Bitcoin:The first and most well-known cryptocurrency, Bitcoin, has seen exponential growth since its inception. Early adopters who invested in Bitcoin when it was valued at a few dollars per coin have seen extraordinary returns, with prices reaching over $60,000 in recent years.

Ethereum: Ethereum, another major cryptocurrency, offers you unique features such as smart contracts and decentralized applications. Its value has also surged, providing substantial returns on investment.

2.7 Infrastructure Investments

Infrastructure investments involve financing large-scale public projects.

Transportation: You can invest in transportation infrastructure, such as toll roads and airports. They can provide you with stable, long-term returns.

Energy: Energy infrastructure investments, such as wind farms and solar power plants, offer you the opportunities for both a steady income and capital appreciation. The growth of renewable energy projects has made this a particularly attractive investment area.

3. Advantages of Alternative Investments

These are some of the pros or benefits of alternative investments:

3.1 Potential for High Returns

Alternative investments offer you the potential for higher returns compared to traditional investments. This is particularly true for investments that target emerging markets or innovative sectors.

According to a study, The Potential of Alternative Investments as an Asset Class - Emerald Insight, alternative investments such as hedge funds and private equity have shown the potential for high returns, making them attractive options for diversifying portfolios.

3.2 Diversification Benefits

Adding alternative investments to your portfolio can significantly enhance diversification. These assets often have a low correlation with traditional markets, providing a buffer against volatility.

Portfolio Stability: During the 2008 financial crisis, many traditional investments plummeted, but certain alternative assets, like gold, provided stability.

Reduced Volatility: Diversifying with alternatives can smooth out the ups and downs in your investment portfolio, offering more consistent returns over time.

3.3 Inflation Hedge

Many alternative investments act as a hedge against inflation. Real assets, such as real estate and commodities, tend to retain their value even as prices rise.

Real Estate: Property values typically increase with inflation, providing you with a natural hedge. Rental income also tends to rise with inflation, maintaining the purchasing power of your investment.

Commodities: Commodities like gold and silver are often sought after during inflationary periods, as they tend to hold their value when fiat currencies decline.

3.4 Access to Unique Opportunities

Alternative investments can provide access to unique opportunities that aren't available in traditional markets. This includes investing in niche markets and innovative sectors.

Niche Markets: Investing in rare wines, art, or other collectibles can offer substantial returns and portfolio diversification.

Innovative Sectors: Venture capital allows you to support and benefit from emerging technologies and startups, which can grow exponentially.

3.5 Low Correlation with Traditional Assets

Market Decoupling: Many alternative assets, such as private equity and hedge funds, often move independently of stock and bond markets, enhancing the overall stability of your portfolio.

Crisis Resilience: During financial crises, alternatives like farmland and infrastructure investments have shown resilience, maintaining value when traditional markets falter.

3.6 Potential for Tax Benefits

Tax-Advantaged Structures: Certain alternative investments, like real estate or certain types of private equity, offer you various tax benefits such as depreciation deductions and deferred capital gains.

Estate Planning: You can also use some alternative assets, such as art and collectibles, in estate planning to reduce estate taxes while preserving value.

3.7 Income Generation Opportunities

High-Yield Investments: Many alternative assets, including real estate investment trusts (REITs) and private debt, can provide you with steady income streams through dividends or interest payments.

Diversified Income Sources: Include assets like infrastructure or royalties in your portfolio to enhance your income stability and reduce reliance on traditional income sources.

3.8 Innovation and Growth Potential

Technology and Startups: Investing in technology startups or biotech firms can offer you exposure to groundbreaking innovations with high growth potential.

Sector Diversification: Alternative assets allow you to diversify into sectors like renewable energy or healthcare, which may offer substantial growth opportunities.

3.9 Enhanced Portfolio Resilience

Crisis Diversification: Assets like timber and infrastructure tend to be less volatile and can provide you with steady returns even during economic downturns.

Risk Mitigation: Diversifying into non-correlated assets helps you mitigate risks and reduces the impact of market swings on your overall portfolio.

3.10 Opportunity for Professional Management

Expertise Access: Many alternative investments are managed by professionals with deep industry knowledge. They can provide you with expert management and access to sophisticated investment strategies.

Specialized Funds: Another good option you can explore is the funds that focus on specific alternative assets, like hedge funds or private equity. These are managed by experts who have the skills to navigate complex markets effectively.

4. Risks and Challenges of Alternative Assets

These are some of the cons and risks of investing in alternative assets:

4.1 Liquidity Concerns

One of the primary risks associated with alternative investments is their lack of liquidity.

Unlike stocks and bonds, which you can sell quickly on public exchanges, alternative assets can be more challenging to sell.

Time to Sell: It can take months or even years for you to find a buyer for certain alternative investments, such as real estate or private equity stakes.

Market Conditions: In a downturn, finding buyers for illiquid assets can be particularly difficult for you, potentially leading to significant losses.

The report Alternative Investments: Risks and Opportunities - JPMorgan highlights the liquidity concerns and other risks associated with alternative investments, emphasizing the importance of understanding these challenges before investing.

4.2 High Fees and Costs

Alternative investments often come with higher fees and costs compared to traditional investments. These can eat into your overall returns.

Management Fees: Hedge funds and private equity funds typically charge high management fees, sometimes as much as 2% of assets under management plus 20% of profits.

Transaction Costs: Buying and selling alternative assets can involve substantial transaction costs, including legal fees, appraisal costs, and brokerage fees that again impact your profits.

4.3 Lack of Regulation

Many alternative investments operate in less regulated markets, which can increase the risk of fraud and mismanagement.

Fraud Risk: Less regulation can expose you to fraud and Ponzi schemes. For example, the collapse of Bernie Madoff's Ponzi scheme highlighted the risks associated with lack of oversight.

Transparency Issues: You may also find it challenging to get accurate and timely information about your investments, which can lead to potential losses.

4.4 Complexity and Knowledge Requirements

Investing in alternative assets requires you to have specialized knowledge and expertise.

Due Diligence: You need to properly evaluate alternative investments, which can only come from extensive research and understanding of the specific market.

Expertise Needed: Without the necessary expertise, you might make poor investment choices, leading to significant financial losses.

4.5 Market Volatility

The alternative investments that you make can be subject to significant market volatility, which can result in substantial fluctuations in value.

Cryptocurrencies: For example, the value of Bitcoin and other cryptocurrencies can swing wildly, leading to large gains or losses in a short period.

Commodities: Commodity prices can also be highly volatile, influenced by factors such as geopolitical events, weather conditions, and market speculation.

By understanding the advantages and risks associated with alternative investments, you can make more informed decisions and strategically diversify your portfolio.

However, consulting with a financial advisor is crucial to navigating this complex landscape effectively.

5. Strategies for Successful Alternative Investing

Navigating the world of alternative investments requires you to have a strategic approach to maximize returns and minimize risks.

You need effective strategies to enhance your investment success.

Here are the key tips to help you make the most of alternative assets and achieve your financial goals:

5.1 Research and Due Diligence

Before diving into alternative investments, you need to do thorough research.

The complexity and unique nature of these investments means that you need to understand the specifics of each asset class.

In-depth Analysis: You must investigate the asset, its market, and historical performance. Once you understand the fundamentals you will be able to make informed decisions.

Consult Professionals: Try to engage with alternative investment advisors who have the expertise to guide you. Their experience and insights can be invaluable in helping you navigate the complexities of alternative assets.

Global Private Markets Review 2022 - McKinsey & Company provides valuable insights into the importance of thorough research and due diligence when investing in alternative assets, underscoring the need for professional guidance.

5.2 Portfolio Allocation

By allocating a portion of your portfolio to alternative investments, you can make it diversified and boost returns.

Balanced Approach: Consider allocating 10-20% of your portfolio to alternative investments. This balance can ensure that you gain the benefits without overexposing your portfolio to risk.

Regular Review: Continuously monitor your portfolio allocation to ensure it aligns with your investment goals and risk tolerance.

You can check Alternative Investing – BlackRock that offers insights on alternative investing and discuss effective portfolio allocation strategies, including the benefits of diversifying across different types of alternative assets.

5.3 Risk Management

Mitigating risks is crucial in alternative investing. Employ strategies to protect your investments and minimize potential losses.

Diversify Within Alternatives: You can spread your investments across different types of alternative assets to reduce risk. For example, allocate funds to real estate, hedge funds, and commodities.

Hedge Strategies: Make use of hedging techniques, such as options and futures, to protect your investments against adverse market movements.

Alternative Investments and Portfolio Diversification - Brookings Institution explores various risk management strategies for alternative investments, highlighting how these assets can be used to mitigate portfolio risks.

5.4 Long-Term Perspective

Adopting a long-term investment horizon can be beneficial for you as alternative investments often require time to mature.

Patience Pays Off: Many alternative investments, like private equity and real estate, can take years to realize significant returns. Patience and a long-term perspective are essential for you to achieve this.

Reduce Short-Term Volatility: A long-term outlook helps to smooth out short-term market fluctuations, leading to more stable returns for you over time.

5.5 Stay Informed

Keep up with market trends and developments for successful alternative investing.

Continuous Learning: Stay updated with the latest news and trends in the alternative investment space. This knowledge will help you make informed decisions and adapt to changing market conditions.

Stay informed about market trends and developments is crucial for successful alternative investing, as discussed in the paper Past, Present, and Future of Sustainable Finance - Annals of Operations Research.

5.6 Start Small

Starting small allows you to gain experience and understand the dynamics of alternative investments without taking on excessive risk.

Gradual Increase: You can begin with a modest allocation to alternative assets and gradually increase exposure as you gain more experience and confidence.

Learn and Adjust: Use your initial investments as a learning experience, and adjust your strategies based on your observations and results.

5.7 Leverage Technology

Utilize advanced tools and platforms that can provide you with better insights and access to alternative investments.

Investment Platforms: Use online investment platforms that offer access to alternative assets and detailed market analysis.

Analytical Tools: Employ financial tools and software to analyze market trends and asset performance effectively.

5.8 Focus on Quality

Investing in high-quality assets and reputable funds can reduce your risks and enhance returns.

Reputable Funds: Choose funds with a strong track record and transparent management practices.

High-Quality Assets: Prioritize investments in well-researched and high-quality assets to minimize potential losses.

5.9 Network with Experts

Building connections with industry professionals can provide you with valuable insights and guidance.

Industry Events: Attend industry conferences and events to meet experts and learn from their experiences.

Investment Groups: Join investment groups or clubs to share knowledge and gain different perspectives on alternative investments.

5.10 Regularly Rebalance

Periodically reviewing and adjusting your portfolio ensures it remains aligned with your goals and market conditions.

Performance Review: Regularly evaluate the performance of your alternative investments and their impact on your overall portfolio.

Adjust Allocation: Make necessary adjustments to maintain your desired allocation and optimize performance based on market changes.

Conclusion

Alternative investments offer numerous advantages, from high return potential to portfolio diversification. However, they come with their own set of risks and challenges.

By employing strategies such as thorough research, proper portfolio allocation, effective risk management, and maintaining a long-term perspective, you can navigate these complexities successfully.

Remember, consulting with a financial advisor or an alternative investment professional can provide tailored advice that aligns with your specific financial goals.

Through careful planning and informed decision-making, you can leverage alternative investments to build a robust and resilient portfolio, positioning yourself for long-term financial success.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

Q. What are alternative investments and how do they differ from traditional investments?

A. Alternative investments include assets like real estate, private equity, and commodities. They differ from traditional stocks and bonds and are less liquid and more complex.

Q. How can alternative investments enhance my portfolio's diversification?

A. By adding alternative investments, you can reduce exposure to market volatility and spread risk across various asset classes.

Q. What are the potential risks associated with alternative investments?

A. Risks include liquidity concerns, high fees, lack of regulation, and the need for specialized knowledge.

Q. How do I determine the right allocation of alternative investments in my portfolio?

A. A balanced approach would be allocating 10-20% of your portfolio to alternative assets. However, it should align with your investment goals and risk tolerance.

Q. Why is a long-term perspective important in alternative investing?

A. Many alternative investments require time to mature and yield significant returns, making patience and a long-term outlook essential.

Q. What are some effective risk management strategies for alternative investments?

A. Effective strategies include diversifying within alternative assets, using hedging techniques, and continuously monitoring your investments.

Q. Why should I consult with a financial advisor for alternative investments?

A. A financial advisor provides tailored advice, helping you navigate the complexities of alternative investments and align them with your financial goals.