Source: Pregin

1. Introduction

The global alternative investment market has seen substantial growth over the past decade. As of 2023, it is estimated to be worth around $13 trillion, with projections suggesting it could reach $21 trillion by 2027.

Alternative investments encompass a wide range of asset classes outside traditional investments like stocks, bonds, and cash. These include private equity, hedge funds, real estate, commodities, and increasingly, cryptocurrencies.

These asset classes deliver robust returns and portfolio diversification, making them an attractive option for those looking to diversify their portfolios and reduce risk.

Key Takeaways

- Alternative investments offer high potential returns and diversification benefits.

- Thorough research and due diligence are essential before investing in alternative assets.

- Consulting with professionals can enhance investment strategies and mitigate risks.

- Setting clear investment goals helps align your portfolio with financial aspirations.

- Regularly monitoring and adjusting your portfolio is crucial for maintaining performance.

- Understanding and complying with regulatory frameworks is vital for safeguarding investments.

- Staying informed about market and regulatory changes helps you make better investment decisions.

2. Importance of Diversification in Investments

Diversification is a cornerstone of any effective investment strategy.

You can mitigate risk and enhance potential returns by spreading your investments across various asset classes, sectors, and geographies.

When it comes to your alternative investments, diversification plays an even more critical role due to the unique characteristics and risk profiles of these assets.

2.1. Risk Management

One of the primary benefits of diversification is risk reduction.

Traditional markets are susceptible to economic downturns, geopolitical events, and other systemic risks.

However, your alternative investments often have a low correlation with traditional assets, meaning their performance does not necessarily follow the same patterns.

Also, diversification in alternative investments can lead to improved returns.

By allocating capital to various alternative assets, you can capitalize on different growth opportunities.

2.2. Historical Perspective

The concept of diversification is not new, but its importance has been underscored time and again during market downturns.

Take the 2008 financial crisis, for example. Traditional equity markets plummeted, causing significant losses for many investors.

However, those who had diversified into alternative assets like commodities, real estate, and hedge funds managed to cushion the blow.

Gold prices, for instance, surged as investors sought safe-haven assets, demonstrating the protective nature of alternative investments.

According to the CFA Institute on Diversification’s analysis, spreading investments across different asset classes can significantly reduce risk and stabilize returns.

2.3. Real-Life Success Stories

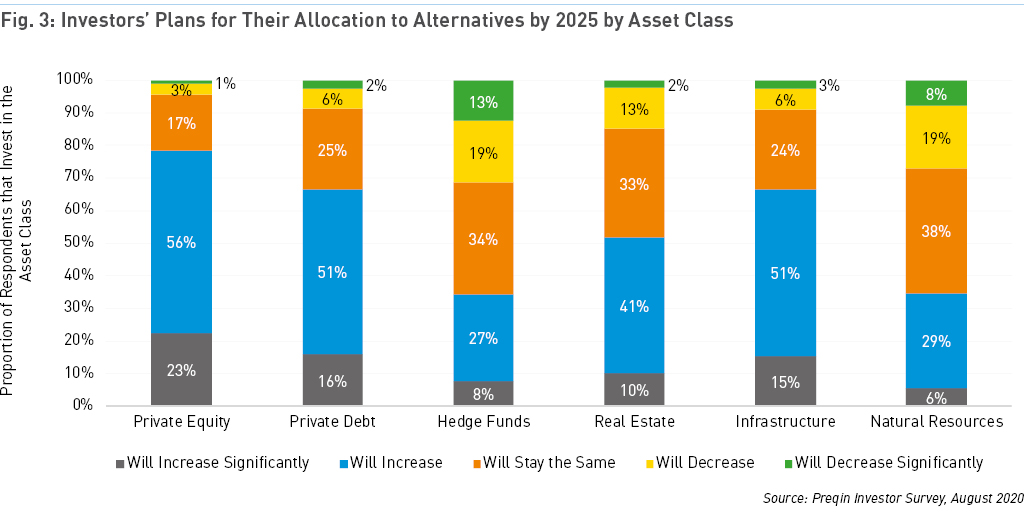

2.3.1. Case Study: Yale Endowment Fund

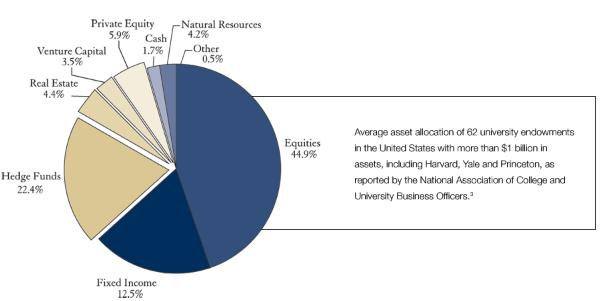

The Yale Endowment Fund is a prime example of successful diversification in alternative investments.

Under the stewardship of David Swensen, Yale's Chief Investment Officer from 1985 until 2021, the endowment adopted a revolutionary investment strategy that significantly deviated from traditional asset allocation models.

The Yale Model

Swensen pioneered what is now known as the "Yale Model," emphasizing a substantial allocation to alternative investments, including private equity, hedge funds, real estate, and natural resources.

This strategy capitalized on the higher returns and lower correlations offered by these asset classes.

As a result, Yale's endowment fund grew from $1 billion in the mid-1980s to over $31 billion by 2021.

How the Yale Model Works?

A notable example within Yale's portfolio is its investment in venture capital.

Early investments in companies like Google and Alibaba generated substantial returns, demonstrating the high potential of private equity and venture capital investments.

Also, Yale's allocation to hedge funds and real estate provided steady income and growth, further stabilizing the fund's performance during market downturns.

2.3.2. Case Study: Tiger Global Management

Tiger Global Management, founded by Chase Coleman in 2001, is another case of successful diversification in alternative investments.

Initially focused on public equity markets, the firm expanded into private equity and venture capital, creating a diversified investment strategy that has yielded remarkable returns.

The firm has made early-stage investments in companies like Facebook, LinkedIn, and JD.com, which have delivered substantial returns.

Tiger Global also maintains a significant presence in public markets.

The firm's hedge fund strategies focus on long-term growth investments in publicly traded technology companies.

This diversified approach has resulted in consistent, high returns for Tiger Global and its investors.

The success of Tiger Global Management highlights the benefits of a diversified investment strategy that includes both private and public equity investments.

3. Types of Alternative Investments

Source: J.P. Morgan

Here are the various types of alternative investments that you can select basis your preference, risk capacity and fund allocation:

3.1. Private Equity

Private equity refers to investments made directly into private companies or through buyouts of public companies, resulting in their delisting from public stock exchanges.

Key features of private equity investments include:

- Long-Term Horizon

- Active Management

- High Potential Returns

3.1.1. Pros and Cons

Advantages of Investing in Private Equity:

- High Returns

- Diversification

- Control and Influence

Potential Risks and Challenges:

- Illiquidity

- High Minimum Investment

- Operational Risk

3.2. Hedge Funds

Hedge funds are pooled investment funds that employ diverse strategies to earn active returns on your investment.

Types of hedge fund strategies include:

Long/Short Equity: For this, you buy long stocks, expected to increase in value and short-selling stocks expected to decrease.

Market Neutral: When you seek to profit from both increasing and decreasing prices while maintaining a market-neutral position.

Event-Driven: You focus on exploiting pricing inefficiencies caused by corporate events such as mergers, acquisitions, or bankruptcies.

Global Macro: In this, you take positions based on predictions of macroeconomic events, such as interest rate changes or political developments.

Benefits of Hedge Fund Investments:

- Diverse Strategies

- Potential for High Returns

- Portfolio Diversification

Risks and Considerations:

- High Fees

- Illiquidity

- Complexity and Transparency

3.3. Real Estate

With real estate investments you purchase property as an investment to generate income rather than using it as a primary residence.

This can include residential, commercial, industrial, and rental properties.

Types of real estate investments include:

Residential Properties: Single-family homes, apartments, and condos.

Commercial Properties: Office buildings, retail spaces, and hotels.

Industrial Properties: Warehouses, factories, and distribution centers.

Rental Properties: Properties purchased to rent out to tenants for income.

3.3.1. Pros and Cons

Advantages of Real Estate Investments:

Income Generation: Real estate can provide you with a steady stream of rental income.

Appreciation: Property values tend to increase over time, offering potential capital gains.

Tax Benefits: You can benefit from tax deductions related to property depreciation, mortgage interest, and other expenses.

Potential Risks and Challenges:

Illiquidity: You can sell off real estate easily and it can take time to liquidate.

Management and Maintenance: The properties you invest in may require ongoing management and maintenance, which can be time-consuming and costly.

Market Risk: Property values can fluctuate based on economic conditions, location, and market trends.

For a comprehensive overview of real estate investments, the Real Estate Investment: A Global Perspective study provides valuable insights into different types of real estate investments and their historical performance.

3.4. Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold.

You can invest in commodities by trading in physical goods or through financial instruments linked to these goods.

These are the various types of commodities that you can invest in:

Precious Metals: Gold, silver, platinum.

Energy Products: Oil, natural gas, coal.

Agricultural Products: Wheat, corn, soybeans.

Industrial Metals: Copper, aluminum, nickel.

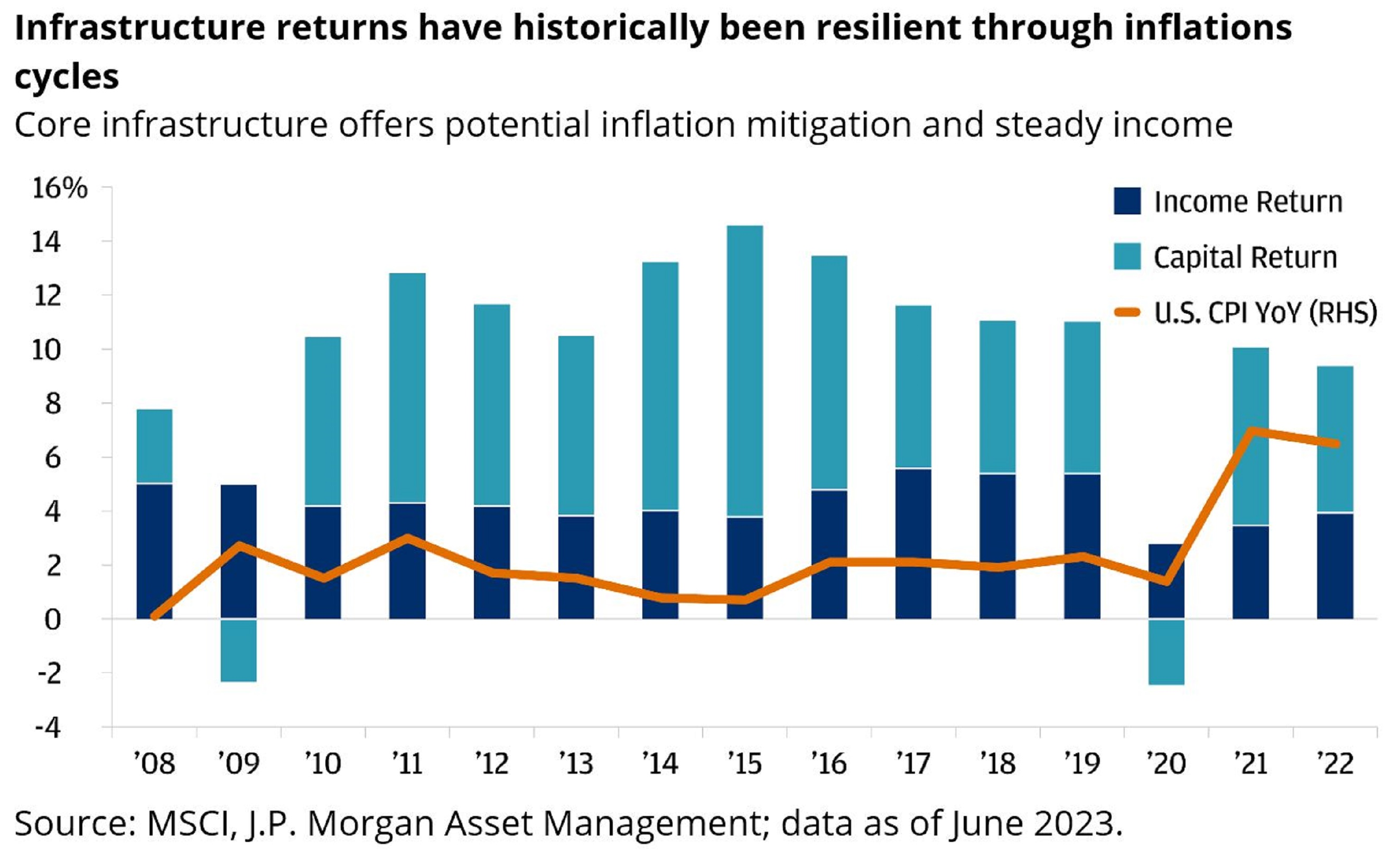

Commodities have historically performed well during periods of inflation and economic uncertainty.

They can act as a hedge in your portfolio against currency devaluation and market volatility.

The Gold Demand Trends report offers a detailed analysis of the performance and trends in the gold market, a key commodity for investors.

3.4.1. Pros and Cons

Benefits of Investing in Commodities:

- Inflation Hedge

- Diversification

- Potential for High Returns

Risks and Market Volatility:

- Price Volatility

- Storage and Transportation

- Market Risk

3.5. Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security.

The total market capitalization of cryptocurrencies reached an all-time high of over $3 trillion in November 2021, showcasing their growing significance in the financial world.

Cryptocurrencies have gained substantial market presence and acceptance as alternative investments.

Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology, a distributed ledger enforced by a network of computers.

Over the past decade, the cryptocurrency market has expanded significantly, with thousands of cryptocurrencies now in existence.

Major cryptocurrencies that you can invest in are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

3.5.1. Pros and Cons

Here are the various advantages of Investing in cryptocurrencies:

- High Potential Returns

- Diversification

- Accessibility and Liquidity

Risks and Regulatory Challenges:

- Volatility

- Regulatory Uncertainty

- Security Risks

For an in-depth understanding of the cryptocurrency market, check the J.P. Morgan Guide to Cryptocurrencies which provides comprehensive information on major cryptocurrencies and their market dynamics.

4. Strategies for Diversifying in Alternative Investments

Source: IASG

4.1. Asset Allocation

Asset allocation is the process of dividing your investment portfolio among different asset categories, such as stocks, bonds, real estate, and alternative investments.

The goal is to optimize the balance between risk and reward based on your investment goals, risk tolerance, and time horizon.

Effective asset allocation can significantly impact portfolio performance.

By spreading investments across various asset classes, you reduce the risk that any single investment or asset class will severely impact your overall portfolio.

This diversification helps stabilize returns and protect your portfolio during market volatility.

4.1.1. Effective Asset Allocation

To allocate assets effectively, you should consider various factors such as your financial goals, investment horizon, and risk tolerance.

If you are in the category of a young investor with a longer time horizon, you may allocate more to higher-risk, higher-reward investments like private equity or cryptocurrencies.

In contrast, if you are nearing retirement, you might prefer more stable, income-generating assets like real estate or hedge funds.

4.1.2. Example Portfolios

Here are some diversified portfolios split that incorporate alternative investments:

Aggressive Growth Portfolio:

- 40% Equities

- 20% Private Equity

- 20% Hedge Funds

- 10% Real Estate

- 10% Cryptocurrencies

Moderate Growth Portfolio:

- 50% Equities

- 15% Hedge Funds

- 15% Real Estate

- 10% Commodities

- 10% Bonds

Conservative Income Portfolio:

- 30% Bonds

- 20% Real Estate

- 20% Hedge Funds

- 15% Equities

- 15% Commodities

These portfolios are designed to balance risk and reward, catering to different investment goals and risk tolerances.

Regularly review and adjust your asset allocation to ensure that it remains aligned with your financial objectives and market conditions.

4.2. Risk Assessment

Assessing risk is crucial when you are investing in alternative assets, which often have different risk profiles compared to traditional investments.

To evaluate the risks involved, you need to analyze various factors, including market risk, liquidity risk, and operational risk.

4.2.1. Manage and Mitigate Risk

Here are some effective strategies that can be used to manage and mitigate risks to protect your investments from potential losses:

Diversification: Spread your investments across different asset classes and sectors to reduce exposure to any single investment's risk.

Hedging: You can use financial instruments like options, futures, and swaps to hedge against potential losses in your portfolio.

Regular Monitoring: Continuously monitor your investments and adjust your portfolio as required to respond to market changes and evolving risks.

Effective asset allocation is crucial for optimizing portfolio performance, as discussed in the McKinsey on Asset Allocation article.

5. Steps to Start Diversifying in Alternative Investments

Unlike traditional assets, your alternative investments can come with unique complexities and risks that require a deeper understanding.

5.1. Research and Due Diligence

You need to thoroughly research and conduct due diligence to uncover potential pitfalls and assess the true value of an investment opportunity.

To conduct due diligence effectively, you can follow these steps:

Understand the Investment: Know the specific type of alternative investment you are considering, whether it’s private equity, hedge funds, real estate, commodities, or cryptocurrencies.

Analyze Financials: Review the financial health and performance metrics of the investment. Look at historical returns, cash flow statements, and balance sheets.

Evaluate the Management Team: Research the background and track record of the management team or fund managers. Their experience and expertise can significantly impact investment performance.

Assess Market Conditions: Consider current market trends and economic conditions that might affect the investment’s performance.

Check Legal and Regulatory Compliance: Ensure that your investment complies with relevant laws and regulations.

5.1.1. Consult Professionals

You can significantly enhance your investment strategy by consulting professionals, such as alternative investment advisors.

These experts have specialized knowledge and experience and can help you navigate the complexities of alternative investments.

You should seek advice from professionals when:

Starting Out: If you are new to alternative investments, an advisor can help you understand the basics and develop a strategy.

Facing Complex Investments: For complex investments like hedge funds or private equity, professional guidance is crucial.

Diversifying Your Portfolio: Advisors can help identify the best alternative investments to complement your existing portfolio.

The benefits of professional guidance include:

- Personalized investment strategies

- Access to exclusive investment opportunities

- Support to manage and optimize your portfolio

Advisors can also assist in risk management and regulatory compliance, ensuring that your investments are aligned with industry standards and legal requirements.

5.2. Setting Investment Goals

5.2.1. Defining Clear Objectives

You must set specific investment goals for a successful investment strategy.

Clear objectives will provide you with direction and help you measure progress. This can ensure that your investment choices align with your financial aspirations.

To define your investment goals, consider the following:

Time Horizon: Determine whether your goals are:

- Short-term (1-3 years)

- Medium-term (3-7 years)

- Long-term (7+ years)

This will influence your risk tolerance and investment choices.

Risk Tolerance: Assess how much risk you are willing to take. Higher-risk investments like cryptocurrencies might offer higher returns, but they come with greater volatility.

Income vs. Growth: Decide whether you are looking for regular income, such as from real estate rentals. Or are you looking for long-term growth, like from private equity investments?

Aligning investment choices with your goals will ensure that every investment contributes to your overall financial plan.

5.2.2. Monitoring and Adjusting

Regularly review and adjust your portfolio to maintain alignment with your investment goals and to adapt to changing market conditions.

This proactive approach can help you optimize performance and manage risks effectively.

To monitor and adjust your portfolio, consider these steps:

Review Performance: Regularly check the performance of your investments against your goals. Use metrics like return on investment (ROI), net asset value (NAV), and cash flow analysis.

Analyze Market Trends: Stay informed about market developments and economic indicators that could impact your investments.

Rebalance Your Portfolio: Adjust the allocation of your assets to maintain your desired risk-reward balance

Use Tools for tracking investment: You can use performance tools such as portfolio management software like Personal Capital and Mint, as well as brokerage platforms that offer performance tracking and analysis features.

These tools can help you make data-driven decisions and keep your investment strategy on track.

5.3. Regulatory Considerations

Navigating the legal and regulatory landscape is critical when you are investing in alternative assets.

Regulations vary by country and asset type, impacting how you can invest and what you need to comply with.

Key regulations affecting alternative investments include:

Securities Laws: Regulations like the Securities Act of 1933 and the Securities Exchange Act of 1934 govern the sale of securities, including private equity and hedge funds.

Tax Laws: Understanding the tax implications of your investments is crucial. This includes capital gains tax, income tax on dividends, and property tax for real estate investments.

Compliance Requirements: Certain investments require adherence to specific compliance standards.

For example, hedge funds must comply with the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Compliance and due diligence requirements involve maintaining transparency, reporting accurate financial information, and adhering to ethical standards.

Failing to comply with regulations can result in legal penalties and financial losses for you. This makes it essential to stay informed and diligent.

5.3.1. Stay Informed

Staying updated on regulatory changes is vital for you to safeguard your investments and ensure compliance.

Regulatory environments can shift, impacting how you invest and manage your portfolio.

To stay informed, you can utilize these resources:

Financial News Outlets: Follow reputable sources like The Wall Street Journal, Bloomberg, and Financial Times for the latest regulatory updates.

Industry Associations: Organizations like the Investment Company Institute (ICI) and the Alternative Investment Management Association (AIMA) can provide you with valuable insights and updates on regulatory developments.

Professional Advisors: Regular consultations with legal and financial advisors can help you navigate regulatory changes and ensure your investments remain compliant.

By keeping abreast of regulatory updates, you can make informed decisions, avoid legal pitfalls, and protect your investment portfolio from unforeseen risks.

Conclusion

Diversifying into alternative investments offers you a pathway to potentially higher returns and greater risk management.

By understanding the market size, the importance of diversification, and the types of alternative investments, you can make informed decisions.

Implementing strategies for asset allocation and risk assessment, and following the steps for starting your diversification journey, will help you build a robust and resilient portfolio.

By taking these steps, you position yourself for long-term financial growth and stability.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

What are alternative investments?

Alternative investments are asset classes outside traditional stocks, bonds, and cash, such as private equity, hedge funds, real estate, commodities, and cryptocurrencies.

Why is diversification important in investing?

Diversification helps spread risk and can lead to more stable returns by investing across different asset classes and sectors.

How do I conduct due diligence on alternative investments?

Conducting due diligence involves understanding the investment, analyzing financials, evaluating management teams, assessing market conditions, and ensuring legal compliance.

What are the risks associated with investing in cryptocurrencies?

Cryptocurrencies are highly volatile, face regulatory uncertainties, and are susceptible to security risks like hacking and cyber-attacks.

How can I set effective investment goals?

Effective investment goals should consider your time horizon, risk tolerance, and whether you are looking for income or growth, which can help you align your investment choices with your financial objectives.

What tools can I use to monitor my investment portfolio?

Portfolio management software like Personal Capital and Mint, along with brokerage platforms, can help track investment performance and make data-driven adjustments.

Why should I consult with an alternative investment advisor?

Consulting with an advisor provides specialized knowledge, personalized strategies, and ongoing support, enhancing your ability to manage complex alternative investments effectively.