What to Expect?

- Insightful Guidance To Navigate The Dynamic World Of AI Investing

- Discover Leading Brokers And Investment Platforms For Your AI Investment

- Gain Valuable Insights Into AI Market: Trends, Opportunities, And Potential Risks

- Risk Management Strategies To Safeguard Your AI Investments

- Guidance On How To Kick Start Your AI Investment Journey

- Tools To Make Investment Decisions In The Evolving AI Landscape

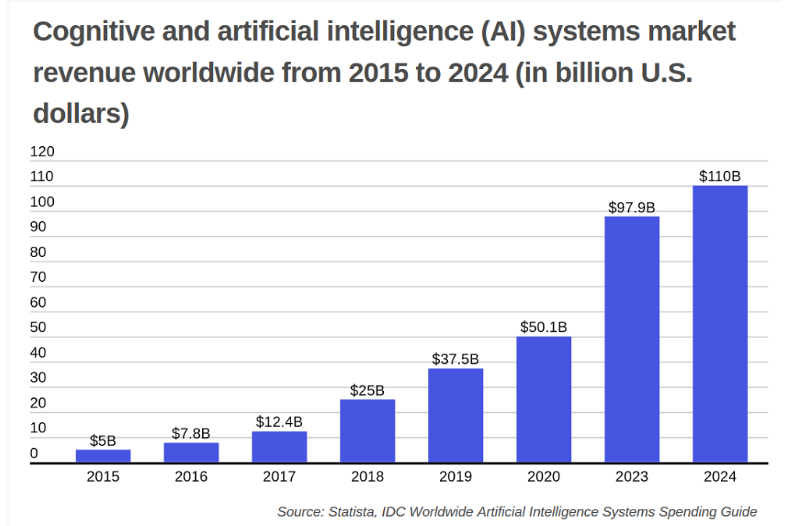

In 2024, the global AI market is projected to exceed a staggering $500 billion. This showcases the immense growth potential of AI technologies worldwide.

Take the example of Twilio Inc. (NYSE: TWLO). Twilio is a cloud communications platform that provides developers with APIs for voice, messaging, and video services. In 2016, Twilio went public at an initial offering price of $15 per share. By early 2022, Twilio's stock price soared to over $300 per share, representing an astonishing increase of more than 1,900% since its IPO.

Investing in artificial intelligence is a great opportunity for you to get fabulous returns on your investment. However, navigating the complex world of AI investments requires careful consideration and strategic planning.

In this beginner's guide, we'll explore what investing in AI involves and practical steps for you to get started. There are various strategies you need to follow to manage risks and achieve your financial goals.

How to Start Investing in AI in 2024

Understanding AI Investments

Investing in AI can be done by allocating capital to companies that develop and utilize artificial intelligence technologies to drive innovation and create value. These companies can range from known tech giants like Google and Microsoft to smaller startups specializing in AI-driven solutions.

The key for you is to identify companies with a strong track record of innovation that have a competitive advantage in their respective markets. They should also have a clear vision for leveraging AI to drive growth and a formidable management team.

When you invest in AI, you're essentially hedging on the future potential of these companies to capitalize on the widespread adoption of AI technologies. This can help them generate sustainable returns for you and other investors. The roadmap for them is to continuously develop AI-powered products and services.

These should not only be relevant and a great market fit but should be better than anything their competitors can offer. Only then can they generate demand, find clients, and make profits that make their stock soar.

Getting Started with Investing in AI

Investing in Artificial Intelligence offers you a chance to capitalize on one of the most transformative technologies of our time. AI has the potential to reshape the way we live, work, and invest. It is set to enhance efficiency and productivity and revolutionize entire industries.

If you are considering adding AI to your investment portfolio, here are several avenues to explore:

AI Stocks and ETFs

One of the most direct ways to invest in AI is by purchasing stocks of companies at the forefront of AI innovation. These companies are from various industries, such as technology, healthcare, automotive and finance.

Here are some notable AI stocks that have a high growth potential that you can consider:

1. Apple (AAPL)

Apple's ecosystem of devices and services is increasingly coupled with AI capabilities. These range from facial recognition and natural language processing to virtual assistants like Siri. The company places high value on privacy and security and has a loyal customer base. This makes Apple a formidable player in the AI field.

2. NVIDIA (NVDA)

NVIDIA is a global leader in Graphics Processing Units (GPUs) and AI technologies. Its GPUs are widely used for training deep learning models, making it a key player in the AI hardware space. NVIDIA's stock has delivered exceptional returns over the years. This is driven by its dominance in gaming, data centers, and autonomous vehicles. These are some of the reasons that make it a preferred stock for most investors.

3. Tesla (TSLA)

Tesla is mostly known for its electric vehicles. However, it is also a pioneer in AI and autonomous driving technology. Its advanced driver-assistance systems (ADAS) and self-driving capabilities rely heavily on AI algorithms. The company continues to innovate in the AI space and its stock remains a top choice for most investors.

4. Meta Platforms (META)

Meta Platforms has invested heavily in AI to enhance user experiences across its social media platforms like Facebook. From virtual reality (VR) to augmented reality (AR) applications, AI is integral to Meta's long-term strategy. Meta remains a dominant force in the AI-driven digital landscape and is a stock with the potential for great returns.

5. Microsoft (MSFT)

Microsoft is leveraging AI across its product portfolio, such as cloud computing and productivity tools to gaming and healthcare solutions. With its diversified business model and strong commitment to AI research, Microsoft stock can offer both stability and growth potential for you.

6. Amazon.com (AMZN)

Amazon's AI forays are in e-commerce, cloud computing, logistics, and voice assistants. Amazon Web Services (AWS) offers a suite of AI services for developers. It has vast resources and tremendous potential and is a stock worth considering.

7. Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC is the world's largest contract semiconductor manufacturer. It plays a critical role in powering AI devices and applications. It manufactures chips for leading AI chipmakers, including NVIDIA and Advanced Micro Devices (AMD). As the demand for AI-centric semiconductors upshoot , TSMC stands to benefit immensely and its stock is poised for a great rise.

Direct Investment in Small AI companies

An alternative to investing in stocks is direct investment in small AI companies. This can be an exciting opportunity for you to capitalize on the potential growth of innovative startups in the AI space and get great returns.

But be careful that these companies may carry higher risk due to their smaller size and potentially volatile nature. Conversely, they also offer the potential for substantial returns if you are willing to take the risk.

Here are some small AI companies you can consider for direct investment:

1. C3.ai (AI)

C3.ai is a leading enterprise AI software provider that offers a suite of AI applications for industries such as energy, manufacturing, healthcare, and telecommunications. It is focused on digital transformation and predictive analytics and seeks to become a big player in this space. The company has attracted attention from investors seeking exposure to AI-driven solutions for business optimization and innovation.

2. Palantir (PLTR)

Palantir is a data analytics and software company known for its AI-powered platforms that help organizations make sense of complex data. Its software is used by government agencies, financial institutions, and healthcare organizations to analyze large datasets and extract actionable insights. It has positioned itself as a key player in the AI and big data analytics space within a short time.

3. PROS Holdings (PRO)

PROS Holdings provides AI-powered pricing and revenue management solutions for businesses in various industries, including manufacturing, distribution, and travel. It uses advanced algorithms and machine learning techniques to help companies optimize pricing strategies, improve profitability, and enhance customer satisfaction.

4. Phreesia (PHR)

Phreesia is a healthcare technology company that offers AI-powered patient intake and engagement solutions for medical practices and health systems. Its platform simplifies the patient check-in process, improves data accuracy, and enhances communication between patients and healthcare providers. It is considered a pioneer in bringing digital transformation and AI-driven solutions to the healthcare industry.

5. Okta (OKTA)

Okta is a cloud-based identity management company that leverages AI and machine learning to provide secure access to applications and data for organizations of all sizes. It helps businesses manage user authentication, authorization, and access control across their IT infrastructure. The company’s AI-driven identity solutions help to ensure the security and integrity of the digital assets of various organizations.

6. Twilio (TWLO)

Twilio is a cloud communications platform that enables developers to integrate voice, messaging, and video capabilities into their applications using APIs. Its AI-powered communications solutions help businesses engage with customers more effectively through personalized interactions and omnichannel communication channels.

If you are planning to invest directly in small AI companies, it's essential to conduct thorough research. Assess the company's competitive position and growth prospects, and carefully consider the risks involved. Experts reckon that while AI companies may offer significant growth potential, they also face challenges such as market competition, technological disruption, and funding constraints.

Brokers for AI Investment

When it comes to investing in AI, choosing the right broker is crucial for you. A qualified and experienced broker can help you access a diverse range of AI-related stocks, ETFs, and other investment opportunities.

Here are some of the top brokers that you can consider for investing in companies engaged in the AI space:

1. TD Ameritrade

They have a user-friendly platform with advanced trading tools and a wide range of investment options, including AI-related securities.

2. Charles Schwab

This brokerage firm provides comprehensive research and educational resources along with low-cost trading options. This makes it suitable if you are a novice or an experienced investor, who wants to invest in companies in the AI space.

3. Fidelity Investments

Their trading platform is robust and based on extensive market research. They list a diverse selection of investment products, including AI-focused ETFs and mutual funds.

4. E*TRADE

E*TRADE offers you powerful trading tools, educational resources, and competitive pricing. They have emerged as a popular choice for investors seeking exposure to AI-related securities.

5. Robinhood

Robinhood is a commission-free trading platform with a user-friendly interface. They are more popular with younger AI investors.

6. Interactive Brokers

Interactive Brokers can be a good choice if you are an active trader. They have an advanced trading platform with low-cost commissions and can provide you access to global markets, including AI-related securities.

7. Ally Invest

Ally Invest has a competitive pricing structure and offers you a wide range of investment options. They are suitable for investors of all experience levels, who are interested in AI investments.

8. TradeStation

TradeStation is popular with both active traders and investors. With them, you can get access to advanced trading technology and customizable trading strategies. They offer you a diverse selection of AI-related securities with the potential for great returns.

9. Merrill Edge

Get a combination of online trading tools, personalized guidance, and research resources with Merrill Edge. Whatever your level of trading and investment goals, you will find a good range of options with them.

10. WeBull

WeBull offers commission-free trading, real-time market data, and a social trading community. This has helped them become a popular choice for investors across the spectrum who want to invest in cutting-edge AI companies.

Risk Management Strategies for Investing in AI

1. Portfolio Diversification

Spread your investments across multiple AI companies and sectors to reduce the impact of any single company or sector's performance on your overall portfolio. By diversifying, you can also minimize the risk associated with individual stocks, while still benefiting from the growth potential of the AI sector.

Some of the sectors you can consider are technology and software development, healthcare, finance and fintech, e-commerce and retail, automotive and transportation, telecommunications, energy and utilities, manufacturing and industrial automation and many more.

2. Research and Due Diligence

Thoroughly research your potential AI investments before making any decisions. Analyze the company's financials, leadership team, competitive positioning, and AI capabilities. This can help to ensure you are investing in companies with strong fundamentals and growth potential. U.S. Securities and Exchange Commission's guide on due diligence is a good online resource for this.

3. Stay Up To Date

Keep abreast of the latest developments in the AI industry, including technological advancements, regulatory changes, and market trends. By staying informed, you can anticipate potential risks and adjust your investment strategy accordingly.

A good place to start to check the latest trends in artificial intelligence is McKinsey & Company's report ‘The State of Artificial Intelligence’.

4. Long-Term Perspective

Adopt a long-term investment horizon when investing in AI companies. This will help you ride out short-term market fluctuations and capitalize on the sector's long-term growth potential. Avoid making reflexive reactions to market volatility and focus instead on the underlying fundamentals of your investments.

A good example of this is NVIDIA stock which experienced a significant decline in its stock price in late 2018, due to concerns about slowing demand for its gaming GPUs and inventory buildup.

The stock plummeted from around $290 per share to below $130 per share representing a substantial decrease of over 55%. However, in the following years, the company successfully diversified its business and its stock price rebounded, reaching new highs above $330 per share by early 2022. In 2024, the stock price crossed the $800 mark.

5. Monitor Performance

Regularly monitor the performance of your AI investments and reassess your portfolio allocation as needed. Stay vigilant for any signs of underperformance or changes in market dynamics. These may necessitate adjustments to your investment strategy.

Learn about performance measurement for asset management with CFA Institute's Performance Measurement for Asset Management report.

6. Set Realistic Expectations

Be realistic about the risks and rewards of investing in AI. Understand that these investments can be both volatile and may experience periods of underperformance. When you start with realistic expectations from your investment and its returns, you can avoid chasing unrealistic gains.

7. Continuous Risk Assessment

Assess the risk-reward profile of each AI investment that you make and allocate funds accordingly. Consider all factors such as market volatility, competitive threats, regulatory risks, and technological obsolescence. This can help you evaluate the risks involved in your investments and take corrective actions.

8. Use Of Stop-Loss Orders

Consider implementing stop-loss orders to limit potential losses on your AI investments. You can set predefined price levels at which you are willing to sell your shares. This can help you protect your capital in case of significant market downturns or adverse developments.

9. Regular Review and Rebalancing

Periodically review your AI investments and rebalance your portfolio to match your desired asset allocation. You can adjust your portfolio based on changes in market conditions, investment performance, and risk tolerance.

10. Consult a Financial Advisor

Seek guidance from a qualified financial advisor or AI investment advisory firm to help you develop a comprehensive risk management strategy tailored to your investment goals, risk tolerance, and time horizon. A professional advisor can provide valuable insights and expertise to navigate the complexities of AI investing and mitigate potential risks effectively.

Conclusion

Investing in AI presents an exciting opportunity for you to participate in the technological revolution reshaping our world. To invest successfully, you need to know what allocating capital in AI involves. You also need to take practical steps to get started and implement strategies for managing risks.

You also need to remember that investing in AI carries inherent risks and uncertainties, with no guarantees of success. As such, you should consult with a reputable investment advisor or financial planner to develop a personalized investment strategy. This plan to invest in AI should be tailored to your financial goals, risk tolerance, and time horizon.

With careful planning, disciplined execution, and a long-term perspective, you can harness the potential of AI investments to build wealth and achieve financial independence.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

Q1: Which US companies are using AI?

American companies like Amazon, Google (Alphabet), Microsoft, and Facebook are integrating AI into their products and services. Some other players in the field, like NVIDIA, Salesforce, and IBM are developing AI solutions for businesses.

Q2: What are the best AI ETFs to invest in?

ARK Autonomous Technology & Robotics ETF (ARKQ), Global X Robotics & Artificial Intelligence ETF (BOTZ), and iShares Robotics and Artificial Intelligence ETF (IRBO) are some of the best AI ETFs to consider. A good place to start is the EFT database of ETFDB for a detailed listing and intra-day price change.

Q3: Is AI good for investing?

AI can be beneficial for investing as it enables you to make data-driven decision-making with the use of automated trading strategies, and provides predictive analytics. AI algorithms can analyze vast amounts of data quickly and accurately to help you identify market trends, manage risks, and optimize your investment portfolio.

Q4: How do I start AI trading?

To start AI trading, you can utilize any of the algorithmic trading platforms or brokerage services that offer AI-powered trading tools and strategies. These platforms use AI algorithms to analyze market data, execute trades, and manage investment portfolios automatically based on predefined parameters and objectives that you select as an investor.

Q5: Who are the top AI companies?

Some of the top AI companies that are today leading the industry are NVIDIA, Alphabet (Google), Microsoft, IBM, Amazon, Facebook, Apple, Salesforce, Intel, and Baidu. These companies are at the forefront of AI innovation, developing cutting-edge technologies and solutions that are transforming industries and driving economic growth.