Source: Music Money Guide

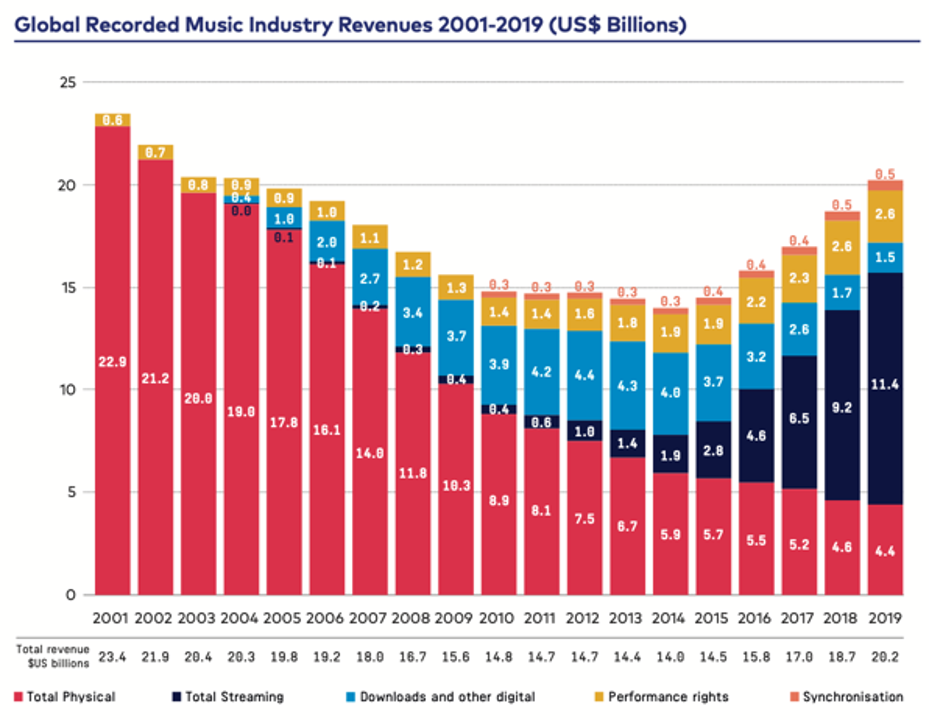

The music industry is massive, with the global music market valued at over $20 billion in 2022, and the United States alone accounting for more than $7.5 billion of that figure.

This growing market is driven by the rapid growth of streaming services, increasing music consumption, and the enduring appeal of evergreen hits.

Investing in music royalties is gaining traction among investors and for a good reason.

Consider the case of Hipgnosis Songs Fund, which has yielded impressive returns.

Founded in 2018, it has built a portfolio that includes rights to songs by artists like Neil Young and Shakira.

In its first year, Hipgnosis reported a net asset value (NAV) increase of 14.4%, showcasing the lucrative potential of music royalties.

Key Takeaways

- Investing in music royalties can provide lucrative, stable income streams, particularly with the growing popularity of streaming platforms.

- Established artists' music rights offer predictable returns, while emerging artists present higher risks but potentially high rewards.

- Diversifying investments across different songs, genres, and artists can mitigate risks and enhance overall returns.

- Legal and contractual risks, including copyright infringement and disputes with artists, require careful management and due diligence.

- Understanding market trends, historical performance, and legal terms is crucial for effective music royalty investment.

Why Should You Invest in Music?

Source: Live Index

Traditional investment avenues like stocks and real estate are well-known, but alternative investments such as music royalties offer you unique benefits.

As music royalties are not directly tied to the fluctuations of the stock market, they provide you with a hedge against economic volatility.

Streaming services like Spotify and Apple Music are continuing to grow, as does the demand for music, ensuring a steady income stream for rights holders.

Investing in music royalties allows you to diversify your portfolio.

The diversification and stability, combined with the emotional satisfaction of owning a piece of your favorite songs, make music royalties an attractive alternative investment.

Potential for Passive Income with Music Royalties

One of the most compelling reasons to invest in music royalties is the potential for passive income.

Once you acquire rights to a song, you start earning royalties every time the song is played on streaming platforms, the radio, or used in media.

This income stream can be both predictable and substantial, depending on the popularity and longevity of the music.

Take the example of classic hits like "Every Breath You Take" by The Police.

This song has generated millions in royalties since its release in 1983. Owning a share of such a hit means you could earn money consistently without active involvement.

If you are looking for a steady, passive income, music royalties present a lucrative opportunity.

Understanding Music Royalties

Source: Major Labl

Let’s start with the basics of what are music royalties and how they are paid:

What Are Music Royalties?

Music royalties are payments made to rights holders (songwriters, composers, artists, and producers) for the use of their music.

These payments ensure that creators are compensated whenever their work is used commercially.

These are the various types of royalty associated with music:

Performance Royalties

Performance royalties are earned whenever a song is played publicly.

This includes plays on radio stations, streaming services, live performances, and even background music in stores and restaurants.

Performance rights organizations (PROs) like ASCAP, BMI, and SESAC collect these royalties on behalf of the rights holders and distribute them accordingly.

For instance, every time a song is played on Spotify or performed at a concert, the rights holder earns a performance royalty.

This makes performance royalties a significant and recurring source of income for music investors.

Mechanical Royalties

Mechanical royalties are earned when a song is reproduced physically or digitally.

This includes sales of physical media like vinyl records and CDs, as well as digital downloads and streaming.

In the age of digital music, mechanical royalties from streaming services constitute a major revenue stream.

When you invest in music royalties, understanding the distinction between performance and mechanical royalties is crucial.

Both types offer diverse revenue opportunities, ensuring that you benefit from multiple streams of income.

How Do Royalties Generate Income?

Source: Public App

Streaming Platforms

Streaming platforms like Spotify, Apple Music, and Amazon Music are primary sources of income for music royalties.

With billions of users globally, these platforms pay substantial royalties to rights holders based on the number of streams.

For example, a hit song with millions of streams can generate significant income through streaming royalties.

Radio Airplay

Radio airplay remains a vital income source for music royalties.

Songs played on terrestrial and satellite radio stations earn performance royalties.

Despite the growth of digital music, radio continues to reach vast audiences, ensuring that radio airplay royalties remain substantial.

For instance, classic rock and pop songs still receive significant radio play, translating into continuous royalty earnings. Investing in songs with a strong radio presence can provide a reliable income source.

Licensing for Films, TV Shows, and Commercials

Licensing music for use in films, TV shows, commercials, and video games is another lucrative revenue stream.

Sync licenses, which are agreements to use a song in a visual medium, can yield substantial one-time payments or ongoing royalties.

Consider the song "Bohemian Rhapsody" by Queen, which has been featured in numerous movies, TV shows, and commercials.

The licensing fees for such iconic tracks can be quite high, providing a significant return on investment.

By investing in music with high licensing potential, you can tap into a valuable and often overlooked revenue stream.

Types of Music Royalty Investments

Source: Audio Sorcerer

When it comes to investing in music royalties, you have several options, each offering unique advantages. These are:

Direct Purchases of Song Rights

Investing in Established Artists

Investing in established artists can be a lucrative strategy due to their proven track record and consistent revenue streams.

When you purchase song rights from well-known artists, you benefit from their established fan base and ongoing popularity.

For instance, buying the rights to songs by artists like The Beatles or Taylor Swift can provide a steady stream of income through royalties from radio plays, streaming, and licensing deals.

Established artists' songs are likely to continue generating significant royalties due to their widespread appeal and frequent airplay.

This can be an excellent choice if you prefer a more secure investment with potentially lower risk.

However, the initial cost can be high, reflecting the established value of the music catalog.

Real-life example: Michael Jackson and The Beatles Catalogue

Michael Jackson’s acquisition of The Beatles’ song catalog is one of the most famous and successful music rights investments in history.

In 1985, Jackson purchased the ATV Music Publishing catalog, which included the publishing rights to over 250 songs by The Beatles, including iconic hits like "Yesterday," "Hey Jude," and "Let It Be."

The purchase of ATV Music Publishing turned out to be a financial masterstroke. The Beatles’ catalog is one of the most valuable and widely played collections of music in the world.

Estimates suggest that Jackson’s initial investment in ATV Music Publishing yielded hundreds of millions of dollars in revenue over the years.

After Jackson died in 2009, his estate continued to benefit from his investment in the Beatles' catalog. In 2016, the estate sold its 50% stake in Sony/ATV Music Publishing to Sony for approximately $750 million.

This sale underscored the immense value of the catalog and the significant appreciation of Jackson’s initial investment.

Emerging Artists and Future Potential

You can also consider investing in emerging artists that offer the potential for high returns, though with higher risk.

These artists are in the early stages of their careers, and investing in their music can be akin to investing in a startup.

If the artist becomes popular, the value of their music rights can increase significantly.

For example, early investors in the music of Billie Eilish or Ed Sheeran saw substantial returns as these artists gained fame.

This strategy requires a keen eye for talent and an understanding of industry trends.

While riskier, the potential for high rewards makes investing in emerging artists an exciting option if you are willing to take a gamble on the future stars of the music world.

Royalty Funds and Platforms

Diversification Benefits

Royalty funds and platforms provide an excellent way to diversify your investment in music royalties.

These funds pool money from multiple investors to purchase a diverse range of music rights, spreading the risk across various songs and artists.

This approach can help you mitigate the impact of investing in any single song or artist underperforming.

For example, the Hipgnosis Songs Fund invests in a wide array of songs, offering you a slice of income from a diversified music catalog.

Professional Management

Investing through royalty funds also benefits from professional management.

These funds are typically managed by industry experts who have a deep understanding of the music market. They can make informed decisions about which rights to purchase and how to maximize returns.

This can be particularly beneficial if you are new to music royalty investments or if you prefer a hands-off approach.

Platforms and Means to Invest in Music

Source: Medium

Investing in music royalties can be approached through various platforms and mechanisms, each catering to different investment strategies and risk appetites.

Some of these are:

Music Royalty Marketplaces

Royalty Exchange: Royalty Exchange is a popular online marketplace that connects rights holders with investors. This platform allows you to bid on royalty streams from various music catalogs. You can review detailed financial information about the royalties on offer, ensuring transparency.

SongVest: SongVest offers a unique platform where you can purchase fractional shares of song royalties. It allows for smaller initial outlays and diversified portfolios.

Hipgnosis Songs Fund: It is one of the most well-known music royalty funds, listed on the London Stock Exchange. It invests in catalogs of hit songs, providing investors with exposure to a diverse range of royalty streams.

Round Hill Music Royalty Fund: Similar to Hipgnosis, the Round Hill Music Royalty Fund invests in high-quality music catalogs. It offers the benefits of professional management and diversification, reducing the risks associated with investing in individual song rights.

Kickstarter and Patreon: Crowdfunding platforms like Kickstarter and Patreon enable fans and investors to support artists directly. This allows you to invest in music at its creation stage, potentially benefiting from future royalties.

Vezt: Vezt is a blockchain-based platform that allows artists to raise funds by selling shares of their royalties to fans and investors. Vezt provides a direct connection between artists and investors, with the added benefit of blockchain technology to track and manage royalty distributions.

Risks and Considerations

Source: Royalty Exchange

Investing in music royalties offers exciting opportunities but also comes with certain risks. Understanding these risks is crucial to making informed investment decisions.

Market Volatility

Fluctuations in Streaming Revenue

One of the primary risks in music royalty investments is the fluctuation in streaming revenue.

The income that you receive from music royalties is heavily dependent on the number of streams a song garners on platforms like Spotify, Apple Music, and Amazon Music.

While these platforms have grown rapidly, they are still subject to market changes and competition.

A sudden dip in a platform’s popularity or changes in its payout structures can significantly impact your revenue.

For example, Spotify has periodically adjusted its payout rates, affecting the earnings of rights holders.

As an investor, it's essential for you to keep abreast of these changes and be prepared for income variability.

Changes in Consumer Preferences

Consumer tastes in music can change rapidly, and what is popular today may not be tomorrow.

This volatility can impact the longevity and profitability of your investments.

A song or artist that is currently generating significant royalties might see a decline if public interest wanes.

Trends in music genres, the emergence of new artists, and shifts in cultural preferences can all influence royalty income.

Investing in a diverse portfolio of songs across different genres and eras can help mitigate this risk by ensuring that your income is not overly reliant on a single trend or artist.

Legal and Contractual Risks

Copyright Infringement

Copyright infringement is a serious legal risk in the music industry.

If a song you have invested in is found to infringe on another's copyright, it could lead to costly legal disputes and potential loss of income.

Copyright laws are complex, and navigating them requires careful attention.

As an investor, you need to ensure that the rights you purchase are clear of any infringement issues.

Engaging legal experts or consulting an alternative investment advisor can help protect your investment from such risks.

Contractual Disputes with Artists

Contractual disputes between artists and rights holders can pose significant challenges.

These disputes can arise from disagreements over royalty splits, usage rights, or contract terms.

Such conflicts can lead to prolonged legal battles and suspended royalty payments, directly impacting your investment returns.

It's crucial to thoroughly review all contractual agreements and ensure they are fair and clear to both parties.

Investing through reputable platforms or funds that handle these negotiations can also provide a layer of security.

Due Diligence Process

Source: Song Vest

Conducting thorough due diligence is critical to successful music royalty investments.

This process involves assessing the financial, legal, and market aspects of the royalty assets you are considering.

Legal and Financial Analysis

Contractual Terms and Conditions

A detailed examination of the contractual terms and conditions associated with royalty rights is crucial.

This includes understanding the duration of the rights, geographic limitations, and any specific clauses that could affect income.

Royalty Pools and Distribution Mechanisms

Understanding how royalties are pooled and distributed is another critical aspect of due diligence.

Different songs and catalogs might have different distribution mechanisms, influencing the timing and amount of payouts.

For instance, royalties from streaming platforms are typically distributed based on the total streams relative to all streams on the platform.

Tax Implications

Understanding the tax implications of music royalty income is essential to maximizing your investment returns and ensuring compliance with tax regulations.

Tax Treatment of Royalty Income

Ordinary Income vs. Capital Gains

Royalties are generally considered ordinary income and are taxed at your marginal tax rate.

This can be higher than the capital gains tax rate, which applies to profits from the sale of investments held for more than a year.

If you sell your music rights for a profit, that gain might be taxed at the capital gains rate, which can be beneficial if it's lower than your ordinary income tax rate.

Qualified Business Income Deduction (QBID)

The Qualified Business Income Deduction (QBID) allows certain taxpayers to deduct up to 20% of their qualified business income.

Consult with a tax advisor to determine if you are eligible for QBID and how best to structure your investments to take advantage of this benefit.

Strategies for Investing in Music Royalties

Source: iSpy Tunes

Effective investment strategies are key to maximizing returns and managing risks in the music royalty market. These are:

Diversification Across Catalogs

Balancing Established Hits with Emerging Talent

Diversification is a critical strategy in music royalty investments.

Balancing investments in established hits with emerging talent can provide a mix of stable income and growth potential.

Established hits offer reliable, steady royalties while emerging artists can offer you substantial upside if they achieve success.

For example, owning royalties from classic songs like "Imagine" by John Lennon provides a steady income stream, while investing in a rising star might yield higher returns if they become popular.

Genre and Demographic Considerations

Diversifying across different music genres and demographics can also help mitigate risks.

Different genres have varied audience bases and can perform differently across markets.

By investing in a range of genres—such as pop, rock, hip-hop, and country—you can spread risk and tap into multiple revenue streams.

Long-Term vs. Short-Term Investment Horizon

Patience for Royalty Growth

Having a long-term investment horizon can be beneficial when investing in music royalties.

Long-term investments in music royalties can yield substantial returns as songs continue to generate income year after year.

Opportunities for Quick Returns in Speculative Markets

If you are looking for quicker returns, investing in music royalties can also be speculative.

Identifying and investing in trending songs or emerging artists can provide opportunities for rapid growth and quick profits.

Conclusion

Music royalties offer a unique opportunity for passive income in the digital age.

With the continued growth of streaming services and digital music consumption, investing in music royalties can provide a steady and potentially lucrative income stream.

Given the complexities and risks associated with music royalty investments, consulting with an alternative investment advisor company or financial advisor is highly recommended.

Leveraging their expertise ensures that you make informed decisions and maximize the potential of your music royalty investments.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

What are music royalties and how do they generate income?

Music royalties are payments made to rights holders for the use of their music, generating income from streaming, radio airplay, and licensing.

How can I invest in music royalties?

You can invest directly by purchasing song rights or through royalty funds and platforms that offer diversified music catalogs.

What are the risks associated with investing in music royalties?

Key risks include market volatility, changes in consumer preferences, and legal issues such as copyright infringement and contractual disputes.

How is royalty income taxed?

Royalty income is typically taxed as ordinary income, but selling music rights may incur capital gains tax.

What is the difference between performance and mechanical royalties?

Performance royalties are earned from public plays of a song, while mechanical royalties are earned from reproductions like digital downloads and physical media sales.

How do I diversify my music royalty investments?

Diversify by investing in a mix of established hits, emerging artists, and various music genres to balance risk and returns.