Source: filmbudgeteers

In 2022, the revenue generated by the motion picture and video production and distribution sector in the United States reached nearly $93 billion.

The global movies and entertainment market is projected to increase from $104.49 billion in 2023 to $182.23 billion by 2031.

Investing in films is a lucrative avenue for diversifying your investment portfolio.

Unlike traditional investments such as stocks and bonds, film investment offers a unique opportunity to be part of the creative process and contribute to the cultural landscape.

With the rise of streaming platforms and increasing global box office revenues, the film industry presents numerous investment opportunities that can yield you significant returns.

Key Takeaways

- Blockbuster films offer high financial returns but require substantial investments and come with significant risks.

- Independent films can achieve remarkable financial success with lower budgets but rely heavily on creative marketing and festival circuits.

- Box office revenues are a primary income source but must be shared with theaters and distributors.

- Streaming platforms provide a stable revenue stream, expanding the film’s audience and mitigating box office risks.

- Ancillary revenue sources like merchandise, syndication, and soundtracks significantly enhance a film's profitability.

- Understanding different production models—independent vs. studio films can help you diversify your portfolios and manage risks.

Importance and Appeal of Film Financing and Investing

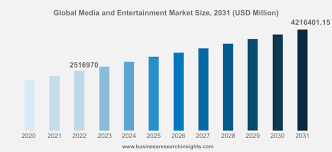

Source: Business research Insights

The appeal of film financing or investing lies in its blend of financial potential and artistic engagement.

It offers you the chance to support innovative storytelling and influential media projects.

Successful films also generate substantial profits through various revenue streams, including box office sales, streaming rights, merchandise, and more.

The high visibility and potential for significant financial returns make film financing an attractive option as an alternative investment.

Different Ways to Invest in Films

You can invest in a movie in different ways. Some of these are:

Equity Investments

Equity investment in films involves providing capital to a film project in exchange for a percentage of ownership and a share of the profits.

Essentially, you become a part-owner of the film and are entitled to a portion of the revenue it generates.

This type of investment is similar to buying shares in a company, where the value of your investment depends on the financial success of the film.

Advantages and Risks Of Equity Investments

Equity investments can offer substantial returns if the film performs well.

As an investor, you often have a say in the creative and business decisions, allowing for a more hands-on approach.

However, this type of investment carries significant risks. Films are inherently unpredictable, and many do not recoup their production costs.

Factors such as market trends, competition, and audience reception can greatly impact the film's success.

Real-Life Example Of Equity Investment: "Paranormal Activity"

A prime example of a successful equity investment is the horror film "Paranormal Activity."

Produced with a modest budget of $15,000, it went on to gross over $193 million worldwide.

This success story highlights the potential for high returns from low-budget films that resonate with audiences.

Investors who backed "Paranormal Activity" saw extraordinary returns, showcasing the lucrative possibilities of equity investments in films.

Debt Financing

Debt financing is when you lend money to a film project with the expectation of being repaid with interest.

Unlike equity investment, where you become a part-owner of the film, debt financing treats your investment as a loan.

The film production company agrees to repay the principal amount plus interest over a specified period.

This method is often used to cover production costs, and it allows filmmakers to secure necessary funds without giving up ownership stakes.

Advantages and Risks

Here are the various pros of cons of debt financing:

Advantages

Lower Risk: Debt financing is generally less risky compared to equity investments. The repayment terms are agreed upon upfront, providing you with a clear timeline for returns.

Fixed Returns: You receive fixed interest payments, which can provide a steady income stream regardless of the film’s box office performance.

Priority Repayment: As a debt investor you get priority in repayment over equity investors.

Risks

Limited Upside Potential: The returns are capped at the agreed-upon interest rate, so you won’t benefit from the film’s potential blockbuster success.

Repayment Uncertainty: If the film fails or faces significant delays, there might be challenges in receiving timely repayments.

Market Volatility: Changes in market conditions and competition can affect the film's revenue, indirectly impacting the repayment capability.

Example: Studio Films Using Debt Financing

Many major studio films utilize debt financing to manage their substantial budgets.

For instance, studios often partner with banks or private lenders to secure funds for high-budget projects.

A notable example is Disney, which frequently uses debt financing to fund its blockbuster productions.

By leveraging debt, studios can mitigate financial risk while maintaining control over their creative projects.

Crowdfunding

Crowdfunding is a method of raising capital by soliciting small amounts of money from a large number of people, typically via online platforms.

In the context of film financing, filmmakers present their project ideas to the public, who can contribute financially to support the production.

In return for becoming a backer or investing, you might receive various perks, such as early access to the film, exclusive merchandise, or even a mention in the credits.

Platforms for Crowdfunding

Several platforms specialize in crowdfunding for films, including:

Kickstarter: A popular platform where filmmakers set a funding goal and deadline. Projects must meet their funding targets to receive any money.

Indiegogo: Offers flexible funding options, allowing filmmakers to keep any funds raised even if they don’t reach their goal.

Seed & Spark: Focuses exclusively on film and television projects, providing additional resources and support for creators.

Example: Successful Crowdfunded Films

One of the most famous crowdfunded films is "Veronica Mars."

After the TV series was canceled, fans rallied around a Kickstarter campaign to fund a feature film.

The campaign raised over $5.7 million from more than 91,000 backers, leading to the successful production and release of the movie.

This example highlights how crowdfunding can mobilize a dedicated fan base to bring a beloved project to life.

From Script to Screen: Understanding the Film Production Process for Investors

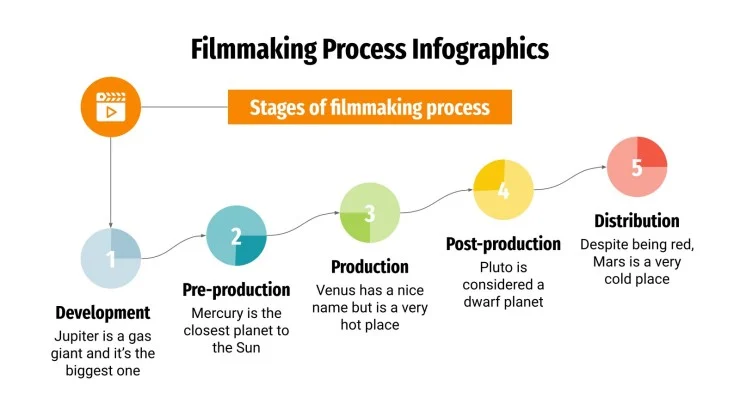

Source: Slidesgo

As an investor, you must understand the film production process to ensure that you invest in the films where you get high returns. Here’s how it works:

Scriptwriting and Development

The journey of a film begins with a compelling script.

Scriptwriting involves crafting the story, developing characters, and creating dialogue.

During this phase, writers often work on multiple drafts to refine the narrative.

As an investor, you need to be certain of the high quality of the script as it lays the foundation for the entire project.

Securing Finance

Once the script is ready, the next step is securing financing.

This involves raising funds through various means such as equity investments, debt financing, or crowdfunding.

Filmmakers create detailed pitch decks and business plans to attract potential investors.

This is a critical stage for you to evaluate the financial viability and potential returns of the project.

You must also decide whether you want to invest as equity, debt or as part of crowdfunding.

This is also the time to negotiate and agree on the terms and conditions of return of your money with profits or ROI.

Casting and Crew Selection

Casting involves choosing the right actors to bring the characters to life.

Crew selection focuses on hiring skilled professionals for key roles like the director, cinematographer, and production designer.

The reputation and experience of the cast and crew can significantly impact a film's success and earning potential, making it an essential consideration for you.

Filming Process

The filming process is where the script is transformed into visual reality.

This phase includes setting up scenes, directing actors, and capturing footage.

It is often the most intensive part of production, requiring meticulous planning and execution.

Managing Production Logistics

Managing logistics involves coordinating schedules, locations, equipment, and personnel to ensure smooth operations.

Effective logistics management is crucial to stay on budget and on schedule, which directly affects the film’s financial performance and your ROI.

Editing Process

The editing process involves selecting the best takes, arranging scenes, and creating a cohesive story.

Editors work closely with directors to ensure the film’s pacing and structure are optimized.

Finalizing the Film

Finalizing the film involves completing all technical aspects and preparing it for distribution. This includes color grading, sound mixing, and adding titles and credits.

Once finalized, the film is ready for release, marking the culmination of the production process.

This is the critical moment for you as an investor, where the film transitions from a creative project to a marketable product.

Key Financial Considerations: Budgeting and Financial Planning

Source: Medium

Creating a Budget

Creating a comprehensive budget is one of the first and most crucial steps in film financing.

A detailed budget outlines all the expected costs involved in bringing a film from concept to completion.

This includes pre-production expenses like script development and casting, production costs such as location fees and equipment rentals, and post-production expenditures for editing and special effects.

As an investor, it is essential for you to understand the film’s budget that you are planning to invest in.

It can provide you with a clear picture of the financial requirements and help in assessing the project’s feasibility and the return on your investment.

A well-prepared budget also demonstrates the filmmaker's meticulous planning and financial acumen.

Contingency Planning

In film production, unexpected expenses are almost inevitable.

Contingency planning involves setting aside a portion of the budget to cover unforeseen costs, such as weather delays, equipment failures, or additional shooting days.

Typically, a contingency fund accounts for about 10-15% of the total budget.

Before investing, understand the contingency planning of the makers.

It indicates the production team’s preparedness to handle surprises without derailing the project financially and impacting your investment.

Cost Control Measures

Is the film you are considering investing in have cost-control measures in place?

Implementing cost control measures is vital to ensure the film stays within budget.

This includes monitoring expenditures, negotiating favorable terms with vendors, and making efficient use of resources.

Regular financial reviews and audits help keep the production on track.

Understanding these measures can provide you with the confidence that the production team is capable of managing the budget effectively, thereby minimizing financial risks.

Revenue Streams and Profit Margins

Source: Screendaily

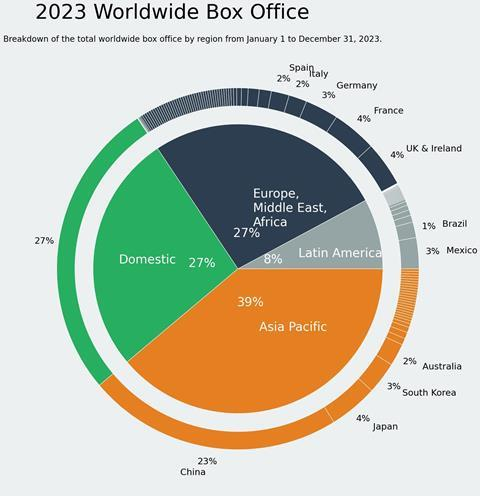

Box Office Revenues

Box office revenues are the most direct source of income for a film.

This is the money earned from ticket sales in theaters.

While blockbuster films can generate massive box office returns, it’s important to remember that this income is shared with theater owners and distributors.

Before investing, you should spend time to understand box office trends and the potential audience reach of the film.

This can help you predict possible earnings from this revenue stream.

Distribution and Revenue Generation

Effective distribution strategies are critical for maximizing a film’s revenue potential.

Distribution involves planning the release strategy, negotiating with theater chains

It ensures that the film reaches a broad audience through various channels, including theaters, streaming services, and television networks.

A well-executed distribution strategy can significantly enhance a film’s financial success and your ROI.

For example, staggered international releases can prolong a film’s earning potential and adapt marketing strategies to different regions.

Partnerships with major distributors can also provide wider reach and better promotional efforts, ensuring the film’s visibility in a crowded market.

Streaming and Digital Distribution

With the rise of streaming platforms like Netflix, Amazon Prime, and Disney+, digital distribution has become a significant revenue source.

Films released on these platforms can reach a global audience, providing steady income through licensing deals and subscription fees.

This represents a growing market with substantial potential for consistent returns for you, especially as streaming continues to dominate the entertainment industry.

Ancillary Revenue Sources

Ancillary revenue sources include merchandising, soundtrack sales, and rights for television broadcasts and home video releases.

For instance, successful films often generate additional income through branded merchandise like toys and apparel.

Soundtracks can also be a lucrative side stream, especially for musicals and films with popular music scores.

These revenue streams contribute to the overall profitability and longevity of the film’s earning potential that impact your ROI.

Investing in films targeted for streaming platforms can mitigate some of the risks associated with box office performance.

These platforms also allow films to reach a global audience, expanding potential viewership.

Monitoring trends, such as the rise of franchise films and holiday release windows, can provide you insights into which projects to invest in.

For example, the film "Bird Box" reportedly reached 26 million viewers in its first week on Netflix, showcasing the vast reach and impact of digital distribution.

As streaming continues to grow, it represents a stable and potentially lucrative investment opportunity.

Case Studies of Profitable Film Investments

Source: mediasocietyculture.

Successful Independent Films

Independent films often operate with lower budgets but can achieve remarkable financial success and critical acclaim.

They can prove to be a great avenue for your investment with a potential for good returns.

For instance, "Blair Witch Project," made for about $60,000, grossed nearly $250 million worldwide.

Another example is "Little Miss Sunshine," produced for $8 million and earning over $100 million globally.

Investing in independent films can be highly rewarding due to their lower initial costs and potential for high returns.

These films often rely on unique, compelling stories and innovative marketing strategies, making them attractive to niche audiences.

The success of "Blair Witch Project" was largely due to its viral marketing campaign, which created a buzz and drew audiences.

Understanding these factors helps you identify promising indie projects that might replicate such success.

Factors Contributing to Success Of Independent Films

Several factors contribute to the success of independent films, such as:

Compelling Storytelling: Unique and engaging narratives that stand out in a crowded market.

Effective Marketing: Innovative, often low-cost marketing strategies that generate significant word-of-mouth promotion.

Festival Circuit: Premiering at film festivals can attract critical acclaim and distribution deals, boosting a film's profile and earning potential.

By focusing on these elements, you can identify investment opportunities in the indie film sector that offer substantial returns with manageable risks.

Case Studies of Profitable Film Investments

Source: Disneyplus

Blockbuster Movie Investments

Blockbuster movies represent some of the most lucrative investments in the film industry.

These films typically have high production and marketing budgets but can yield enormous returns.

A prime example is "Avengers: Endgame," which had a production budget of around $356 million and grossed over $2.7 billion worldwide.

Another notable example is "Avatar," produced for approximately $237 million and earning over $2.8 billion globally.

These films benefit from wide releases, massive marketing campaigns, and established fan bases, ensuring they reach a vast audience.

Why To Invest In Blockbuster Movie?

Investing in blockbusters can be highly rewarding for you, due to the potential for significant financial returns.

These films often come with extensive promotional support and distribution networks, maximizing their reach.

However, they also carry substantial risks due to their high upfront costs.

You need to understand the various elements that contribute to a blockbuster’s success. Some of these are - strong franchises, star power, and innovative storytelling.

These can help you make informed investment decisions with the potential of a good ROI.

Factors Contributing to Success

Several factors contribute to the success of blockbuster movies. Some of these are:

Franchise Power: Established franchises like the Marvel Cinematic Universe come with built-in audiences.

Star Cast: Big-name actors and directors attract attention and viewers.

Marketing Muscle: Extensive marketing campaigns create widespread awareness and anticipation.

High Production Values: Impressive special effects, sound design, and cinematography enhance the viewer experience.

By focusing on these elements, you can better assess the potential success of blockbuster films and make strategic investments.

Independent vs. Studio Films

Source: LinkedIn

As an investor, should you put your money into independent movies or studio films? Here are some pointers that can help you make an informed decision:

Independent Films

Independent films operate with lower budgets and often focus on unique, compelling stories.

A successful example is "Get Out," which was made for $4.5 million and grossed over $255 million worldwide.

Independent films often have more creative freedom and can achieve high returns relative to their low investment.

Studio Films

Studio films are typically high-budget productions with significant backing from major film studios.

Examples include "Jurassic World," produced for $150 million and grossing $1.67 billion globally.

Studio films often aim for mass appeal and have the advantage of wide distribution networks.

Lessons Learned from Different Production Models

Understanding the differences between independent and studio films can help you make informed choices regarding your investment.

Independent films offer the potential for high returns on a lower investment but come with higher risk due to limited resources and distribution challenges.

Studio films, while requiring larger investments, tend to have lower risk due to their established support systems and market presence.

You can diversify their portfolios by balancing investments between indie projects with high creative potential and studio-backed films with more predictable returns.

Conclusion

Investing in films offers various opportunities, from blockbusters to independent films.

Understanding the financial aspects, such as budgeting, revenue streams, and distribution strategies, is crucial.

The film industry’s dynamic nature and diverse investment opportunities allow you to find projects that align with your risk tolerance and investment goals.

As always, consulting with a financial advisor or an alt investment expert can provide further guidance and help navigate this intriguing investment landscape.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

What are the main ways to invest in films?

Investing in films can be done through equity investments, debt financing, or crowdfunding, each with its own set of risks and rewards.

How do box office revenues impact a film’s profitability?

Box office revenues are critical for a film's profitability, but they are often split between theaters and distributors, impacting the net income for investors.

What are the benefits of streaming and digital distribution for film investors?

Streaming platforms provide a stable revenue stream, broader audience reach, and mitigate some risks associated with traditional box office performance.

What is the difference between investing in independent films and studio films?

Independent films offer high potential returns on lower investments but carry higher risks, while studio films require larger investments but tend to have more predictable returns due to extensive backing and resources.

Can crowdfunding be a successful way to invest in films?

Yes, crowdfunding can be successful, especially for films with unique stories and strong fan engagement, as seen with projects like "Veronica Mars."