What to Expect?

- Dive into the World of Cryptocurrency Investing and Opportunities for Substantial Gains.

- Explore the Complexities of Crypto Investments, its Decentralized Nature, and Cryptographic Security.

- Uncover the Top Cryptocurrencies Driving the Market: Bitcoins, Altcoins, Tokens, their Unique Features and Potential.

- Understand the Arguments for and against Cryptocurrencies as "Real Money."

- Learn Step-By-Step on How to Buy Cryptocurrencies.

- Gain Insights into the Risks and Rewards of Crypto Investing.

Cryptocurrency investing has captured the attention of millions worldwide. This alternative investment offers you an opportunity for substantial gains, once you understand its complexities that require careful navigation.

Often hailed as the future of money, cryptocurrency, is a digital or virtual form of currency. It operates on decentralized networks using cryptographic techniques to secure transactions.

One of the most famous cases of an individual benefiting from cryptocurrency investing is the curious case of Erik Finman. He is often called the "Bitcoin Teen Millionaire."

In 2011, when he was just 12 years old, he received a gift of $1,000 from his grandmother. Instead of spending it conventionally, he invested it in Bitcoin, purchasing around 100 coins when the price was approximately $10 each.

As Bitcoin's value surged over the years, Finman's initial investment skyrocketed in worth. By the time he turned 18 in 2017, the value of his Bitcoin holdings had exceeded $1 million, turning him into a self-made millionaire.

But before you hop in and invest in cryptocurrencies, you must understand how it works, the risks involved, and the best way to make your investment grow.

Understanding Crypto Investments

Cryptocurrency, also known as crypto, is a digital or virtual currency. It uses cryptography for security and operates independently of a central authority like a country’s central bank. Unlike traditional currencies that are issued by governments, such as the US Dollar or the Euro, cryptocurrencies are decentralized and typically based on blockchain technology.

One of the defining characteristics of cryptocurrencies is their limited supply. For example, Bitcoin, the first and most well-known cryptocurrency, has a maximum supply of 21 million coins. This scarcity of cryptocurrencies is often cited as one of the reasons for their value appreciation over time.

Another aspect of crypto investments is their volatility. Cryptocurrency prices can be highly volatile, with rapid price fluctuations occurring within a short span. This volatility presents you with opportunities for significant gains, as well as a high risk of your invested amount going down the drain.

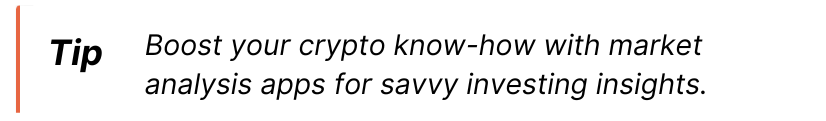

Types of Cryptocurrencies

These are the top cryptocurrencies that are traded worldwide today:

1. Bitcoin (BTC)

Bitcoin is often called the ‘digital gold.’ It is the first and most widely recognized cryptocurrency in the world. It was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. Bitcoin operates on a decentralized network called a blockchain.

Its primary purpose is to serve as a peer-to-peer electronic cash system, enabling secure and borderless transactions without the need for intermediaries, such as a central bank.

The scarcity of Bitcoin, with a maximum supply capped at 21 million coins, contributes to its store of value proposition. It has gained mainstream acceptance as an alternative investment and a hedge against inflation.

Many institutions across the world are allocating funds to Bitcoin as part of their investment portfolios.

2. Ether (ETH)

Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin and a team of developers.

The platform introduced the concept of programmable money, allowing for the creation of custom tokens and complex financial instruments on its blockchain.

Ethereum's native cryptocurrency is Ether (ETH), which is used for transactions and on the Ethereum network. It has emerged as the leading platform for decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized applications.

3. Altcoins

Altcoins or alternative cryptocurrencies, include any digital asset or currency other than Bitcoin. These coins try to improve upon Bitcoin's limitations or offer unique features and use cases. Examples of this are Litecoin (LTC), Ripple (XRP), and Cardano (ADA).

Altcoins often have faster transaction speeds, enhanced privacy, and consensus mechanisms to address specific market needs and challenges. They also help you diversify beyond Bitcoin, and cater to various sectors and industries, such as gaming, privacy, and decentralized finance (DeFi).

4. Tokens

Tokens are digital assets created and issued on existing blockchain platforms, such as Ethereum. These tokens represent a wide range of assets, including digital collectibles, utility tokens, security tokens, non-fungible tokens (NFTs), and new financial products and services like lending, borrowing, and yield farming.

They offer flexibility and programmability and enable the creation of custom tokens with specific functionalities and features. Tokens facilitate the tokenization of real-world assets, such as real estate, art, and commodities. With tokens, you can get fractional ownership and high liquidity.

5. Stablecoins

Stablecoins are cryptocurrencies that maintain a stable value as their price is attached to an external asset, such as a fiat currency (e.g., USD), precious metals, or other cryptocurrencies.

These stable-value assets can provide you stability and predictability in volatile cryptocurrency markets. You can use them for trading, remittances, and everyday transactions.

Stablecoins enable fast and low-cost transactions, with instant transfers and remittances across borders without the need for intermediaries.

6. Ripple (XRP)

Ripple is both a digital payment protocol and a cryptocurrency designed for fast and low-cost cross-border payments. Its native cryptocurrency, XRP, serves as a bridge currency for facilitating transactions on the Ripple Protocol Consensus Algorithm (RPCA) and as a liquidity tool for financial institutions.

7. Litecoin (LTC)

Litecoin is a peer-to-peer cryptocurrency created by Charlie Lee in 2011. Many consider it as a "lite" version of Bitcoin. You will find that it shares many similarities with Bitcoin in terms of its underlying technology and decentralized nature. However, it offers faster transaction times and lower fees.

It also has a faster block generation time and a higher supply limit of 84 million coins. These contribute to its potential as a medium of exchange for everyday transactions and micropayments.

8. Cardano (ADA)

Cardano is a decentralized blockchain platform that was founded by Charles Hoskinson, one of the co-founders of Ethereum, Cardano focuses on academic rigor, peer-reviewed research, and formal methods.

It is based on a layered protocol stack and aims to address scalability, interoperability, and sustainability. You can invest in its native cryptocurrency ADA, which is used for transactions, staking, and governance within the Cardano ecosystem.

9. Polkadot (DOT)

Polkadot is a multi-chain blockchain platform that enables interoperability between different blockchains. It aims to create a decentralized and scalable web where users can control their data and assets without relying on intermediaries.

Its native cryptocurrency is DOT, in which you can invest with confidence in cross-chain communication, scalability, and security.

10. Chainlink (LINK)

Chainlink is a decentralized oracle network that connects smart contracts with real-world data. Its native cryptocurrency LINK, is used for payments, staking, and incentivizing node operators and you can invest in the same for long-term gains and profits.

It aims to bridge the gap between blockchain-based smart contracts and external data sources, such as APIs, databases, and payment systems.

To check more cryptocurrencies and their current prices you can check CoinMarketCap.

Is Crypto Real Money?

While cryptocurrencies operate as a medium of exchange and store of value, the question of whether they qualify as "real money" is subject to heated debate. Some argue that cryptocurrencies meet most, if not all the criteria of money.

However, skeptics point to the lack of widespread adoption and regulatory uncertainty surrounding cryptocurrencies. These are the reasons why they may not yet qualify as real money in the traditional sense.

Here are some of the arguments for and against cryptocurrencies as real money:

Reasons in Favor of Cryptocurrencies

1. Unit of Account

Cryptocurrencies serve as a unit of account by providing a standard measure for pricing goods and services. While traditional fiat currencies like the Dollar or Euro have long served this purpose, cryptos are increasingly being used as a unit of account in both digital economies and decentralized finance (DeFi) platforms.

You can denominate prices, wages, and debts in cryptocurrencies. This facilitates economic transactions and price discovery within crypto-native communities.

2. A Medium of Exchange

Cryptocurrency functions as a medium of exchange by enabling the transfer of value between parties in a decentralized and borderless manner. With the proliferation of digital wallets and payment platforms, cryptocurrencies have emerged as a convenient and efficient means of conducting peer-to-peer transactions, remittances, and cross-border payments.

3. A Store of Value

Cryptocurrency serves as a store of value by allowing you to hold and preserve wealth over time. Like traditional fiat currencies, cryptos can be used to store purchasing power and hedge against inflationary pressures.

Many supporters view cryptocurrencies, particularly those with limited supplies like Bitcoin, as digital gold or a safe haven asset that can preserve value in times of economic uncertainty.

4. Divisibility

Cryptocurrencies offer divisibility, allowing you to split them into smaller units for transactions of varying sizes. This feature enhances their usability as a medium of exchange, as you can conduct transactions ranging from small micropayments to large-scale transfers.

5. Durability

Cryptocurrencies demonstrate durability as digital assets stored on immutable and decentralized blockchain networks. Unlike physical currencies that are susceptible to wear and tear, cryptos are resistant to physical degradation and decay.

The cryptographic techniques used to secure blockchain transactions ensure the integrity and permanence of cryptocurrency holdings, providing long-term durability and resilience against tampering or manipulation.

6. Accessibility

Cryptocurrencies offer accessibility by providing an open and permissionless financial system that allows anyone with an internet connection to participate. Unlike traditional banking systems that may require individuals to meet specific eligibility criteria or access restrictions, cryptocurrencies enable you to create digital wallets and transact freely without intermediaries.

7. Innovative Features

Cryptos have introduced innovative features and functionalities that extend beyond those of traditional fiat currencies, offering unique value propositions and use cases. For example, smart contract platforms like Ethereum enable the creation of programmable money, allowing for the execution of self-executing contracts and decentralized applications (dApps).

Additionally, cryptocurrencies have features such as privacy enhancements, scalability solutions, and interoperability protocols. This further enhances their utility and versatility in diverse applications.

Reasons Against Cryptocurrencies

1. Not Backed by any Assets

Cryptocurrencies are not backed by any tangible assets or commodities, unlike traditional fiat currencies that may be backed by reserves of gold or other national assets. Fiat currencies derive their value from the trust and confidence placed in the issuing government or central bank, which guarantees their value and stability.

In contrast, cryptos derive their value solely from supply and demand dynamics in the market. This makes them susceptible to speculative bubbles, market sentiment, and external factors. Without the backing of physical assets or government guarantees, cryptocurrencies lack intrinsic value and may be subject to price manipulation and volatility.

2. Finite Supply

While some cryptocurrencies like Bitcoin have a capped maximum supply, the total supply of most cryptos is not fixed. This means that they can be subject to inflationary pressures through mechanisms like mining rewards or token issuance.

Unlike fiat currencies that may be regulated by central banks to control inflation and ensure price stability, cryptos may experience supply shocks and fluctuations in issuance rates. This can lead to uncertainty and unpredictability in their value over time.

3. Not a Physical Asset

Cryptocurrencies exist solely in digital form and lack physical presence, unlike traditional forms of money such as cash or precious metals. While digital currencies offer convenience and accessibility, they also pose challenges in terms of security, custody, and usability.

Unlike physical assets that you can hold, touch, and exchange directly, cryptocurrencies require you to rely on digital wallets, private keys, and online platforms for storage and transactions. This exposes cryptos to various risks such as hacking, theft, and loss.

4. Volatility

Cryptocurrencies are highly volatile, with prices often experiencing significant fluctuations within short periods. This volatility presents opportunities for traders to profit from price swings. However, it also poses risks for you and other users who seek stability and predictability in their financial transactions.

High volatility can erode purchasing power, and deter merchants from accepting cryptocurrencies as payment. This undermines confidence in their suitability as a medium of exchange or store of value.

5. No Government Protection

Cryptocurrencies are not backed or insured by any government or regulatory authority, unlike traditional bank deposits that may be protected by deposit insurance schemes. In the event of theft, fraud, or loss of funds, you may have limited recourse for recovery or compensation, as transactions on blockchain networks are irreversible and pseudonymous.

Without government protection or regulatory oversight, you bear full responsibility for safeguarding funds and managing risks.

6. No Insurance

Unlike traditional financial products and services that may be insured by government-backed schemes or private insurance providers, cryptocurrencies generally lack insurance coverage for losses or damages.

While some cryptocurrency exchanges and custodial services may offer insurance against certain risks such as theft or hacking, coverage may be limited, conditional, or subject to exclusions.

As a result, you face heightened risks and uncertainties compared to traditional financial markets, where insurance mechanisms provide you with a safety net. Without adequate insurance protection, you are vulnerable to financial losses and liabilities in the event of adverse events or security breaches.

How to Buy Crypto?

Here’s the step-by-step process for buying cryptocurrencies:

1. Choose a Cryptocurrency Exchange

It is crucial for you to select the right cryptocurrency exchange for a smooth and secure buying experience. You can go through user reviews and ratings to gauge the community's satisfaction with each platform. Consider factors such as the variety of cryptos offered, trading fees, ease of use, customer support, and regulatory compliance.

Coinbase, for example, is a popular choice among beginners due to its user-friendly interface and robust security measures. If you are an experienced trader, you will find exchanges like Binance or Kraken as they have advanced trading features.

You can compare different exchanges and choose one that aligns with your preferences and investment goals.

2. Create an Account

Once you have selected an exchange, the next step is to create an account. This can be done by providing your email address, choosing a secure password, and completing any identity verification procedures.

Follow the exchange's instructions carefully to ensure your account setup process goes smoothly. You can enable two-factor authentication (2FA) for an extra layer of security.

3. Deposit Funds

After you have set up your account, all you need is to deposit funds and start trading. Most cryptocurrency exchanges support deposits via bank transfer, credit/debit cards, or cryptocurrency transfers from another wallet.

Choose the deposit method that is convenient for you and follow the instructions to initiate the transfer. The deposit times and fees may vary depending on the deposit method and the exchange's policies.

4. Navigate the Trading Interface

Familiarize yourself with the trading interface of the exchange to make informed decisions when buying cryptocurrency. Some important features to explore are order books, price charts, and trading pairs to understand how the market works.

You can also take advantage of tools like technical analysis indicators and trading signals. This can help you to identify potential buying opportunities and trends.

Take the required time to practice navigating the trading interface and placing orders to gain confidence before you make substantial investments.

5. Choose the Cryptocurrency to Buy

With thousands of cryptocurrencies available in the market, it may be difficult for you to choose the right one to invest in. Apart from fundamentals such as use case, technology, team, community, and market potential, you should consider factors such as adoption rate, developer activity, and regulatory environment.

Bitcoin and Ethereum are a good choice if you are a beginner. While altcoins offer higher growth potential, they also have higher risks. You can also consider diversifying your portfolio across multiple cryptocurrencies to mitigate risk and maximize returns.

6. Place your order

After deciding which cryptocurrency to buy, place your order. You can choose between a market order, which executes immediately at the current market price, or a limit order, which allows you to specify the price at which you want to buy.

Consider factors such as liquidity, order book depth, and trading volume before placing your order. Also, review the order details carefully before confirming to avoid any mistakes or errors.

7. Store Your Crypto

Once your order is executed, your cryptocurrency will be credited to your exchange account. You must transfer your crypto to a secure wallet for long-term storage. You can use a hardware wallet or a reputable software wallet to protect your assets from theft, hacks, and other security threats.

Conclusion

The world of crypto investments is enticing with the promise of fabulous returns and windfall profits. However, this comes at the cost of various risks and requires due diligence.

You can consider consulting a financial advisor or an alt-investment advisor company before making any investment decisions. By staying informed and exercising caution, you can navigate the exciting and dynamic world of cryptocurrency investing with confidence.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

Q: Which crypto is best to invest now?

A: The best cryptocurrency to invest in depends on what are your investment goals and risk tolerance. Popular options that you consider include Bitcoin (BTC) for long-term stability and Ethereum (ETH) for potential growth opportunities.

Q: How do I buy crypto?

A: You can buy cryptocurrency through any of the various reputable exchanges like Coinbase, Binance, or Kraken. Simply create an account, deposit funds, and choose the cryptocurrency you want to purchase, make the payment, and the cryptocurrency will show up in your wallet.

Q: Is crypto currency legal?

A: Cryptocurrency’s legality varies from country to country. While some nations fully embrace it, others impose restrictions or bans. Before investing, research your local regulations to ensure compliance.

Q: How to invest money in cryptocurrency?

A: To invest in cryptocurrency you need to first understand the market and different types of cryptocurrencies. Then, you need to choose a trusted exchange, create an account, deposit funds, and follow your investment strategy with caution.