Source: Caisgroup

1. Introduction

The alternative investment market has become an attractive option for investors looking to diversify their portfolios and achieve higher returns.

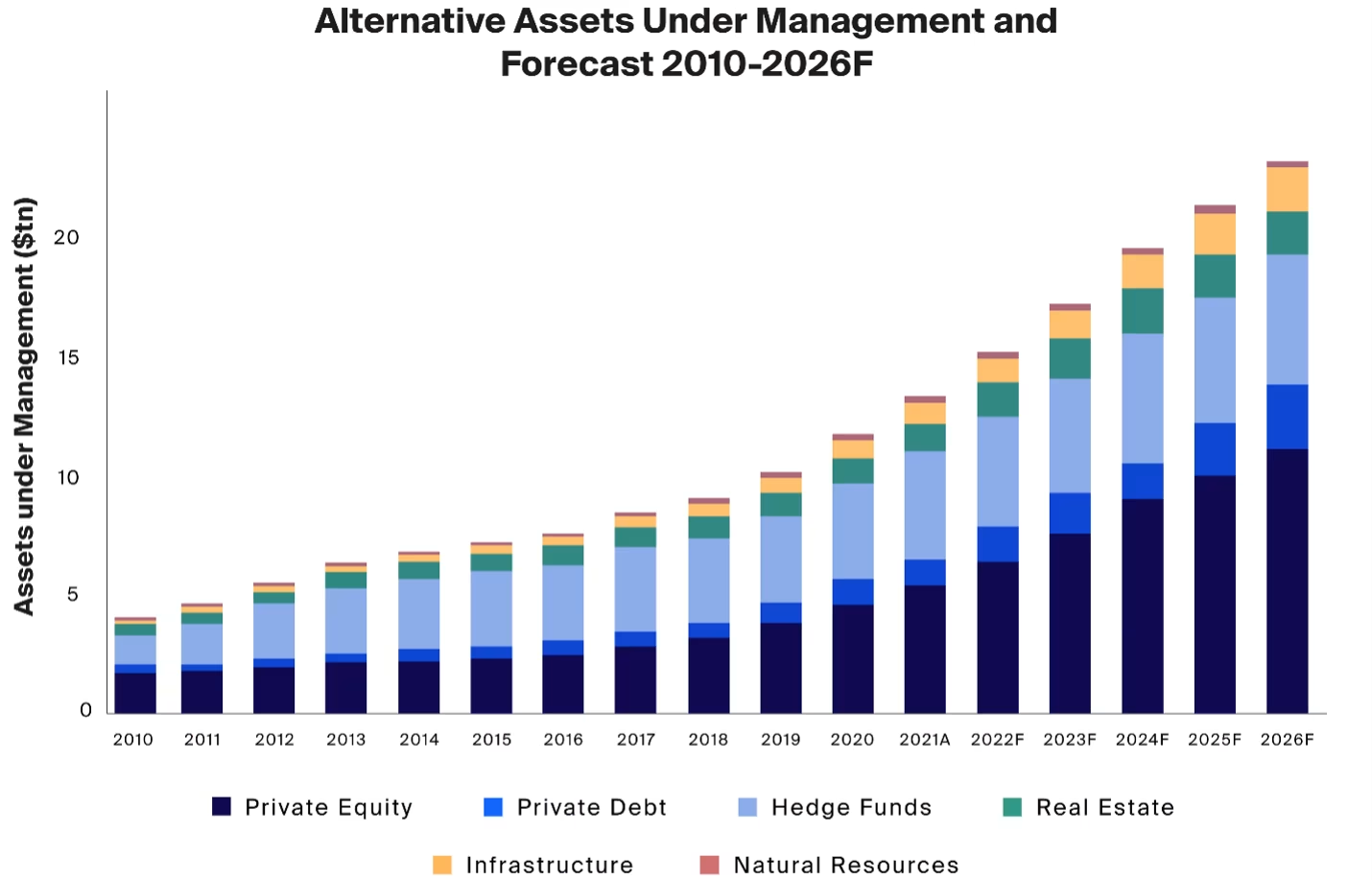

In 2023, the global alternative investment market was valued at approximately $13.4 trillion and is projected to reach $22.6 trillion by 2026.

Here are just two examples that highlight the potential of these investments.

Yale's endowment fund allocated a significant portion to alternative assets. This strategic shift led to an impressive annualized return of 11.4% over the past 20 years, significantly outperforming traditional asset classes.

Similarly, the Ontario Teachers' Pension Plan (OTPP) achieved remarkable success through private equity investments with an average annual return of 10.7% over the last decade.

Understanding the nuances and potential of alternative investments is crucial if you are looking to achieve similar returns or unlock hidden wealth.

Key Takeaways

- Alternative investments offer diverse opportunities beyond traditional stocks and bonds.

- Many alternative investments, such as private equity and cryptocurrencies, have the potential for substantial returns, although with higher risk.

- Adding alternative investments can enhance your portfolio diversification, reducing overall risk by including non-correlated assets.

- Many alternative investments, like real estate and private equity, have liquidity constraints, requiring long-term commitments and limited exit options.

- Alternative investments often involve complex strategies and require specialized knowledge and expertise to manage effectively.

- These investments are subject to regulatory uncertainties and market risks, which can impact their performance and stability.

- Assets like real estate and commodities can serve as effective hedges against inflation, preserving purchasing power over time.

1.1 Decoding Alternative Investments

Alternative investments cover a broad range of asset classes outside traditional stocks, bonds, and cash.

These include private equity, hedge funds, real estate, commodities, and collectibles.

Unlike traditional investments, alternative assets often involve complex structures and strategies, offering you unique opportunities and challenges as an investor.

1.2. Historical Context and Evolution

Over the past few decades, alternative investments have gained traction as investors seek diversification and higher returns.

The 2008 financial crisis, in particular, highlighted the need for assets less correlated with public markets.

2. The Advantages of Alternative Investments

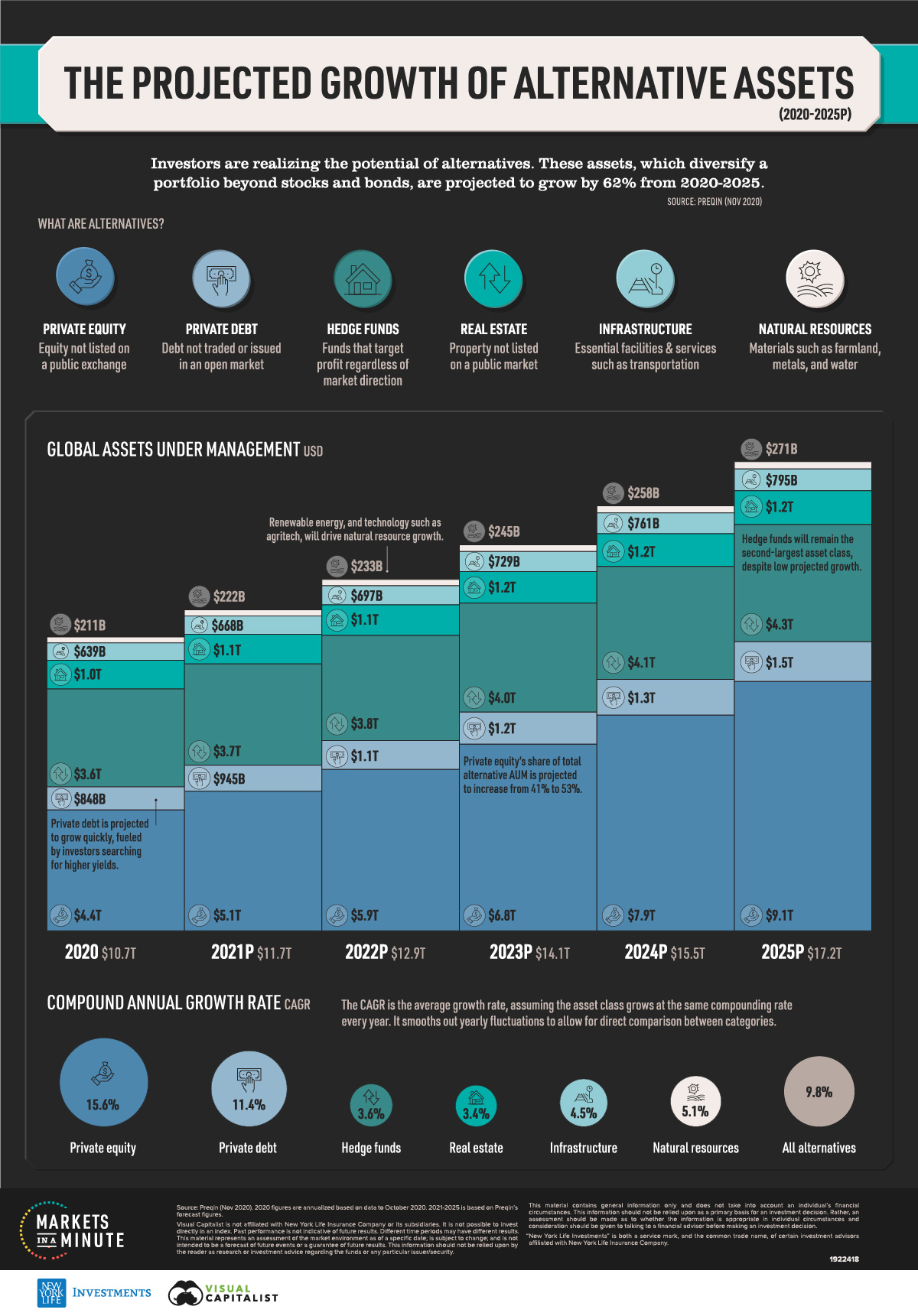

Source: Visualcapitalist

These are the various benefits or pros of investing in alternative assets:

2.1. Diversification Benefits

One of the primary benefits of alternative investments is their ability to diversify a portfolio.

By including assets that do not move along with traditional markets, you can reduce the overall portfolio risk.

For instance, real estate and commodities often exhibit low correlation with stocks and bonds and can provide you a hedge against market volatility, as noted in ResearchGate on Diversification Benefits and Risks.

2.2. Higher Return Potential

Alternative investments have the potential to deliver you higher returns compared to traditional asset classes.

Historical data shows that private equity has consistently outperformed public equities over long investment horizons, as highlighted in Bain & Company's Private Equity Report 2022.

2.3. Inflation Protection

Certain alternative assets, such as real estate and commodities, serve as effective hedges against inflation.

Real estate investments, for instance, often increase in value over time, keeping pace with or exceeding inflation rates according to NCREIF on Real Estate and Inflation Hedging.

Similarly, commodities like gold tend to appreciate during inflationary periods, preserving purchasing power.

2.4. Access to Unique Opportunities

Alternative investments provide you access to unique opportunities that are not available in public markets.

For example, venture capital investments allow you to participate in the growth of early-stage companies with high growth potential that can result in substantial returns, as shown in the PwC Private Equity Survey.

2.5. Enhanced Portfolio Stability

Alternative investments help you to enhance your portfolio stability during market downturns.

Assets like infrastructure and private debt often have stable cash flows and lower volatility compared to public equities.

This stability can help cushion the impact of any market fluctuations, as discussed in Brookings on Infrastructure Investment and Economic Growth.

2.6. Customizable Strategies

Alternative investments offer the flexibility to implement customized investment strategies.

Whether through hedge funds employing long-short strategies or private equity funds focusing on specific sectors, these investments can be tailored to match your risk tolerance and financial goals.

2.7. Potential for Capital Appreciation

Certain alternative assets, like collectibles and art, have the potential for significant capital appreciation.

For instance, rare art pieces and vintage wines can increase in value over time, providing you with substantial returns when you sell them.

2.8. Tax Advantages

Some alternative investments come with tax benefits. Real estate investments, for example, can offer tax deductions through depreciation.

Also, investing in certain sectors, like renewable energy, can provide you with tax credits, enhancing the overall return on your investment, as highlighted by Nareit on REIT Tax Benefits.

3. Alternative vs. Traditional Investments

3.1. Risk and Return Profiles

Alternative investments usually exhibit different risk and return profiles compared to traditional investments.

While they can offer higher returns, they also come with increased risks, such as liquidity constraints and regulatory challenges.

Understanding these differences is crucial for you to make informed investment decisions.

3.2. Liquidity and Accessibility

Liquidity is a significant consideration when comparing alternative and traditional investments.

Traditional assets like stocks and bonds are generally more liquid, allowing you to buy or sell easily.

In contrast, alternative investments often require longer holding periods and may involve restrictions on withdrawals.

3.3. Transparency and Regulation

Traditional investments are typically subject to stringent regulatory oversight, ensuring a high level of transparency and protection on your investment.

In contrast, alternative investments often operate in less regulated environments.

This lack of regulation can increase the risk of fraud and mismanagement.

3.4. Fees and Costs

The fee structures of alternative investments can be significantly different from those of traditional investments.

These higher costs can eat into returns, so it's important that you weigh them against the potential benefits.

3.5. Market Sensitivity

Traditional investments are generally more sensitive to market conditions and economic cycles.

Stocks, for example, can be highly volatile and influenced by market sentiment and economic indicators.

In contrast, some alternative investments, like real estate and infrastructure, may be less affected by short-term market fluctuations, providing you with a more stable investment.

3.6. Investment Time Horizon

Alternative investments generally require you to have a longer investment time horizon compared to traditional investments.

You need to invest in private equity, real estate, and infrastructure projects for several years before they realize their full value.

Traditional investments, such as stocks and bonds, are more suited for shorter-term investment horizons and offer greater flexibility in timing withdrawals.

3.7. Performance Metrics and Benchmarks

Your traditional investments often have well-established benchmarks like the S&P 500 for stocks or the Bloomberg Barclays US Aggregate Bond Index for bonds.

Alternative investments, on the other hand, may not have direct benchmarks. This may make it difficult for you to conduct a performance assessment.

3.8. Income Generation Potential

You may find certain traditional investments, such as dividend-paying stocks and bonds, attractive for their income-generating potential.

In comparison, alternative investments such as real estate and private debt, can also provide steady income streams, often with higher yields.

Understanding the income generation capabilities of each type can help you in constructing a balanced portfolio that meets your financial needs.

4. The Role of Alternative Investment Funds (AIFs)

Alternative Investment Funds (AIFs) are pooled investment vehicles that invest in alternative assets.

They can provide you with access to a diversified portfolio of alternative investments, managed by professional fund managers.

AIFs can take various forms, including hedge funds, private equity funds, and real estate investment trusts (REITs).

4.1. Types of AIFs

Hedge Funds: These funds employ a range of strategies to generate high returns, often using leverage and derivatives.

Private Equity Funds: These invest directly in private companies, seeking to enhance their value through strategic management and operational improvements.

Real Estate Investment Trusts (REITs): These funds invest in income-producing real estate properties and offer you exposure to the real estate market without direct ownership.

5. Exploring Different Types of Alternative Investments

Alternative investments offer you unique opportunities beyond traditional stocks and bonds.

They can enhance portfolio diversification, have a potential for higher returns, and offer you a hedge against market volatility.

Here are various types of alternative investments that you can consider for your portfolio:

5.1. Private Equity

Private equity involves investing in private companies not listed on public exchanges, aiming to improve operations and increase value.

Example: The Carlyle Group's investment in Beats by Dre, later acquired by Apple for $3 billion, resulted in significant returns for investors.

Pros

High Return Potential: Private equity often delivers high returns, significantly outperforming public markets over the long term due to strategic management and operational improvements.

Access to Exclusive Opportunities: Provides access to investment opportunities not available in public markets, allowing you to participate in high-growth private companies.

Active Involvement: As an investor you can influence company decisions and management practices, potentially enhancing the company’s value and performance.

Long-Term Growth: This is an ideal option if you are looking for long-term capital growth, as private equity investments typically have a multi-year horizon.

Cons

Liquidity Constraints: Investments are generally illiquid, with long lock-up periods that restrict your ability to quickly access funds.

Regulatory Risks: It is subject to complex regulatory environments that can affect investment outcomes and increase compliance costs.

Management Dependency: Its performance relies on the effectiveness of the management team, making it crucial to choose skilled and experienced managers.

5.2. Hedge Funds

Hedge funds use diverse strategies like leveraging, short selling, and derivatives to generate returns regardless of market conditions.

Example: The Medallion Fund, managed by Renaissance Technologies, has an average annual return of 39% before fees since inception.

Pros

High Return Potential: Hedge funds can achieve exceptional returns through sophisticated and aggressive investment strategies, including leverage and arbitrage.

Diversification: Offers exposure to a variety of asset classes and investment strategies, reducing overall portfolio risk and improving stability.

Market Neutrality: Designed to perform well in both rising and falling markets, providing a hedge against market volatility and downturns.

Cons

High Fees: Typically charge substantial management and performance fees, which can significantly reduce net returns for investors.

Complexity: Employ complex strategies that require a high level of expertise and may be difficult for average investors to comprehend.

Regulatory Risks: Subject to less regulatory oversight compared to mutual funds, which can increase the potential for mismanagement or fraud.

5.3. Real Estate

Real estate investments involve purchasing properties for rental income or capital appreciation, including residential, commercial, and industrial properties.

Example: The development of Hudson Yards in New York City has attracted significant investments and generated substantial returns.

Pros

Steady Income: It generates regular rental income, providing you with a reliable cash flow.

Appreciation Potential: Properties can appreciate significantly over time, offering you substantial capital gains in addition to rental income.

Tangible Asset: Real estate is a physical asset that provides you with a sense of security and can serve as collateral for financing.

Inflation Hedge: Property values and rental income tend to rise with inflation, protecting purchasing power and maintaining real value.

Cons

High Initial Capital: It requires a significant upfront investment for purchase and ongoing maintenance costs.

Market Risks: Subject to market fluctuations, economic downturns, and changes in local real estate markets that can impact value and income.

Management Intensive: Property management can be time-consuming and costly, requiring effort to handle tenant issues, maintenance, and legal compliance.

Illiquidity: Real estate investments are not easily liquidated. This may make it challenging for you to quickly access funds when needed.

5.4. Commodities

Investing in commodities like gold, silver, and oil can provide you with a hedge against inflation and market volatility.

These physical assets are often used as safe havens during economic uncertainty.

Example: Gold prices surged during the 2008 financial crisis, underscoring its value as an alternative investment.

Pros

Inflation Hedge: Commodities often increase in value during inflationary periods, preserving purchasing power and acting as a safeguard against inflation.

Diversification: They add diversification to your portfolio by introducing assets that are not correlated with traditional stocks and bonds.

Global Demand: Supported by global demand, especially for precious metals and energy commodities, and provides a long-term growth potential.

Liquidity: Many commodities, such as gold, are highly liquid and can be quickly bought or sold in the market.

Cons

Price Volatility: Commodity prices can be highly volatile, influenced by geopolitical events, supply and demand fluctuations, and market speculation.

No Income Generation: Unlike dividend-paying stocks or rental properties, commodities do not generate income unless sold at a profit.

Storage Costs: Physical commodities require secure storage, which can incur additional costs and logistical challenges for you.

Market Risk: These are subject to market risks and regulatory changes that can impact commodity prices and investment returns.

5.5. Collectibles and Rare Assets

Collectibles include items like fine art, rare coins, vintage cars, and wine. These investments can appreciate significantly in value over time.

Example: The sale of Leonardo da Vinci's "Salvator Mundi" for $450 million in 2017 highlights the potential for significant returns.

Pros

High Appreciation Potential: Rare and desirable items can appreciate substantially in value, providing significant returns on investment.

Tangible Asset: Collectibles are physical items that can be enjoyed and displayed, offering personal satisfaction in addition to financial returns.

Diversification: They add a unique asset class to your portfolio, reducing reliance on traditional financial markets.

Cultural and Historical Value: Often, these have intrinsic cultural and historical significance, adding to their appeal and value.

Cons

Illiquidity: The market for collectibles can be illiquid, making it difficult for you to quickly sell items at their market value.

Valuation Challenges: Determining the true value of collectibles can be complex and subjective and often requires an expert appraisal.

Storage and Insurance Costs: Proper storage and insurance are necessary to protect collectibles, leading to additional expenses.

Market Risk: These are subject to market trends and changing tastes, which can impact demand and value unpredictably.

5.6. Infrastructure

Infrastructure investments focus on essential public services like transportation, utilities, and communications. These assets often provide you with stable, long-term cash flows.

Example: Investments in toll roads or renewable energy projects offer consistent returns through user fees.

Pros

Stable Cash Flows: These types of investments provide you with predictable and stable income streams, often backed by long-term contracts and government support.

Essential Services: They involve critical infrastructure essential to the economy, ensuring sustained demand and usage.

Cons

Operational Challenges: Managing and maintaining infrastructure assets can be complex and require specialized expertise.

Long-Term Horizon: This involves long-term investment horizons with limited liquidity and exit options.

5.8. Private Debt

Private debt involves lending to private companies or individuals, typically offering you higher yields than public debt due to higher risks.

Pros:

Higher Yields: Offers higher interest rates and returns compared to traditional fixed-income investments, compensating for increased risk.

Predictable Income: Provides regular interest payments, offering a stable and predictable income stream for you.

Cons

Credit Risk: Higher risk of default compared to public debt, requiring thorough due diligence and risk assessment.

Illiquidity: Private debt investments are generally illiquid, with limited opportunities for early exit or secondary market sales.

5.9. Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum have emerged as popular alternative investments due to their potential for high returns and use of blockchain technology, as discussed in J.P. Morgan Research on Bitcoin and Cryptocurrencies.

Example: Bitcoin's dramatic rise in value from a few cents to tens of thousands of dollars.

Pros

High Return Potential: Offers substantial returns, with some cryptocurrencies experiencing exponential growth in value over short periods.

Decentralization: Operates independently of traditional financial systems, providing a hedge against centralized economic policies.

Innovation and Technology: Involves cutting-edge blockchain technology, potentially transforming various industries and financial systems.

Cons

Extreme Volatility: Prices can be extremely volatile, leading to significant fluctuations and potential for substantial losses.

Regulatory Uncertainty: Subject to evolving regulatory environments that can impact legality, usage, and investment potential.

Lack of Intrinsic Value: Often criticized for lacking intrinsic value, with prices driven primarily by speculation and market sentiment.

6. Conducting Thorough Research on Alternative Investments

It is essential for you to conduct thorough research for successful alternative investing.

6.1. Evaluating Performance Metrics

Key performance metrics you need to consider are the investment’s historical return, volatility, and Sharpe ratio, as explained in the Cambridge Associates Alternative Investing Guide.

7. Investing in Alternative Assets

7.1. Accessing Investment Platforms

Numerous platforms and tools are available for investing in alternative assets. Online platforms such as YieldStreet and Fundrise offer access to a variety of alternative investments, including real estate and private equity.

7.2. Seek Professional Guidance

Given the complexities involved, you should consider consulting with an alternative investment advisor or a financial advisor.

Professional advisors can help you navigate the intricate landscape of alternative investments, ensuring you make informed decisions.

8. Optimize Your Alternative Investment Portfolio

8.1. Strategic Portfolio Allocation

Optimizing your alternative investment portfolio involves strategic allocation. Diversifying across different types of alternative assets can help you balance risk and enhance returns.

8.2. Effective Risk Management

Managing risks is crucial in alternative investing. For this, you can employ strategies such as diversification, regular performance reviews, and risk assessment to mitigate potential downsides.

8.3. Regular Review and Rebalancing

Regularly reviewing and rebalancing your portfolio ensures that your investments remain aligned with your financial goals.

Conclusion

Alternative investments offer an opportunity to diversify your portfolio and achieve higher returns.

However, they come with their own set of challenges and risks.

By conducting thorough research, seeking professional advice, and strategically managing your investments, you can unlock the hidden wealth potential of alternative assets.

FAQs

Q. What are alternative investments?

A. Alternative investments are financial assets that are outside the traditional categories of stocks, bonds, and cash, such as private equity, hedge funds, real estate, commodities, and more.

Q. Why should I consider alternative investments?

A. Alternative investments can provide portfolio diversification, the potential for higher returns, and a hedge against market volatility and inflation.

Q. What are the risks associated with alternative investments?

A. Risks include higher entry barriers, liquidity constraints, regulatory uncertainties, market volatility, and the need for specialized knowledge.

Q. How do hedge funds generate returns?

A. Hedge funds use diverse strategies such as leveraging, short selling, and derivatives to generate returns, aiming to perform well in various market conditions.

Q. How can real estate investments benefit my portfolio?

A. Real estate investments can provide steady rental income, potential for property appreciation, and a hedge against inflation, adding stability to a portfolio.

Q. What should I consider before investing in cryptocurrencies?

A. Consider the extreme volatility, regulatory uncertainties, security risks, and the speculative nature of cryptocurrencies before investing.