Source: Caisgroup

1. Introduction

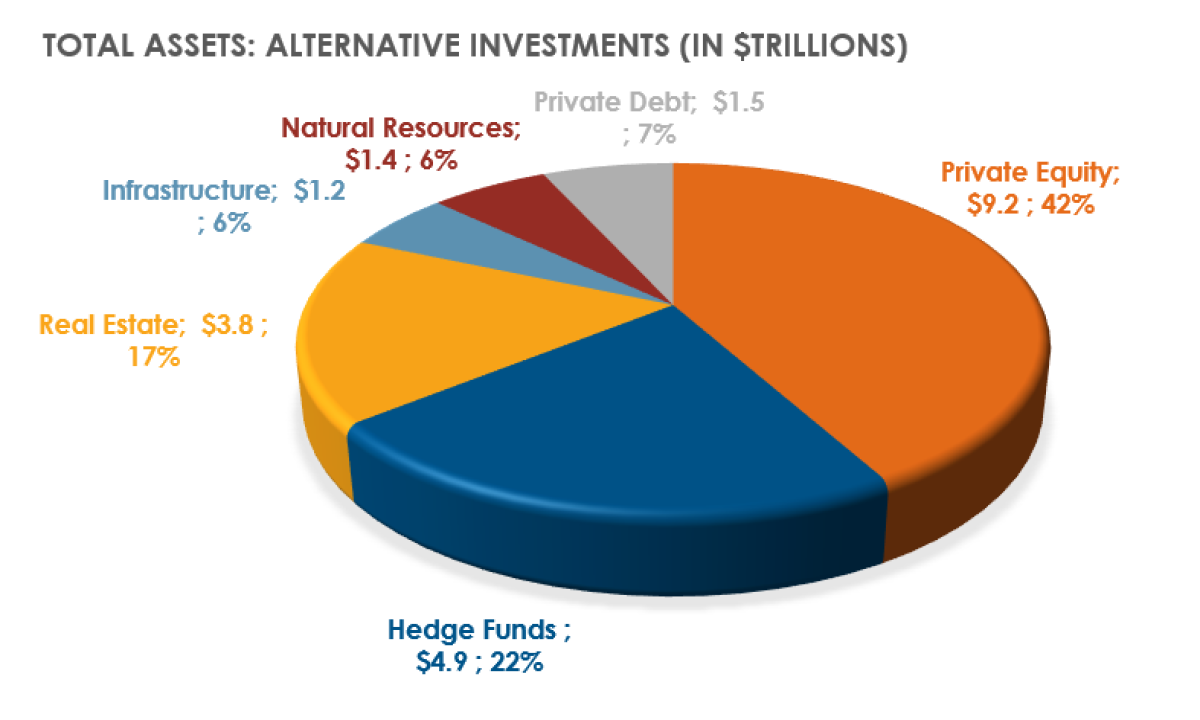

The global alternative investments market is a financial powerhouse with $22 trillion in assets under management, comprising 15% of the total global assets under management.

There are multiple reasons driving this growth. Such as prospects of higher returns, portfolio diversification needs, and the increasing accessibility of alternative investment platforms.

Key Takeaways

- Diversification reduces risk by spreading investments across various asset classes.

- Real estate investments offer tangible assets, steady income, and appreciation potential.

- Tech startups present high-risk, high-reward opportunities with exponential growth potential.

- Cryptocurrencies offer significant gains but come with high volatility and risk.

- Peer-to-peer lending provides higher returns than traditional savings with moderate risk.

- Art and collectibles can yield high returns, combining financial gain with personal interest.

- Sustainable investments align ethical values with the potential for long-term financial performance.

2. The Global Alternative Investments Market

Source: Hbsonline

Alternative investments include assets outside the conventional categories of stocks, bonds, and cash.

These assets often provide returns that aren't correlated with the stock market. This means your portfolio can remain robust even when the stock market is volatile.

2.1. Notable Growth Trends

Several key trends have fueled the expansion of the alternative investments market, such as:

Private Equity: This involves investing in private companies or buying out public companies to delist them from stock exchanges.

Hedge Funds: These are investment funds that employ diverse strategies to earn active returns for their investors.

Real Estate: Both direct real estate investments and Real Estate Investment Trusts (REITs) have gained popularity.

Cryptocurrencies: Digital currencies like Bitcoin and Ethereum have seen explosive growth.

2.2 Real-Life Alternative Investments Example: Uber's Phenomenal Growth

Imagine you had the foresight to invest in Uber when it was just a fledgling startup.

Venture capital firms like Benchmark Capital did just that, and their early faith in the ride-hailing giant paid off spectacularly.

Uber's initial public offering (IPO) in 2019 was a landmark event, with the company's valuation soaring to $82.4 billion.

Early investors saw returns exceeding 1000%, turning modest investments into massive financial gains.

This example shows the potential rewards of investing in innovative startups.

It’s not just about picking a company with a good idea; it’s also about seeing the future potential and market impact of that idea.

Uber revolutionized urban transportation, and those who recognized this early reaped substantial benefits.

3. Tips for Diversifying Your Portfolio with Alternative Investments

3.1 Reduce Exposure to Any Single Asset

Diversification is a fundamental principle in investment strategy. Think of it as not putting all your eggs in one basket.

By spreading your investments across different asset classes—stocks, bonds, real estate, and alternative assets—you reduce the risk that comes with any single investment failing.

This way, if one asset underperforms, the others can help cushion the blow.

For instance, if you invest solely in tech stocks and the tech sector crashes, your entire portfolio takes a hit.

But if you've also invested in bonds, real estate, and commodities, those other investments might remain stable or even grow, balancing out the losses.

Diversification is essentially your financial safety net, ensuring that you're not overly dependent on the performance of a single asset.

3.2. A Well-Diversified Portfolio Can Achieve More Stable Returns

When you diversify, you aim for a mix of investments that perform well under different economic conditions.

This balance can lead to more stable, predictable returns over time.

By holding a variety of assets, you can smooth out the highs and lows, achieving a more stable overall return.

This stability is particularly beneficial if you're investing for long-term goals like retirement, where you need consistent growth without excessive risk.

4. Popular Alternative Investment Options For Smart Investors

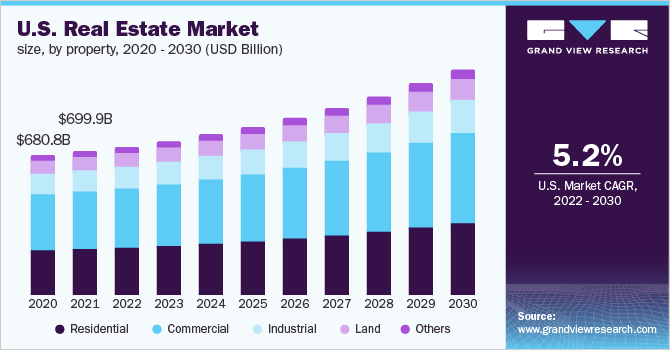

Source: Grandviewresearch

4.1. Real Estate

Investing in real estate offers several unique benefits. First, real estate is a tangible asset—you can see and touch your investment.

This tangibility often provides you with a sense of security that stocks or bonds might not be able to provide.

4.1.1. Benefits of Real Estate: Potential for Steady Income, Appreciation

Real estate can also generate steady income for you through rental payments.

Owning a rental property means you receive monthly income, which can be particularly advantageous in times of stock market volatility.

Also, real estate properties tend to appreciate over time, increasing in value as the market grows.

4.1.2. Examples: REITs (Real Estate Investment Trusts), Rental Properties

There are various ways that you can invest in real estate. One easy option that many investors use is through Real Estate Investment Trusts (REITs).

REITs allow you to invest in real estate without the hassle of owning physical property.

They operate like mutual funds, pooling money to invest in a diversified portfolio of properties. This provides exposure to real estate while offering liquidity and lower entry costs.

Another option is directly purchasing rental properties. Owning rental properties can be more hands-on, but it offers greater control and potentially higher returns.

You benefit from rental income and property appreciation, making it a perfect choice for long-term wealth building.

Success Stories from the Fundrise Portfolio highlights several success stories in real estate crowdfunding, demonstrating the potential returns for early investors.

4.2. Tech Startups: High-Risk, High-Reward Alternative Investment

Investing in tech startups is not for conservative or over-cautious investors, but the rewards can be substantial.

Startups are high-risk investments because they operate in uncertain markets and rely heavily on innovation and growth.

However, the potential for exponential growth makes them an attractive option if you are willing to take the risk.

4.2.1. Success Stories: Investments in Companies Like Airbnb, SpaceX

Early investments in tech startups like Airbnb and SpaceX have yielded enormous returns for savvy investors.

Airbnb revolutionized the hospitality industry by creating a platform where people can rent out their homes to travelers.

Similarly, SpaceX, founded by Elon Musk, has transformed the aerospace industry.

Early supporters who invested in SpaceX during its early days enjoyed substantial returns as the company secured lucrative contracts and made groundbreaking advancements in space travel.

These success stories highlight the upside of investing in tech startups.

By identifying innovative companies early on, you can position yourself to benefit from their future growth.

However, it's essential to conduct thorough research and understand the risks involved.

4.3. Cryptocurrencies: Bitcoin, Ethereum, and Emerging Altcoins

Cryptocurrencies have emerged as a popular alternative investment, offering both excitement and potential for high returns.

These digital assets operate on decentralized networks, offering you a level of security and transparency that traditional financial systems cannot match.

4.3.1. Cryptocurrency: The Bitcoin Boom

One of the most dramatic investment stories in this space is Bitcoin.

When Bitcoin first appeared on the scene in 2009, it was valued at mere cents per coin. At its peak in 2021, Bitcoin reached a staggering value of $64,000 per coin.

Investors who bought Bitcoin at $0.08 in 2010 and held onto it saw returns exceeding 9,000,000%.

Bitcoin’s example highlights the incredible potential of cryptocurrencies but also their inherent risk.

The market is highly volatile, and while the rewards can be immense, the losses can be equally significant. This volatility is why many experts advise a balanced approach to investing in cryptocurrencies.

4.3.2. Risks and Benefits: High Volatility, Potential for Significant Gains

Investing in cryptocurrencies comes with its own set of risks and benefits for you. The primary risk you face is high volatility.

Cryptocurrency prices can fluctuate wildly, influenced by market sentiment, regulatory news, and technological advancements. This volatility can lead to significant gains or steep losses for you in a short period.

However, the potential for substantial gains is what makes them an attractive option. Early adopters of Bitcoin, for example, have seen their investments increase in value many times over.

Cryptocurrencies also offer you diversification benefits, as their performance is often uncorrelated with traditional asset classes.

To mitigate risks, it's crucial that you stay informed, diversify within the crypto market, and only invest what you can afford to lose.

You can also consult with a financial advisor, who can also provide valuable insights and help you navigate the complexities of cryptocurrency investments.

4.4. Peer-to-Peer Lending

You can call or see peer-to-peer (P2P) lending as a modern twist on traditional borrowing and lending in many ways.

This type of lending connects borrowers directly with you, i.e. the investor through online platforms, bypassing traditional financial institutions.

4.4.1. Mechanism: Loans Directly Between Individuals via Online Platforms

As an investor, you provide funds to individuals or small businesses looking for loans.

These borrowers apply for loans on P2P platforms like LendingClub or Prosper. The platform assesses their creditworthiness and facilitates the loan process.

This type of lending offers you an opportunity to earn higher returns compared to traditional savings accounts or bonds. You act as the lender, earning interest on the money you loan out.

The platforms handle the logistics, from loan approval to payment collection, making it relatively hassle-free for you.

4.4.2. Examples: LendingClub, Prosper, and Their Historical Returns

LendingClub and Prosper are two of the most prominent P2P lending platforms.

LendingClub has facilitated over $60 billion in loans since its inception, offering investors average returns between 4% and 8%.

Prosper, another leader in the space, has similar performance metrics, with historical returns also ranging from 4% to 8%.

These returns are significantly higher than what traditional savings accounts offer, making P2P lending an attractive option for you to diversify your portfolio.

However, it's essential to note that P2P lending carries risk, primarily if borrowers default on their loans.

Diversifying your investments across multiple loans can help you mitigate this risk.

The CFA Institute's article provides detailed insights into the historical performance of peer-to-peer lending investments.

4.5. Art, Antiques, Rare Wines, and Collectibles

Investing in art and collectibles can be, for you, both financially rewarding and personally fulfilling.

These tangible assets include fine art, antiques, rare Wines, Stamps, Coins, and even Vintage Cars.

The value of these items often appreciates over time, especially for rare or unique pieces.

Investing in collectibles is not just about the potential financial return that you can get from them. It's also about passion and interest.

4.5.1. Historical Returns: High Appreciation Potential for Rare Items

Historical data shows that investing in high-quality art and collectibles can yield impressive returns.

For instance, the Mei Moses World All Art Index, which tracks the value of art auction sales, has shown average annual returns comparable to those of the stock market over the long term.

Rare wines, too, have demonstrated substantial appreciation. The Liv-ex Fine Wine 1000 index, which tracks the price performance of fine wines, has consistently outperformed many traditional investments.

The key is that you invest in items with proven value and demand by conducting thorough research or consulting experts in the field.

For a comprehensive guide on investing in art, the Art Market Investor Guide offers valuable information on what you need to know.

4.6. Hedge Funds: Pooled Investment Funds Employing Different Strategies

Hedge funds are investment funds that pool capital from accredited investors and institutional clients, using various strategies to earn active returns.

Unlike mutual funds, hedge funds can invest in a wide range of assets, including stocks, bonds, commodities, and derivatives.

They employ diverse strategies such as long/short equity, market neutral, arbitrage, and global macro to achieve their investment objectives.

For you, investing in hedge funds means accessing sophisticated strategies and potentially higher returns.

However, it often requires a significant minimum investment and comes with higher fees.

Hedge funds aim to generate positive returns in both rising and falling markets, offering you a valuable hedge against market volatility.

4.6.1. Hedge Funds Examples

Here are some of the top hedge funds that you consider for investing:

Bridgewater Associates, founded by Ray Dalio, is one of the largest and most successful hedge funds globally.

Its flagship fund, Pure Alpha, uses a global macro strategy and has delivered impressive returns over the years.

Another notable example is Renaissance Technologies, led by Jim Simons. Renaissance’s Medallion Fund is famous for its high returns, driven by quantitative and algorithmic trading strategies.

These hedge funds exemplify the potential benefits of hedge fund investments.

However, they also highlight the need for thorough due diligence and understanding on your part of the complex strategies employed by these funds.

4.7. Private Equity

Private equity involves investing in private companies or conducting buyouts of public companies to delist them from stock exchanges.

You can make these investments through private equity firms that raise capital from institutional and accredited investors.

The goal is to improve the company’s performance and profitability, eventually selling it at a higher value or taking it public again.

For you, private equity offers the potential for high returns, often higher than public market investments.

It allows you to invest in businesses at various stages of development, from startups to established firms needing restructuring or growth capital.

4.7.1. Case Studies: Successful Private Equity Buyouts and Their Returns

A well-known private equity success story is the buyout of Hilton Hotels by Blackstone Group. In 2007, Blackstone acquired Hilton for $26 billion.

Despite the timing, just before the financial crisis, Blackstone restructured Hilton, improved operations, and expanded the brand.

By 2013, Hilton went public again, and Blackstone’s investment had grown substantially, generating significant returns.

Another example is the acquisition of Dell Technologies by Silver Lake Partners and Michael Dell.

This buyout helped Dell transition from a public company struggling with market pressures to a private entity focused on long-term growth.

When Dell re-entered the public market, the value of the company increased dramatically, benefiting the private equity investors.

4.8. Commodities: Gold, Silver, Oil, Agricultural Products

Another popular alternative asset that you can invest in is commodities. These include buying various physical assets like gold, silver, oil, and agricultural products.

These tangible goods are essential for various industries and hold intrinsic value.

You can trade commodities directly, through futures contracts, or via exchange-traded funds (ETFs) that track commodity prices.

For you, commodities offer a way to diversify your portfolio with assets that are less correlated with stock and bond markets.

They can act as a hedge against inflation and currency fluctuations, providing stability in volatile market conditions.

4.8.1. Benefits: Hedge Against Inflation, Diversification

One of the primary benefits of investing in commodities is their ability to hedge against inflation.

For example, when inflation rises, the value of gold often increases, preserving your purchasing power.

Commodities also provide you with diversification benefits because their price movements are often independent of stock and bond markets.

Including commodities in your investment portfolio can enhance its overall stability and reduce risk.

Whether its precious metals like gold and silver, energy commodities like oil and natural gas, or agricultural products like wheat and corn, these investments can protect your wealth against economic uncertainties.

The CFA Institute's report offers a clear explanation of different hedge fund strategies and how they aim to generate returns.

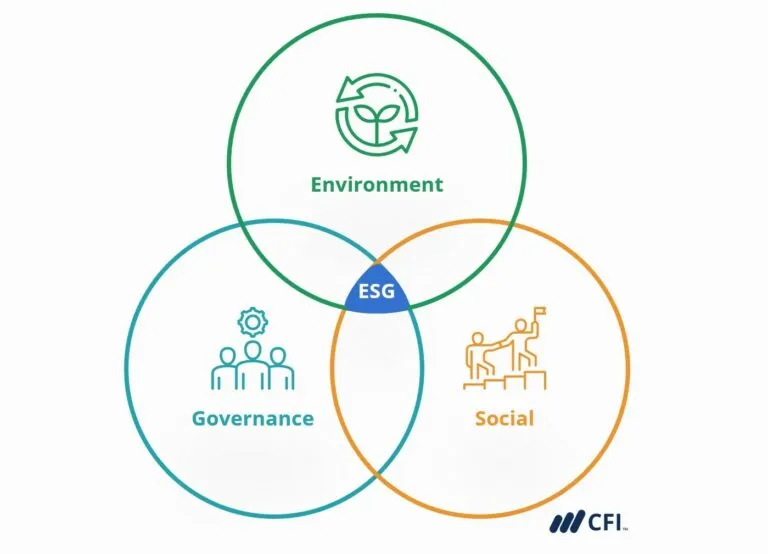

4.9. Sustainable Investments: ESG (Environmental, Social, Governance)

Source: Corporatefinanceinstitute

Sustainable investing is gaining traction as more investors prioritize ethical considerations alongside financial returns.

With ESG, you invest in companies that meet specific environmental, social, and governance criteria.

This approach aligns your investments with values, promoting sustainability and corporate responsibility.

For you, ESG investing offers a way to support positive change while potentially achieving competitive financial returns.

Companies with strong ESG practices often have better long-term prospects, as they manage risks more effectively and foster innovation.

4.9.1. Benefits: Ethical Investing, Long-Term Sustainability

Investing in ESG-focused companies can provide you with several benefits.

Ethically, it allows you to support businesses that contribute to environmental sustainability, social justice, and good governance.

Financially, companies with robust ESG practices often perform better over the long term, as they are more resilient and adaptive to changing market conditions.

4.9.2. Examples of Successful ESG Investments and Their Performance

A notable example of a successful ESG investment is Tesla.

The company’s focus on sustainable energy and innovation in electric vehicles has not only driven significant environmental benefits but also resulted in substantial financial returns for investors.

Another example is NextEra Energy, a leader in renewable energy. Its commitment to clean energy has made it one of the best-performing utility stocks.

These examples highlight how ESG investments can deliver both ethical satisfaction for you along with a strong financial performance, making them an attractive investment option.

The MSCI report on ESG and Financial Performance provides valuable data on the performance of ESG investments, highlighting their growing importance and benefits.

Conclusion

Diversifying your portfolio is essential for achieving financial stability and growth.

You can reduce risk and enhance returns by exploring alternative investments. Diversify like the pros and unlock the full potential of your investment portfolio.

Consulting with a financial advisor can help tailor your investment strategy to your goals, ensuring you make informed decisions and capitalize on emerging opportunities.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

Q. What is the benefit of diversifying an investment portfolio?

A. Diversifying reduces risk and provides more stable returns by spreading investments across different asset classes.

Q. How do Real Estate Investment Trusts (REITs) work?

A. REITs pool funds from many investors to purchase and manage real estate properties, offering returns through dividends and property appreciation.

Q. What are the risks associated with investing in tech startups?

A. Tech startups are high-risk investments due to market uncertainty, but they can offer significant rewards if successful.

Q. How can I start investing in cryptocurrencies?

A. You can start by choosing a reputable cryptocurrency exchange, creating an account, and purchasing digital currencies like Bitcoin or Ethereum.

Q. What is peer-to-peer lending and how does it work?

A. Peer-to-peer lending connects borrowers directly with investors via online platforms, offering higher returns than traditional savings accounts.

Q. Are art and collectibles good investments?

A. Yes, art and collectibles can be appreciated significantly over time, providing both financial returns and personal enjoyment.

Q. What is ESG investing and why is it important?

A. ESG investing focuses on companies that meet environmental, social, and governance criteria, promoting ethical practices and long-term sustainability.