Source: Houseclarkreviews

Introduction

Investing in music and films has fascinated many due to its potential for substantial returns and the cultural connection that it offers.

Take for instance, the case of Beyoncé's 2013 self-titled album, "Beyoncé."

Released without prior announcement, it sold over 800,000 copies in just three days, earning millions for its investors and showcasing the lucrative potential of strategic music investments.

Similarly, the 2009 film "Paranormal Activity" was produced on a shoestring budget of $15,000 and went on to gross nearly $200 million worldwide.

These examples highlight the significant returns possible in the music and film industries, making them attractive alternatives to traditional investments.

Key Takeaways

- Investing in music and films can provide substantial financial returns and cultural satisfaction.

- Music royalties offer a stable income stream with a low correlation to traditional markets, enhancing portfolio diversification.

- Performance, mechanical, and synchronization royalties are the main types of music royalties investors can earn from.

- Purchasing music rights directly or using royalty exchange platforms are two effective methods for investing in music royalties.

- Diversifying into music royalties can mitigate risks and stabilize returns during market volatility.

Investing in Music and Films

Let us look at the various aspects of investing in music and films.

This will help you understand the potential of these markets and how to effectively navigate them.

Whether you're looking to diversify your investments or support the arts while earning returns, we will try to equip you with the knowledge you need to make informed decisions.

The Appeal of Music and Films as Investment Opportunities

Music and films offer you a unique blend of financial potential and cultural impact.

Unlike stocks and bonds, these investments are often tied to creative projects that can resonate personally and socially.

By investing in music and films, you not only stand a chance to earn impressive returns but also contribute to the creation of art that entertains and inspires millions.

This dual benefit makes them particularly appealing if you are looking for both financial and emotional rewards.

Why Invest in Music and Films?

Investing in music and films can be highly rewarding for several reasons.

Let's look at the market size and growth potential to understand why these alternative investments are worth your attention.

Market Size and Growth Potential

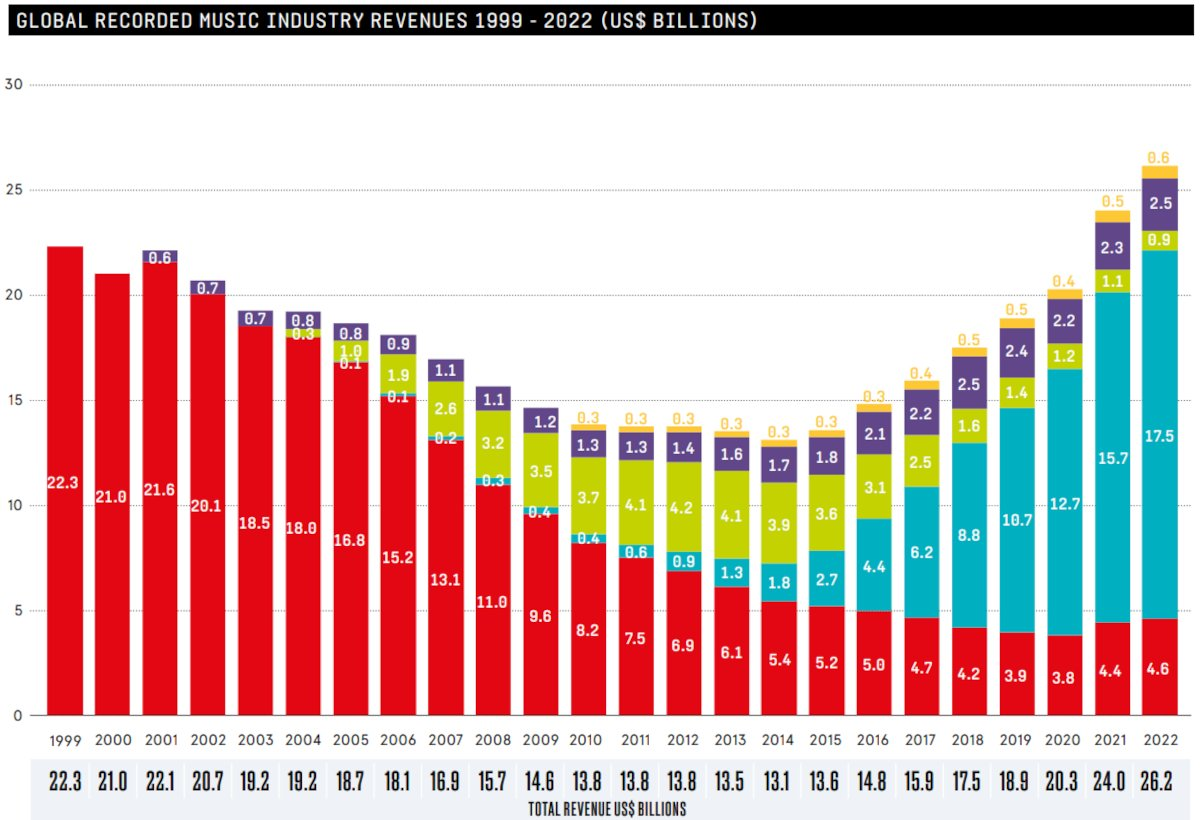

Source: Digitalmusic news

The global music industry has shown remarkable resilience and growth, with revenues reaching $21.6 billion in 2020.

This growth is driven by the surge in streaming services, which now account for over 60% of the industry's revenue.

Platforms like Spotify, Apple Music, and Amazon Music have revolutionized the way people consume music, providing consistent royalty streams for rights holders.

Film industry growth

On the film side, the global box office revenue hit over $42 billion in 2019, a peak year before the pandemic.

Despite the challenges posed by COVID-19, the film industry is rebounding with the resurgence of theatrical releases and the rise of streaming platforms like Netflix, Disney+, and Amazon Prime Video.

These platforms have not only sustained the industry's revenue but have also created new opportunities for content creation and distribution.

Historical Growth Trends

Historically, the music and film industries have shown robust growth, driven by technological advancements and changing consumer behaviors.

In the music industry, the shift from physical sales to digital downloads and now to streaming has opened up new revenue streams and expanded the global reach of artists.

Take for example, Drake's album "Scorpion" which set a record with over a billion streams in its first week, demonstrating the massive potential for earnings in the streaming era.

The film industry has also evolved, with technological innovations enhancing production quality and distribution channels.

Source: Fullsail University

The success of franchises like the Marvel Cinematic Universe, which grossed billions worldwide, underscores the growth potential in film investments.

The rise of independent films and direct-to-consumer streaming models have democratized film production and distribution, offering you more avenues for investment.

The substantial market size and consistent growth of the music and film industries make them attractive alternative investments.

With the right strategy and an understanding of market dynamics, you can capitalize on these opportunities to diversify your portfolio and potentially achieve significant financial returns.

Diversification Benefits

Investing in music and films offers unique diversification benefits that can also enhance your portfolio’s performance and resilience.

Diversification is a key principle in investment strategy, aimed at spreading risk across different asset classes to reduce exposure to any single investment’s volatility.

Low Correlation with Traditional Markets

One of the primary benefits of investing in music and films is their low correlation with traditional markets such as stocks and bonds.

Traditional investments often move in tandem due to broad economic factors.

However, the performance of music and film investments is driven by different dynamics.

For example, the success of a music album or a film release depends more on consumer preferences, marketing efforts, and industry trends rather than economic cycles.

Benefits for Investor

This low correlation means that during periods of stock market downturns or economic recessions, your investments in music and films can provide stability and continue to generate returns.

For instance, during the 2008 financial crisis, while many traditional investments plummeted, the entertainment industry saw continued consumer spending as people turned to music and films for escapism and affordable entertainment.

By adding music and film investments to your portfolio, you create a buffer against market volatility, enhancing your overall financial stability.

Source: Billboard

Risk Mitigation through Portfolio Diversification

Diversifying your portfolio with music and film investments helps mitigate risk by not putting all your eggs in one basket.

The idea is that while some investments may underperform, others may outperform, balancing the overall portfolio returns.

Music and films provide distinct risk profiles compared to traditional assets.

For instance, the revenue from music royalties is often stable and predictable, as it comes from diverse sources like streaming, radio play, and public performances.

Spreading Risks And Overcoming Volatility

For you, this means that investing in music and films can reduce the overall risk of your portfolio.

Let's say you have significant investments in the tech sector, which can be highly volatile. By allocating some of your capital to music and film projects, you can spread out the risk.

Even if tech stocks face a downturn, the consistent revenue from music royalties or the box office success of a film can offset those losses.

Moreover, the global appeal of music and films means they can generate revenue from multiple international markets, further diversifying and reducing risk.

For example, a popular song might earn royalties from streams and airplay across different countries, while a successful film can gross significant revenue from international box office sales.

In essence, integrating music and film investments into your portfolio not only diversifies your assets but also stabilizes your returns and mitigates risks associated with market volatility.

This balanced approach helps you achieve a more resilient and robust financial portfolio.

Emotional and Cultural Engagement

Investing in music and films goes beyond just financial returns.

It offers emotional and cultural rewards that can enrich your investment experience.

Understanding these benefits can provide a deeper appreciation for these alternative investments.

Personal Satisfaction and Cultural Impact

When you invest in music and films, you're not just buying an asset; you're supporting creativity and culture.

This personal connection can bring immense satisfaction. Imagine being part of a project that brings joy to millions of people worldwide.

Music and films are powerful mediums that influence societies, evoke emotions, and create lasting memories.

By investing in these industries, you contribute to the cultural landscape, fostering the creation of art that can inspire and entertain for generations.

Supporting artists

Investing in music and films allows you to support artists and filmmakers whose work you admire.

This support can help you launch careers, fund groundbreaking projects, and bring new, diverse voices to the forefront.

It's an opportunity to be more than just a spectator in the cultural world—you become a patron of the arts, playing a crucial role in the creation of the very content that shapes our world.

Case Studies of Successful Investments

Source: Digital Music News

Music Case Study: Hipgnosis Songs Fund

Hipgnosis Songs Fund, founded by Merck Mercuriadis, has become a significant player in music royalties investment.

The fund acquires song catalogs from renowned artists, ensuring a steady stream of royalties.

In 2020, Hipgnosis acquired a 50% stake in Neil Young's catalog, which includes timeless hits that generate consistent income.

Investors in Hipgnosis benefit from the reliable and diversified income generated by these iconic songs, illustrating how investing in music can be both financially rewarding and culturally significant.

Music Case Study: David Bowie’s Bowie Bonds

Source: Philadelphia Magazine

In 1997, David Bowie pioneered a unique financial instrument known as "Bowie Bonds."

He securitized the future royalties of his pre-1990 catalog, raising $55 million upfront. Investors received a 7.9% annual return over a decade.

This innovative approach not only provided Bowie with capital to buy back his earlier recordings but also offered investors a stake in the future earnings of his iconic music.

Bowie Bonds highlights how music royalties can be a lucrative and creative investment for you.

Film Case Study: "Slumdog Millionaire"

Source: Medium

The 2008 film "Slumdog Millionaire," directed by Danny Boyle, serves as a compelling case study in successful film investment.

Produced on a modest budget of $15 million, the film went on to gross over $378 million worldwide.

It also won eight Academy Awards, including Best Picture. Investors in the film saw significant returns, both financially and in terms of the film's cultural impact.

The success of "Slumdog Millionaire" illustrates how strategic investments in film can yield high returns and cultural accolades.

Film Case Study: Blumhouse Productions

Source: Den of Geek

Blumhouse Productions, founded by Jason Blum, is known for its low-budget, high-reward strategy in the horror genre.

One of its most notable successes is the "Paranormal Activity" series. The first film, produced for just $15,000, grossed nearly $200 million worldwide.

The franchise's continued success has made Blumhouse a powerhouse in the film industry.

Investors in Blumhouse projects benefit from the company’s formula of producing cost-effective films with high earning potential, demonstrating how savvy film investments can pay off significantly.

By examining these real-life examples, you can see how investing in music and films not only offers substantial financial returns but also allows you to be part of meaningful cultural projects.

This dual benefit enhances your investment portfolio while contributing to the arts in a significant way.

The Basics of Music Royalties: How to Invest in Song Rights

Source: iSpytunes

Investing in music royalties can be a lucrative way to diversify your portfolio.

Understanding the different types of royalties is crucial to making informed decisions.

Here’s a breakdown of the main types of music royalties and how they generate income.

Types of Music Royalties

Performance Royalties

Performance royalties are earned whenever a song is played publicly.

This includes radio airplay, live performances, streaming services, and even background music in stores and restaurants.

These royalties are collected by Performance Rights Organizations (PROs) such as ASCAP, BMI, and SESAC in the United States.

By investing in song rights that generate significant public play, you can earn a steady income stream.

For example, classic hits like The Beatles’ "Yesterday" or Queen’s "Bohemian Rhapsody" continuously generate performance royalties due to their frequent airplay and use in various media.

This can provide a stable and passive income stream, especially if you invest in evergreen tracks with enduring popularity.

Mechanical Royalties

Mechanical royalties are earned when a song is reproduced, whether in physical form (like CDs and vinyl records) or digital format (like downloads and streams).

Every time a song is sold or streamed, a mechanical royalty is paid to the rights holder.

These royalties are collected by agencies such as The Harry Fox Agency in the U.S. For instance, when Adele's album "21" sold millions of copies worldwide, significant mechanical royalties were generated for the rights holders.

Investing in mechanical royalties can be highly profitable for you, especially with the rise of streaming platforms.

As digital consumption of music continues to grow, so do the opportunities for earning from mechanical royalties.

By owning rights to popular songs or albums, you can benefit from the increasing trend of digital music consumption.

Synchronization Royalties

Synchronization royalties, or sync royalties, are earned when a song is used in visual media such as movies, TV shows, commercials, and video games.

This type of royalty is paid for the right to synchronize the music with visual content. Iconic songs often secure lucrative sync deals.

Take for example, Led Zeppelin's "Immigrant Song" which was famously used in the film "Thor: Ragnarok," generating substantial sync royalties for the band.

As an investor, you may find sync royalties to be particularly lucrative because they often involve large, one-time payments.

If you invest in song rights that have high sync potential, you can earn significant returns from their use in high-profile media projects.

This can be especially profitable if the song becomes synonymous with a successful movie or commercial.

Understand these different types of music royalties to identify where to invest for maximum returns.

Each type offers unique benefits and opportunities, allowing you to tailor your investment strategy to your financial goals and risk tolerance.

By diversifying your investments across performance, mechanical, and synchronization royalties, you can create a balanced and profitable music royalty portfolio.

Platforms and Tools to Help You Invest in Music

Source: Asset Scholar

Here are some of the platforms and tools that you can use to invest in music:

Royalty Exchange

A leading online marketplace where you can buy and sell music royalties. It provides detailed listings and historical earnings data, making it easier to assess potential investments.

SongVest

This platform offers fractional ownership of music royalties, allowing you to purchase shares in songs and receive royalty payments based on their share of ownership.

Hipgnosis Songs Fund

An investment company that acquires music catalogs from popular artists. As a publicly traded entity, you can buy shares in the fund to gain exposure to a diversified portfolio of music royalties.

Kobalt Capital

Part of Kobalt Music Group, Kobalt Capital manages music royalty funds and offers you the opportunity to invest in music catalogs with a focus on transparency and detailed reporting.

ANote Music

A European-based platform that allows you to purchase shares in music royalties through an auction system. It provides access to a variety of music catalogs from different genres.

Lyric Financial

A financial services company that offers advances on future royalties, enabling artists and rights holders to receive immediate capital. You can participate by funding these advances.

Primary Wave Music

An independent music publishing and talent management company that acquires and manages music rights. You can gain exposure through various investment funds and partnerships.

BMI (Broadcast Music, Inc.)

While not an investment platform, BMI collects performance royalties on behalf of artists and rights holders. You can use BMI's data and services to better understand royalty streams and potential investments.

ASCAP (American Society of Composers, Authors, and Publishers)

Similar to BMI, ASCAP collects performance royalties and offers valuable insights and data that can help you make informed decisions about music investments.

SoundExchange

A non-profit collective rights management organization that collects and distributes digital performance royalties. You can use SoundExchange data to evaluate the performance and potential of digital music investments.

Conclusion

Investing in music and film royalties presents a compelling alternative to traditional investment avenues, offering both financial rewards and the chance to engage deeply with cultural projects.

By understanding the different types of royalties, exploring direct purchases and royalty exchange platforms, and learning from successful case studies, you can make informed decisions that diversify and strengthen your investment portfolio.

Moreover, the low correlation with traditional markets and the stability of royalty income streams provide a unique opportunity to mitigate risks and ensure more consistent returns.

As always, consulting with an alternative investment advisor can further guide you in navigating this dynamic and enriching investment landscape.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

What are music royalties?

Music royalties are payments earned by rights holders for the use of their music in various formats such as streaming, radio play, and public performances.

How do I invest in music royalties?

You can invest in music royalties by purchasing rights directly from rights holders or using royalty exchange platforms like Royalty Exchange.

What are the types of music royalties?

The main types of music royalties are performance royalties, mechanical royalties, and synchronization royalties.

What are synchronization royalties?

Synchronization royalties are earned when a song is used in visual media like movies, TV shows, commercials, and video games.

Why should I consider investing in music royalties?

Investing in music royalties offers low correlation with traditional markets, stable income streams, and the opportunity to support the arts.

What is a notable example of a successful music royalty investment?

A notable example is the acquisition of Bob Dylan's songwriting catalog by Universal Music Publishing Group, estimated to be worth hundreds of millions of dollars.