Source: Wallstreetprep

The world of investments is huge, with the traditional investment market—encompassing stocks, bonds, and mutual funds—being a cornerstone of many portfolios.

As of 2023, the global stock market capitalization reached approximately $95 trillion, while the bond market stood at about $128 trillion.

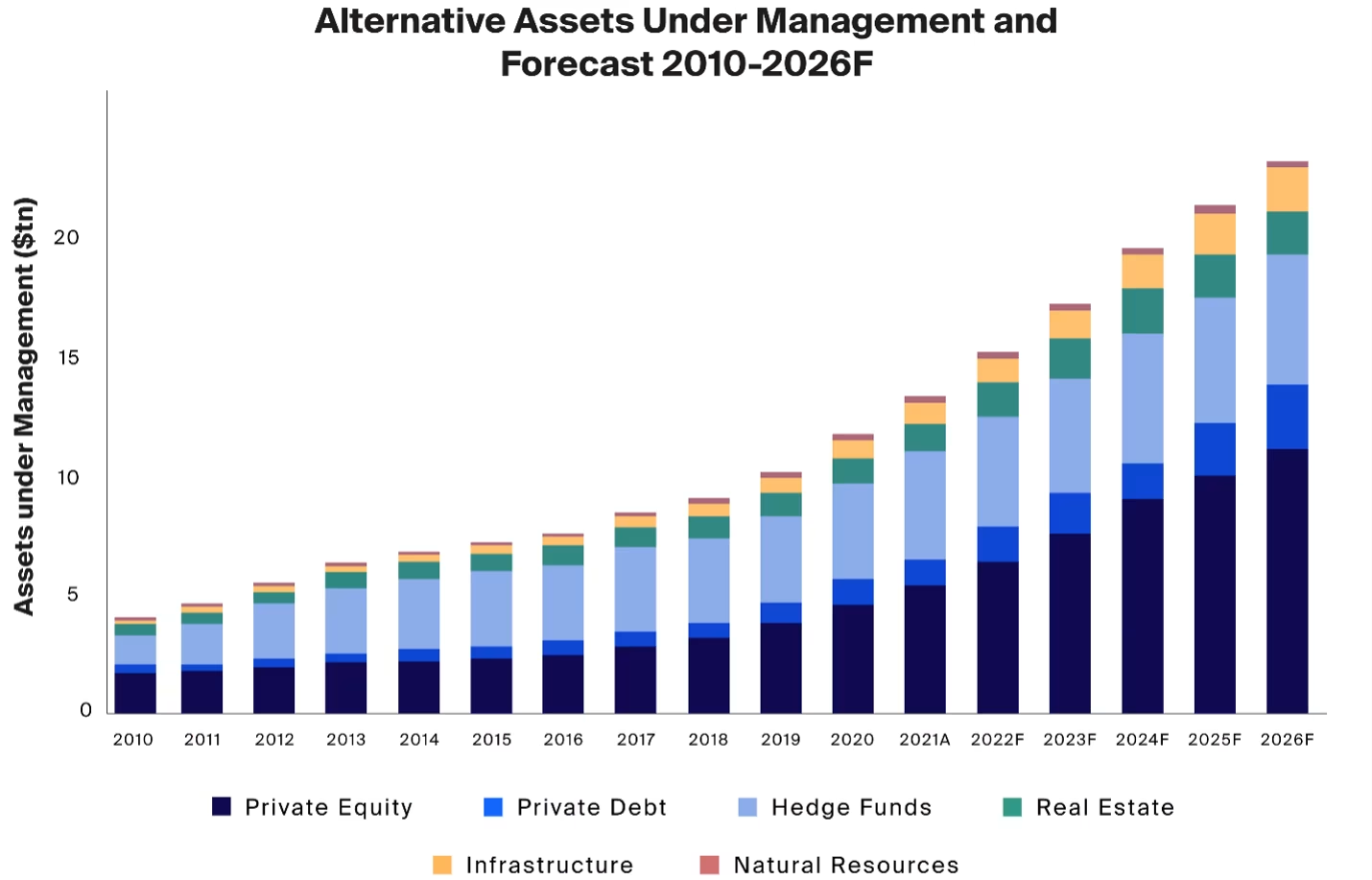

In contrast, the alternative investment market, which includes assets like private equity, hedge funds, real estate, commodities, and cryptocurrencies, has grown significantly, with estimates placing it at over $13 trillion and projected to expand further as investors seek diversification and higher returns.

Key Takeaways

- Traditional investments (stocks, bonds) and alternative investments (private equity, real estate) offer varied options with distinct risk-return profiles.

- Alternative investments may provide higher returns but come with higher risk and complexity compared to stable, predictable returns from traditional investments.

- Alternative investments reduce overall risk by offering lower correlation with traditional assets, smoothing portfolio performance across market cycles.

- Commodities, real estate and other similar alternative investments provide a hedge against inflation and market volatility, preserving wealth.

- Alternative investments offer unique opportunities and allow for tailored risk management strategies.

- Many alternative investments such as real estate, collectibles historically show resilience and long-term appreciation.

Traditional Investments and Alternative Investments – Overview

Let us start with a brief overview of the two types of investments and the pros and cons of investing in them.

What Are Traditional Investments?

Traditional investments refer to investments in conventional assets such as stocks, bonds, and mutual funds.

These assets are widely traded in public markets and are known for their liquidity and regulatory oversight.

Historically, they have been the mainstay of investment portfolios due to their accessibility and relatively lower risk.

What Are Alternative Investments?

Alternative investments include a wide range of assets outside traditional investment categories.

These can be private equity, hedge funds, real estate, commodities, cryptocurrencies, and collectibles like art and wine.

These investments are typically less liquid, often requiring longer holding periods, and can involve higher risk.

However, they offer diversification benefits and the potential for higher returns, making them an attractive option if you are looking to enhance your portfolio’s performance.

For instance, you can choose private equity that involves investing in private companies. This has the potential to yield high returns through strategic business growth and operational improvements.

Similarly, your investments in hedge funds can achieve superior returns with the use of diverse strategies such as long-short equity, global macro, and arbitrage.

The Alternative Investments 2023 report by J.P. Morgan provides a comprehensive overview of the recent trends and detailed descriptions of various alternative investments.

Real-Life Success Stories

Case Study 1: Blackstone's Acquisition of The Cosmopolitan of Las Vegas

In 2014, Blackstone Group acquired The Cosmopolitan of Las Vegas for $1.73 billion.

Over the years, through strategic management and operational improvements, Blackstone enhanced the property's value.

In 2021, Blackstone sold the property for $5.65 billion, generating significant returns for its investors, and demonstrating the lucrative potential of well-executed real estate investments.

Case Study 2: Renaissance Technologies

Renaissance Technologies, a hedge fund founded by Jim Simons, is renowned for its Medallion Fund, which has delivered an average annual return of 66% before fees from 1988 to 2018.

This exceptional performance, driven by sophisticated mathematical models and data analysis, highlights the high-return potential of alternative investment strategies.

Differences between Traditional and Nontraditional Investments

Traditional investments such as stocks and bonds are widely traded in public markets, offering liquidity and regulatory oversight.

They usually provide you with stable returns on your investment with a moderate risk.

Non-traditional or alternative investments, like private equity and cryptocurrencies, involve assets outside standard categories.

They often require longer holding periods, offer higher potential returns, and come with increased risk and volatility due to limited regulatory oversight and market liquidity.

Risk and Return Profiles

Traditional investments are generally considered lower risk compared to alternative investments.

Stocks and bonds, while subject to market fluctuations, offer predictable returns and have a long track record of performance.

In contrast, alternative investments can yield higher returns but come with increased risk and volatility.

For example, hedge funds and private equity funds aim for substantial gains, but the strategies employed for this can also lead to significant losses.

Commodities and real estate can provide you with substantial returns during favorable market conditions but can also be highly volatile.

Traditional investments are generally considered lower risk compared to alternative investments. The Risk and Return Profiles of Traditional and Alternative Investments by CFA Institute details the distinct risk and return profiles of both investment types, highlighting the potential for higher returns in alternative investments.

Liquidity and Accessibility

Liquidity refers to how easily you can convert an asset into cash without affecting its price.

Traditional investments are typically more liquid; you can sell stocks and bonds quickly on public exchanges. Mutual funds also offer daily liquidity.

Alternative investments, on the other hand, are less liquid. Private equity and hedge funds often have lock-up periods, during which you cannot withdraw their money.

As for real estate investments, it require time to sell properties, and commodities can be subject to market conditions that affect their saleability.

Regulation and Transparency

Your traditional investments are heavily regulated by bodies such as the Securities and Exchange Commission (SEC) in the U.S. ensuring a high level of transparency and investor protection.

Publicly traded companies must adhere to strict reporting standards, providing regular financial disclosures.

Alternative investments are less regulated, which can lead to greater risk but also offer more flexibility in investment strategies.

Due diligence is crucial when you are making alternative investments to understand the associated risks and ensure transparency.

Reasons to Switch to Alternative Investments

One of the key reasons for making alternative investments is that they help you to diversify your portfolio and achieve higher returns.

Beyond the promise of superior performance, these investments offer you several unique advantages.

Some of these are:

Higher Returns

The prospect of higher returns is one of the primary reasons to turn to alternative investments.

Your traditional investments, while stable, often yield lower returns, especially in a low-interest-rate environment.

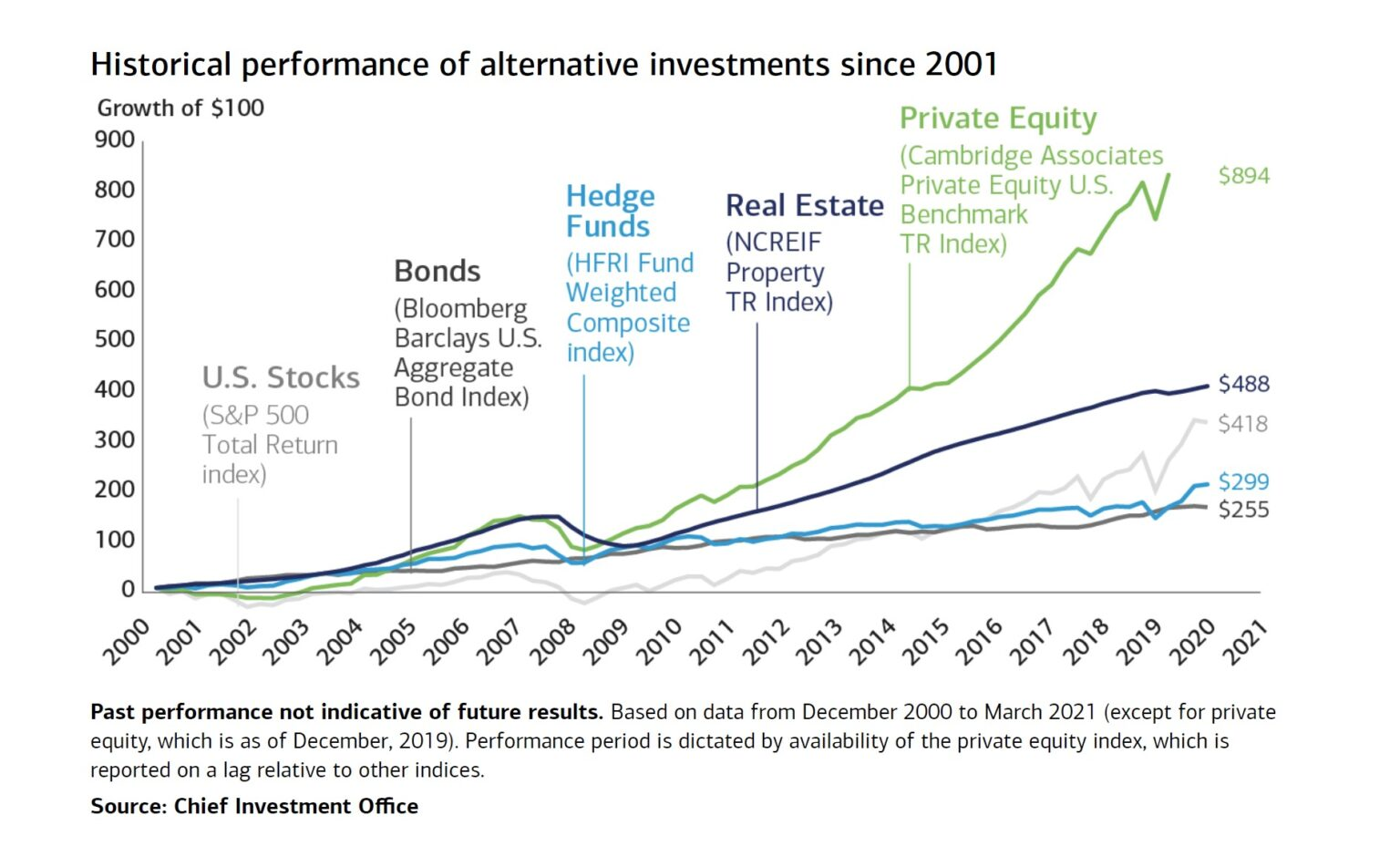

Alternative assets like private equity and hedge funds have historically outperformed traditional assets, offering substantial returns.

For instance, the average annual return of private equity has been around 10-15%, significantly higher than the average stock market return.

Diversification Benefits

Alternative investments also provide you with diversification benefits, reducing overall portfolio risk.

You can thus protect your portfolio against market volatility by incorporating assets that do not correlate directly with traditional investments, such as commodities or real estate.

For example, during stock market downturns, real estate or commodities like gold often perform well, balancing the portfolio's performance.

Alternative investments provide diversification benefits, reducing overall portfolio risk. Diversification Benefits of Alternative Investments by NBER reveals that incorporating assets that do not correlate directly with traditional investments can protect your portfolio against market volatility.

Inflation Hedge

Certain alternative investments, such as real assets and commodities, act as hedges against inflation.

Your real estate properties can appreciate in value and also generate rental income that adjusts with inflation.

Commodities like gold have also historically maintained their value during inflationary periods.

Including these assets in your portfolio can help preserve the purchasing power and provide you with financial stability in inflationary times.

The study Real Assets as a Hedge Against Inflation by ResearchGate explains how real estate properties and commodities like gold have historically maintained their value during inflationary periods.

Technological Advancements and Accessibility

Technological advancements have made alternative investments more accessible to a broader audience.

You can participate in crowdfunding, peer-to-peer lending, and fractional ownership of real estate or art with online platforms and fintech innovations.

This democratization of alternative investments has opened new avenues with which you can diversify your portfolio beyond traditional assets.

Tax Advantages

Many alternative investments offer tax benefits that can help you enhance your overall returns.

For example, investments in real estate can provide deductions through depreciation, and certain private equity investments can help you defer taxes on capital gains.

Hedge Against Currency Fluctuations

Your alternative investments, such as foreign real estate and commodities, can serve as a hedge against currency fluctuations.

This is particularly beneficial if you want to protect your wealth from domestic currency depreciation or fluctuations.

Participation in Sustainable and Impact Investing

The alternative investments allow you to engage in sustainable and impact investing, aligning your portfolios with your values.

This includes investing in renewable energy projects, social enterprises, and other initiatives that contribute positively to society and the environment.

Exposure to Tangible Assets

Investing in tangible assets such as real estate, precious metals, and collectibles can provide you with a sense of security and stability.

These physical assets often retain their intrinsic value and can be less susceptible to market volatility.

Potential for Illiquidity Premium

Many alternative investments come with lower liquidity, which you may find disadvantageous.

However, this illiquidity often comes with a premium, It means that you may receive higher returns as compensation for locking your money away for longer periods.

Traditional Investments and Alternative Investments – The Right Mix

Achieving the optimal mix of traditional and alternative investments is crucial for you to balance risk and return in your portfolio.

Traditional investments like stocks and bonds offer stability and liquidity, making them suitable for short-term goals.

Alternative investments such as real estate and hedge funds can enhance your portfolio diversification and potentially provide higher returns over the long term.

The right mix depends on your goals, risk tolerance, and investment horizon.

Building a Balanced Portfolio

For a balanced portfolio, you need to combine traditional and alternative investments. This also helps you to optimize returns and manage risks.

Your asset allocation should align with your risk tolerance, investment goals, and time horizons. Diversification across asset classes enhances your portfolio stability and growth potential.

For instance, a balanced portfolio might include a mix of 60% stocks, 20% bonds, 10% real estate, and 10% hedge funds, providing you exposure to various market dynamics.

Asset Allocation Strategies by ScienceDirect discusses various asset allocation strategies that can enhance your portfolio stability and increase its growth potential.

Age and Investment Horizon Considerations

Your investment strategies should take into account your age and time horizon as well.

If you are young and have a longer investment horizon, you can afford to take on more risk and include a higher proportion of alternative investments.

However, if you are older or nearing retirement, you may want to prioritize capital preservation and liquidity and consequently favor traditional investments.

Tailoring your portfolio to the life stage ensures that your investment objectives align with your financial needs and risk tolerance.

Traditional Investments vs. Alternative Investments – Pros and Cons

Source: caisgroup

Traditional investments offer stability, predictability, and high liquidity, making them ideal for conservative investors.

However, they may have limited growth potential and can be vulnerable to market volatility.

Alternative investments provide diversification, potential for higher returns, and hedge against inflation, but they also come with higher risk, complexity, and lower liquidity.

Choosing between them involves balancing risk tolerance, investment objectives, and desired portfolio outcomes.

Here are the various pros and cons of traditional investments vs. alternative investments:

Pros of Traditional Investments

Stability and Predictability: Traditional investments offer you stable and predictable returns, making them reliable for long-term financial planning.

High Liquidity and Accessibility: Stocks, bonds, and mutual funds are highly liquid that you can buy and sell without any significant impact on prices.

Lower Costs and Fees: Traditional investments generally have lower costs and fees compared to alternative investments, which can help you save money on transactions.

Cons of Traditional Investments

Limited Growth Potential: Though traditional investments are stable, they have limited growth potential at best, especially in a low-interest-rate environment.

Vulnerability to Market Volatility: Your traditional investments are also prone to market swings, which can impact your portfolio value during downturns.

Inflation Risk: Bonds and fixed-income securities may underperform during inflationary periods, eroding their purchasing power.

Concentration Risk: Traditional investments often focus on specific markets or sectors, which can lead to concentration risk. If these markets or sectors perform poorly, your entire portfolio can suffer significant losses.

Lower Diversification: Traditional investments also lack the diversification benefits you can get with alternative assets.

Relying solely on stocks and bonds can expose your portfolio to systematic risks that could be mitigated by including non-correlated assets.

Regulatory Changes: Your traditional investments are subject to regulatory changes that can affect their performance.

New laws or regulations can impact market dynamics, potentially reducing your returns or increasing costs.

Fixed Returns: Fixed-income securities like bonds provide you with predictable returns. However, they may not keep pace with rising living costs or inflation over the long term.

This limits their effectiveness in wealth accumulation compared to potentially higher-return investments.

Pros of Alternative Investments

Potential for High Returns: Alternative investments can offer you substantial returns, outperforming traditional assets, particularly in private equity and hedge funds.

Diversification Benefits: When you include alternative investments in your portfolio, it provides you with diversification, reduces overall risk and enhances stability.

Hedge Against Market Volatility and Inflation: Assets like real estate and commodities can protect you against market downturns and inflation, preserving your wealth.

Access to Unique Investment Opportunities: Alternative investments often provide you access to opportunities that are not available through traditional markets.

This can include investments in startups, venture capital, private equity, and niche sectors like renewable energy or cryptocurrencies.

These opportunities can offer you higher growth prospects compared to mainstream investments.

Potential for Lower Correlation with Traditional Assets: Alternative investments often exhibit a lower correlation with stocks and bonds.

This means that the value of your alternative investments may not move in sync with broader market trends, providing a potential hedge against downturns in traditional markets.

This diversification benefit can help to smooth your overall portfolio performance.

Inflation Hedge through Tangible Assets: Certain alternative investments, such as commodities such as gold, silver, oil, land and buildings have intrinsic value and can serve as a hedge against inflation.

Unlike fiat currencies, which can lose value over time due to inflation, these tangible assets may retain or increase their value during inflationary periods.

Portfolio Customization and Tailored Risk Management: Alternative investments allow you to tailor their portfolios more precisely to your risk tolerance and investment goals.

By adding alternatives alongside traditional assets, you can achieve a balanced risk-return profile that aligns with your specific financial objectives.

Potential for Portfolio Alpha: Alpha refers to the excess return of an investment compared to its benchmark.

Your alternative investments, particularly actively managed ones like hedge funds or private equity, have the potential to generate alpha through skilled management, market inefficiencies, or unique strategies that traditional investments may not exploit.

Long-Term Growth and Wealth Preservation: Some alternative investments, such as real estate, timberland, or collectibles, have historically shown resilience and long-term appreciation.

These assets can be valuable for you to preserve wealth across generations or build a legacy portfolio.

Cons of Alternative Investments

Higher Risk and Complexity: Alternative investments often come with higher risk and complexity, requiring thorough due diligence and expertise.

Lower Liquidity: Many alternative assets are less liquid, with longer lock-up periods, making them less accessible for your quick cash needs.

Regulatory Challenges and Higher Fees: Alternative investments may face regulatory challenges and typically involve higher fees, which can impact net returns.

Conclusion

The investment landscape offers a diverse array of opportunities beyond traditional stocks and bonds.

Understanding the differences between traditional and alternative investments is crucial to make informed decisions.

While traditional investments provide stability and liquidity, alternative investments offer you higher return potential and diversification benefits, though with increased risk and complexity.

As you navigate the evolving world of investments, it's essential to balance traditional and alternative assets to achieve your financial goals.

Consult with an alternative investment advisor or a financial advisor, who can help tailor your investment strategy to your unique risk tolerance and objectives.

By diversifying your portfolio and staying informed about market trends, you can build a resilient and growth-oriented investment portfolio that adapts to changing economic conditions.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

FAQs

What are examples of alternative investments?

Examples of alternative investments are private equity, hedge funds, real estate, commodities (gold, oil), cryptocurrencies, and collectibles like art and wine.

Are alternative investments riskier than traditional investments?

Yes, alternative investments generally carry higher risk due to factors like lower liquidity, longer lock-up periods, and regulatory challenges.

How do alternative investments perform compared to traditional investments?

Alternative investments can offer you higher returns but also come with increased volatility. Traditional investments provide you stability but may have lower growth potential.

How can I invest in alternative investments?

You can access alternatives through private equity firms, hedge funds, real estate investment trusts (REITs), crowdfunding platforms, and digital investment platforms.

Are alternative investments suitable for all investors?

Alternative investments are suitable for you, if you are an experienced investor with higher risk tolerance and longer investment horizons due to its complexity and potential illiquidity.

What are the benefits of diversifying with alternative investments?

Diversifying with alternative investments reduces your portfolio risk by offsetting potential losses from traditional assets during market downturns. It can also enhance your overall returns.

Do alternative investments provide tax advantages?

Yes, some alternative investments can offer you tax benefits such as deductions on real estate investments or deferrals on capital gains in certain private equity structures.