Investing in Artwork: Your Complete Guide to Maximizing Returns

READING NOW

Did you know that the global art market reached a staggering $64.1 billion in 2023? Art investment has become increasingly popular among investors seeking diversification of their portfolio and potential high returns.

Key Takeaways

- Discover the untapped potential of the global art market

- Learn how to seize opportunities for lucrative returns

- Dive deep into the world of art investment

- Equip yourself with the knowledge and strategies to excel in the art market

Art investment isn’t just about financial gains or exploring an alternative and high-return investment. It is also about strategically building wealth for the future. From timeless masterpieces to cutting-edge contemporary works, the art market offers a wealth of opportunities for investors.

Let us look at the various intricacies of investing in artwork that can help you achieve both financial success and artistic fulfillment. Diversify your portfolio and indulge your passion for creativity, while maximizing your returns.

Stats and Facts on Investing in Artwork

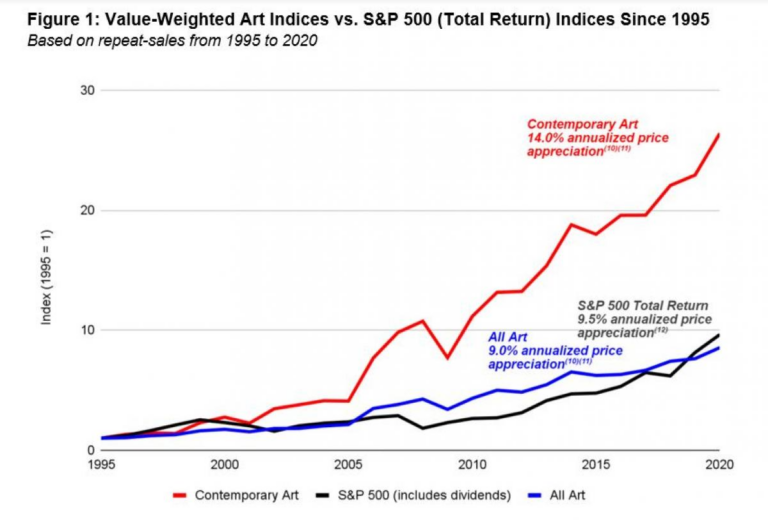

Many recent reports suggest that the average annual return on investment for art has outperformed many traditional asset classes, including stocks and bonds.

Global Art Market Size (2023) | $64.1 billion |

Average Annual Return on Investment in Art (5 years) | 9.80% |

Top Auction Sale in Art History (As of 2023) | $450.3 million (Leonardo da Vinci’s “Salvator Mundi”) |

Percentage of Ultra-High Net Worth Individuals Investing in Art (2023) | 84% |

Number of Art Transactions Worldwide (2023) | Over 40 million |

Leading Art Market by Sales (As of 2023) | United States |

Average Hold Time for Art Investment | 7-10 years |

Number of Art Fairs Worldwide (2023) | Over 300 |

What is Artwork Investment?

Wondering about what exactly is artwork investment? Simply put, investing in artwork involves buying pieces of art with the expectation of generating a financial return in the future. Whether you purchase paintings, sculptures, or other forms of art, the goal is to build wealth as your alternative investment appreciates.

Source: caia.org

Factors Influencing the Value of Artwork

The value of artwork is influenced by various factors. Understanding these factors can help you make informed investment decisions and capitalize on opportunities in the art market. Some of these are:

Artist’s Reputation

The reputation and prestige of the artist play a significant role in determining the value of an artwork. Generally, the artwork of established and renowned artists commands higher prices.

Take the example of just four top artists along with notable artworks:

Artist | Painting | Price (USD) | Year |

Pablo Picasso | Les Femmes d’Alger | $179.4 million | 2015 |

Vincent van Gogh | Portrait of Dr. Gachet | $82.5 million | 1990 |

Leonardo da Vinci | Salvator Mundi | $450.3 million | 2017 |

Michelangelo | Statue of David | Variable | Variable |

Of these, the “Statue of David” by Michelangelo does not have a specific price or year of sale. It is a priceless masterpiece housed in the Galleria dell’Accademia in Florence, Italy.

ProvenanceThe documented history of ownership, known as provenance, can affect the value of artwork. Pieces with a well-documented provenance, owned by notable collectors or institutions, may fetch higher prices.

Artistic Significance

The artistic significance of the artwork, including its style, technique, and historical importance, can influence its value. Masterpieces or works that represent significant artistic movements tend to be more valuable.

Condition

The condition of the artwork, including factors such as preservation, restoration, and overall state of preservation, also impacts its value. You’ll find that well-preserved artworks in excellent condition typically command higher prices.

Rarity

Is the artwork you are buying rare? The rarity of the artwork, with factors such as scarcity, uniqueness, and limited edition status, can also affect its value. Rare or one-of-a-kind pieces are often more valuable to collectors and command a premium price.

Market Demand

The demand for an artwork within the art market can also influence its value. Artworks that are in high demand among collectors or have recently gained popularity may fetch a higher price.

Economic Factors

The overall market trends, interest rates, and investor sentiment also impact the value of artwork. Economic downturns or periods of uncertainty may lead to fluctuations in art prices.

Subject Matter

The subject matter depicted in the artwork also affects its value. Certain themes or subjects by certain artists are more sought after by collectors. Similarly, artworks with universal appeal or cultural significance command higher prices.

Exhibition History

The exhibition history of the artwork also contributes to its value. Artworks with a notable exhibition history such as displays in prestigious galleries, museums, or exhibitions are more valuable to collectors.

Authentication

The authentication and certification of the artwork by recognized experts or institutions greatly impact its value. Authenticated artworks are often considered more valuable and desirable by collectors. They can fetch a premium or high price for the seller.

Forms of Artwork Investments

Traditional Art Forms

Traditional art forms such as paintings and sculptures have long been favored by investors for their perceptible beauty and historical significance. Masterpieces of renowned artists like Picasso, Claude Monet, and da Vinci have historically commanded astronomical prices at auctions and galleries.

Contemporary Art

Contemporary art includes a wide range of styles and mediums that are currently popular. They offer you an opportunity to find the latest trends and invest in the art of emerging artists. Examples of this are abstract paintings and mixed-media installations, which provide unique investment opportunities.

Emerging Artists and Markets

Investing in emerging artists and markets can be a lucrative strategy if you are an investor willing to take calculated risks. Keep an eye on up-and-coming talent from emerging art hubs around the world. You are sure to find good investment opportunities among the emerging artists that are gaining international recognition.

Some of the emerging artists that a reputable site like Sotheby’s lists are: Shara Hughes, Hilary Pecis, Issy Wood, Tomokazu Matsuyama, Xinyi Cheng, Salman Toor, and Rafa Macarrón.

Art Funds and Investment Vehicles

For investors looking for diversification and professional management, art funds and investment vehicles provide access to diversified portfolios of artworks. These funds pool capital from multiple investors around the world.

The funds are used to acquire and manage a portfolio of art assets. This provides you exposure to the art market with reduced risk and administrative burden.

Benefits of Investing in Artwork

Portfolio Diversification

Art is different from stocks, bonds, and other forms of investments. When you invest in art, it doesn’t usually go up or down at the same time as those other investment instruments.

This means that if you have some art in your investment portfolio, it can help lower the chances of losing money if the stock market goes down. Investing in art can help spread out your risks and make your investments safer.

Potential for High Returns

While past performance is not indicative of future results, art investment has the potential to deliver attractive returns over the long term. This is especially true for well-curated collections.

Tangible and Aesthetic Value

Unlike stocks and bonds, which exist purely as financial instruments, artworks have intrinsic value as objects of beauty and cultural significance. They provide aesthetic enjoyment and emotional satisfaction to their owners.

Hedge Against Inflation

Art is a reliable hedge against inflation. It preserves its value and often appreciates over time, alongside economic expansion and increasing prices.

As a tangible asset, art offers investors a haven against the erosive effects of inflation, providing stability and potential for growth in uncertain economic environments.

Enjoyment and Passion for Art

Beyond financial considerations, investing in artwork allows you to indulge your passion for art. You can immerse yourself in the creative process, fostering a deeper appreciation for culture and beauty.

Risk and Challenges of Art Investment

Market Volatility and Unpredictability

The art market can be highly volatile and unpredictable, with prices influenced by factors such as changing tastes, economic conditions, and geopolitical events. It is also subject to fluctuations in demand, taste, and economic conditions.

Art prices can be influenced by various factors such as changes in consumer preferences or shifts in market sentiment. As a result, art investments can be susceptible to price volatility, with their value experiencing significant ups and downs over time.

Illiquidity and Long-Term Commitment

Unlike stocks and bonds, which can be bought and sold with ease, artworks are relatively illiquid assets. They require a long-term investment horizon and commitment to realize returns. Also, they cannot be easily bought and sold on public exchanges.

The process of buying and selling artworks can be time-consuming and complex, with transactions often taking months or even years to complete. This lack of liquidity can pose challenges for you if you need to access your capital quickly.

It can also restrict you from adjusting your investment portfolio in response to changing market conditions.

Authenticity and Provenance Issues

Authenticity and source are critical considerations in art investment. This is because forgeries and disputed sources significantly impact the value and marketability of artworks.

Take the case of the “Salvator Mundi” painting attributed to Leonardo da Vinci. In 2017, the painting sold for a record-breaking $450 million at auction, making it the most expensive artwork ever sold.

Credit: Corbis via Getty Images

However, questions arose regarding its authenticity and source. These uncertainties significantly impacted the painting’s value and marketability. This only highlights the critical role that authenticity and source play in art investment.

Storage and Maintenance Costs

Owning art works requires additional costs such as storage, insurance, and maintenance. This can erode returns and increase the overall cost of ownership. Properly storing and preserving artworks is essential to maintaining their value and ensuring their long-term appreciation.

Regulatory Risks

The art market is largely unregulated compared to other financial markets, leaving investors vulnerable to regulatory risks. The lack of oversight and transparency in the art market can create opportunities for fraudulent activities, insider trading, and market manipulation.

In addition, regulatory changes or interventions by government authorities can impact the art market and investor confidence.

Learn more about the regulatory risks associated with art investment and how they may impact your investment decisions here.

Conclusion

Investing in artwork offers a unique opportunity to diversify your portfolio, generate potential high returns, and engage with the world of art and culture.

Understanding the factors influencing the value of an artwork, exploring different forms of art investments, and carefully managing risks can help maximize your chances of success in the art market.

You can also consult an art investment advisor company or a financial advisor to discuss your investment goals. They can help you develop a personalized strategy that aligns with your needs and risk tolerance.

FAQs

Q: Is artwork a good investment?

A: Yes, artwork can be a good investment option for diversifying your portfolio and achieving higher returns. However, like any investment, it comes with various risks. You need to do thorough research and understand the art market before you invest in it.

Q: What is the best artwork to invest in?

A: The “best” artwork to invest in depends on various factors such as your investment goals, risk tolerance, and market trends. It’s essential to conduct research, considering factors like artist reputation, provenance, and market demand. You can also seek advice from art investment professionals.

Q: How to invest in artwork?

A: Investing in artwork involves researching the art market, understanding factors influencing artwork value, and developing an investment strategy. You can invest directly by purchasing artwork or indirectly through art funds or investment vehicles. Consulting art investment advisors or financial professionals can also provide valuable guidance.

© 2024 New Money Insider. All Rights Reserved.