2024 Noyak Fine Art Investment Guide:

Investing in Fine Art Made Simpler

READING NOW

How to Invest in Artwork Like a Pro?

The iconic painting “No. 5, 1948” by Jackson Pollock was purchased by media magnate David Geffen in 2006 for $140 million. When Geffen later sold the painting in 2014 to an undisclosed buyer for a staggering $200 million, it showcased the remarkable ROI potential in art investment, with a windfall of $60 million in just 8 years.

Picture credit: Artincontext

What to Expect?

- Uncover the Secrets Behind Maximizing Returns in Art Investment

- Dive Deep Into The Nuances Of The Art Market With Data-Driven Insights

- Learn Expert Strategies To Navigate The Complexities Of Art Investment Like A Seasoned Pro

- Discover How To Identify Lucrative Opportunities And Mitigate Risks In The Dynamic Art World

- Master The Art Of Due Diligence And Authentication To Safeguard Your Investments

- Explore Diverse Art Forms And Emerging Trends To Diversify Your Portfolio Effectively

- Gain Exclusive Access To Insider Tips And Industry Best Practices From Seasoned Art Investors

Investing in artwork can be both financially rewarding and personally fulfilling. Art is a great form of alternative investment and can generate fabulous returns.

We’ll walk you through the process of how to invest in artwork like a pro. Also, learn how to conduct research and build relationships or a budget for making informed decisions in this unique asset class.

Artwork Investment Process

Research and Education

Research and knowledge are fundamentals for any investor in art. You must understand the market dynamics, art history, and emerging trends. Only by conducting thorough research on different art forms and artists, you can make informed investment decisions and maximize your returns in the dynamic art market.

If you are new to this, a good starting point can be the Art Market Monitor. It provides in-depth research and analysis on art market trends, sales data, and investment insights. Explore their research section to access valuable resources for informed decision-making in art investment.

Year | Total Sales (in billions USD) | Average Annual Return (%) |

2021 | 55.2 | 8.5 |

2022 | 59.8 | 9.2 |

2023 | 64.1 | 9.8 |

This table provides an overview of the recent trends in the art market, including total sales and average annual returns.

Importance of Understanding the Art Market

Before you start to invest in artwork as a form of alternative avenue of investment, it’s vital to grasp the workings of the art market. Unlike traditional financial markets, the art market operates on its unique set of dynamics.

It is influenced by numerous factors such as cultural trends, collector preferences, and global economic conditions. You can make more informed investment decisions and navigate its complexities with confidence after gaining a comprehensive understanding of the art market.

Take the time to study market trends, historical performance, and the behavior of key players, including collectors, galleries, and auction houses. By staying up-to-date on market developments and understanding their nuances, you can position yourself for success in the world of art investment.

Conduct Research on Art History, Movements, and Trends

Researching art history, movements, and trends can help you identify emerging opportunities and stay ahead of the curve in the art market. To gain insights into artistic evolution and cultural influences, you’ll need to understand art history, exploring its different movements, styles, and periods.

Also, keep a keen eye on contemporary trends and developments, from new mediums and techniques to shifting tastes and preferences among collectors.

This can help you identify promising artists, anticipate market trends, and make strategic investment decisions that align with your objectives.

Learn About Different Art Forms and Artists

Familiarize yourself with the diverse range of artistic expressions, from traditional paintings and sculptures to Avant-Garde installations and digital art. Explore the works of both established masters and emerging talents.

This can help you better evaluate potential investment opportunities and build a well-rounded art portfolio. Consider attending exhibitions, and engaging with the art community to enrich your understanding of art and enhance your investment acumen.

Here are some of the art forms worth considering for alternative investment:

- Paintings

- Sculptures

- Photography

- Prints and Multiples

- Mixed Media

- Digital Art

Building Relationships with Galleries and Artists

Importance of Networking in the World of Art

When it comes to art investment, networking is not just beneficial – it’s essential. Build relationships with key players in the art world, including artists, gallery owners, and collectors. This can open doors to valuable opportunities and insights for you. Attend various cultural events to connect with individuals who share your passion for art and investment.

A good starting point for you can be the Artforum’s Gallery Guide. It has a comprehensive list of galleries and artists in the U.S., facilitating connections and opportunities for art investment.

With networking, you can gain access to insider knowledge, exclusive opportunities, and a supportive community of like-minded individuals. Cultivate genuine connections, show genuine interest in others’ work, and be proactive in seeking out new connections.

Remember, in the art world, relationships are often as valuable as the artwork itself. Here are the various places you can network:

1. Art Galleries

2. Art Fairs

3. Museums

4. Art Organizations (e.g. International Council of Museums, The American Alliance of Museums and Local Art Councils)

5. Artist Studios

6. Art Schools

7. Online Platforms

8. Art Collectors’ Clubs

9. Specialized Events

Engage with Local Galleries, Museums, and Art Communities

Your local art community can be a treasure trove of opportunities for art investment. Actively engage with galleries, museums, and art communities in your area. This can help you forge meaningful connections with fellow enthusiasts.

Attend gallery openings, artist talks, and exhibition previews to discover new talent and build relationships with gallery owners and curators.

Participate in art-related events, workshops, and fundraisers to support the local arts scene and connect with like-minded individuals. By becoming an active participant in your local art community, you can gain valuable insights, access unique opportunities, and enrich your overall experience as an art investor.

Establish Rapport with Artists and Gallery Owners

Build strong relationships with artists and gallery owners, as part of a strategic move in the art investment landscape. By developing rapport and trust, you gain access to insider knowledge, exclusive opportunities, and preferential treatment.

Attend gallery openings, artist receptions, and industry events to network and engage with key players. These relationships not only enrich your experience and give you the first-mover advantage as an investor in new art forms and artists.

Setting a Budget and Investment Strategy

Determine Your Investment Goals and Risk Tolerance

Before diving into art investment, it’s vital to evaluate your investment goals and assess your risk tolerance. What do you hope to achieve with your art investments—long-term capital appreciation, aesthetic enjoyment, or both?

Determine your risk tolerance by evaluating factors such as your financial situation, investment horizon, and comfort level with market fluctuations. Align your investment goals with your risk tolerance to develop a tailored investment strategy that suits your unique needs and preferences.

Top Auction Sales | |||

Year | Painting | Artist | Sale Price (in millions USD) |

2021 | Woman Sitting Near a Window | Pablo Picasso | 103.4 |

2022 | Untitled (Skull) | Jean-Michel Basquiat | 110.5 |

2023 | Salvator Mundi | Leonardo da Vinci | 450.3 |

This table highlights some of the top auction sales in recent years, showcasing the value of renowned artworks.

Create a Budget for Art Acquisitions

Once you’ve defined your investment goals and risk tolerance, it’s time to establish a realistic budget for art acquisitions. Consider your financial resources, cash flow, and liquidity needs when you are setting your budget.

Factor in additional costs such as framing, shipping, and insurance to ensure you have a comprehensive understanding of the total investment required. Be disciplined in sticking to your budget and avoid overextending yourself financially.

Remember, art investment is a long-term endeavor, and patience and prudence are key to achieving success. By creating a well-defined budget for art acquisitions, you can make informed investment decisions and maximize the potential for returns while mitigating risk.

Develop an Investment Strategy Based on Research and Goals

Craft a robust investment strategy for success in art investment. Conduct thorough research on market trends, artist profiles, and historical performance. This is the key to identifying lucrative opportunities. Additionally, align your investment goals with your risk tolerance and financial objectives to create a personalized strategy.

Whether you prioritize long-term appreciation or short-term gains, a well-defined investment strategy helps to guide your decisions and optimize returns in the dynamic art market.

Art Investment Funds Performance | ||

Fund Name | Annualized Return (%) | Assets Under Management (in millions USD) |

ArtFund Global | 12.4 | 2,500 |

FineArt Invest Group | 10.8 | 1,800 |

Masterpiece Capital | 11.2 | 1,200 |

Investment funds specializing in art have shown consistent performance, as evidenced by their annualized returns.

Due Diligence and Authentication

Due diligence and authentication are critical steps in the art investment process. They help you make informed decisions and protect yourself from potential risks.

Research Artist Before Making Purchases

Before making any art purchases, it’s essential to conduct thorough due diligence, researching the artwork, its history, and provenance. This includes verifying the authenticity of the artwork through meticulous examination and consulting experts and appraisers when necessary.

For example, you can utilize Artive, which offers comprehensive authentication services. Always, ensure the legitimacy and authenticity of artworks before making investment decisions.

This can help you mitigate the risk of purchasing counterfeit or misrepresented artworks and safeguard your investment capital.

Research Artwork Before Making Purchases

Before making any investment, meticulously research the artist and examine their background, reputation, and body of work. Scrutinize the artwork itself, and inspect its condition, quality, and any distinguishing features.

Additionally, delve into the artwork’s provenance, tracing its ownership history and documentation to verify its authenticity. By taking the time to conduct comprehensive due diligence, you can make more informed investment decisions. This will also help to minimize the likelihood of purchasing counterfeit or misrepresented artworks.

Do not hesitate to hire professionals to check for the veracity of the artwork. The money you spend on checking the authenticity of the artwork is a worthwhile investment to avoid counterfeits.

Art Market Volatility Index | |

Year | Volatility Index |

2021 | 12.5 |

2022 | 14.2 |

2023 | 11.8 |

The volatility index provides insights into the stability and risk levels associated with art market investments.

Verify the Authenticity of Artwork Through Provenance Research

Provenance research serves as a cornerstone of due diligence in art investment. It provides you invaluable insights into the authenticity and legitimacy of artworks. You can trace the lineage of an artwork, documenting its ownership history and establishing its authenticity with it.

Start by examining any available documentation, such as sales records, exhibition catalogs, and certificates of authenticity. Examine archives, databases, and historical records to corroborate the artwork’s provenance and identify any gaps or inconsistencies.

You can also consult with experts, such as art historians, appraisers, and provenance researchers, who can provide additional expertise and validation.

The National Archives is also a good source for valuable historical records and documents to corroborate the provenance of artworks and verify their authenticity.

By verifying the authenticity of artwork through provenance research, you can mitigate the risk of purchasing counterfeit or fraudulent pieces and safeguard their investment capital.

As artwork is an expensive investment, it is vital that you buy a genuine piece that can be appreciated in value over time.

Considerations for Storage

Storage and insurance are vital in art investment, they ensure the preservation and protection of your valuable assets. When acquiring artwork, you need to evaluate storage options carefully. Take into account all factors such as security, climate control, and accessibility.

Whether you opt for professional art storage facilities or home displays, prioritize proper handling and conservation to prevent damage or deterioration.

Evaluating Storage Options for Artwork

When it comes to storing artwork, making the right storage choice is crucial for preserving its value and integrity. You must consider various factors such as security, climate control, and accessibility.

Professional art storage facilities offer specialized environments designed to protect artworks from damage due to fluctuating temperatures, humidity, and light exposure.

These facilities typically provide state-of-the-art security measures, including surveillance systems, climate-controlled vaults, and restricted access. These can ensure the safety and security of your valuable investments.

If you plan to store the artwork at home, it would require careful consideration of environmental conditions and proper handling techniques.

This is crucial to prevent damage or deterioration. Regardless of where you decide to store them, investing in adequate protection is essential to safeguarding your art collection for years to come.

Understanding the Importance of Proper Handling and Conservation

Preserving the value and longevity of artwork requires diligent attention to proper handling and conservation practices. Artwork is delicate and susceptible to weather elements and improper handling.

Exposure to environmental factors such as light, humidity, and temperature fluctuations can have detrimental effects on artworks, leading to fading, discoloration, and deterioration over time.

To mitigate these risks, ensure that the artworks that you invest in are handled with care. Consider using archival-quality materials and techniques to minimize the risk of damage.

Maintain stable environmental conditions within storage spaces to prevent mold growth, insect infestations, and other forms of deterioration.

You can also implement proper conservation measures, such as regular inspections, cleaning, and maintenance. This can help to prolong the lifespan of artworks and ensure their continued enjoyment for future generations.

By understanding the importance of proper handling and conservation, you can protect your art investments and preserve their value over time.

Average Hold Time for Art Investment | |

Investment Type | Average Hold Time (Years) |

Paintings | 07-10 |

Sculptures | 05-08 |

Contemporary Artworks | 03-05 |

Different types of artworks have varying average hold times, influencing investment strategies and liquidity.

Obtain Adequate Insurance Coverage for Art Assets

Get sufficient insurance coverage for art assets. This is vital for protecting your valuable investments.

Artwork is not only vulnerable to theft and damage but also susceptible to natural disasters and accidents. Without proper insurance, you risk significant financial loss in the event of unforeseen circumstances.

Art insurance policies typically cover various risks, such as theft, fire, water damage, vandalism, and transit-related incidents. It’s essential to choose a policy tailored to the specific needs and value of your art collection. Factors such as the artwork’s appraised value, storage conditions, and transportation requirements should be carefully considered when selecting coverage.

Review policy terms and conditions carefully to understand the extent of coverage, deductions, and any exclusions that may apply. Some insurance providers offer specialized policies for art collections, providing comprehensive protection tailored to the unique risks associated with art ownership.

You can check Chubb’s fine art insurance solutions to safeguard your valuable art collection against unforeseen events like theft, damage, or loss.

Conclusion

Investing in artwork offers a unique opportunity to diversify your portfolio, express your passion for art, and potentially achieve attractive returns.

By conducting thorough research, building relationships with key players in the art world, setting a budget and investment strategy, and practicing due diligence and authentication, you can invest in the artwork with confidence.

For personalized guidance and advice, consult an art investment advisor company.

FAQs

Q: What are the typical returns on artwork investments?

A: Artwork investment returns vary widely depending on factors like the artist’s reputation, artwork condition, and market demand. Some artworks yield substantial returns, while others may not perform as well.

Q: What are the steps involved in investing in artwork?

A: Investing in artwork involves steps like researching the art market, setting investment goals and budgets, networking with galleries and artists, and conducting due diligence. By following a structured approach and leveraging resources available in the art community, you can navigate the complexities of art investment effectively.

Q: How can I determine if artwork is a good investment?

A: Whether artwork is a good investment depends on factors like your financial goals, risk tolerance, and knowledge of the art market. While artwork has the potential to provide attractive returns and diversify investment portfolios, it also carries risks such as market volatility and illiquidity.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making investment decisions.

The Art of Investing: How Fine Art Can Diversify Your Portfolio?

Introduction

Investing in fine art is no longer an exclusive domain of the ultra-wealthy or seasoned collectors.

It is increasingly becoming a great alternative investment option for all investors looking to diversify their portfolios.

According to Art Basel’s Art Market Report, the global art market was worth over $67 billion in 2021, highlighting its significant size and potential for high returns on investment.

Take, for example, Leonardo da Vinci’s “Salvator Mundi” which sold for $450 million in 2017, an incredible increase from its $10,000 sale price in 1958.

Although rare, this type of ROI highlights the potential that lies in art investment and why you should be investing in art to diversify your portfolio.

Key Takeaways

- The global art market is valued at over $67 billion, with significant potential for high returns on investment.

- Diversification in investment portfolios is crucial for risk management and enhancing potential returns.

- Fine art investment has a long history and has gained popularity due to its ability to preserve value and offer unique growth opportunities.

- Art investments have a low correlation with traditional markets, providing stability during economic downturns and market volatility.

- Proper storage and insurance are essential to protect art investments from environmental damage and other risks.

- Emerging technologies are revolutionizing the art market by offering greater transparency and security.

1. Why Do You Need To Diversify Your Investments?

Diversification is a fundamental principle of investing, aimed at reducing your risk by allocating investments across various financial instruments, industries, and other categories.

By spreading your investments, you can minimize the impact of any single asset’s poor performance on your overall portfolio.

Think of it as not putting all your eggs in one basket. This strategy can enhance your potential returns as you invest in different areas that would each react differently to the same event.

1.1 Importance of Diversification in Investment Portfolios

It is essential that you diversify your portfolio for risk management.

This helps to smooth out the volatility that can come when you rely too heavily on a single asset class.

For instance, during the 2008 financial crisis, many investors saw their stock-heavy portfolios plummet.

However, those with diversified portfolios, including bonds, real estate, and commodities, fared better.

Adding fine art to your investment mix can diversify your portfolio, offering stability and unique growth opportunities.

The art market often moves independently of the stock market, providing you with a hedge against economic downturns.

1.2 Overview of Fine Art as an Investment

Investing in art isn’t a new phenomenon.

Art has always been a symbol of wealth and status, with patrons and collectors investing in masterpieces for both aesthetic enjoyment and financial gain.

Historically, art investment has evolved significantly, with roots tracing back to the renaissance. A Brief History of Investing in Art provides an excellent overview of this evolution.

In the 20th century, art investment gained more structure with the establishment of art funds and auction houses, making it accessible to a broader range of investors.

1.3. Rise in Popularity Among Alt Investors

The popularity of art investment has surged in recent decades.

This rise can be attributed to several factors, including the increasing wealth of individuals, the globalization of the art market, and the advent of digital platforms facilitating easier access to art.

High-profile sales and celebrity endorsements have also played a role.

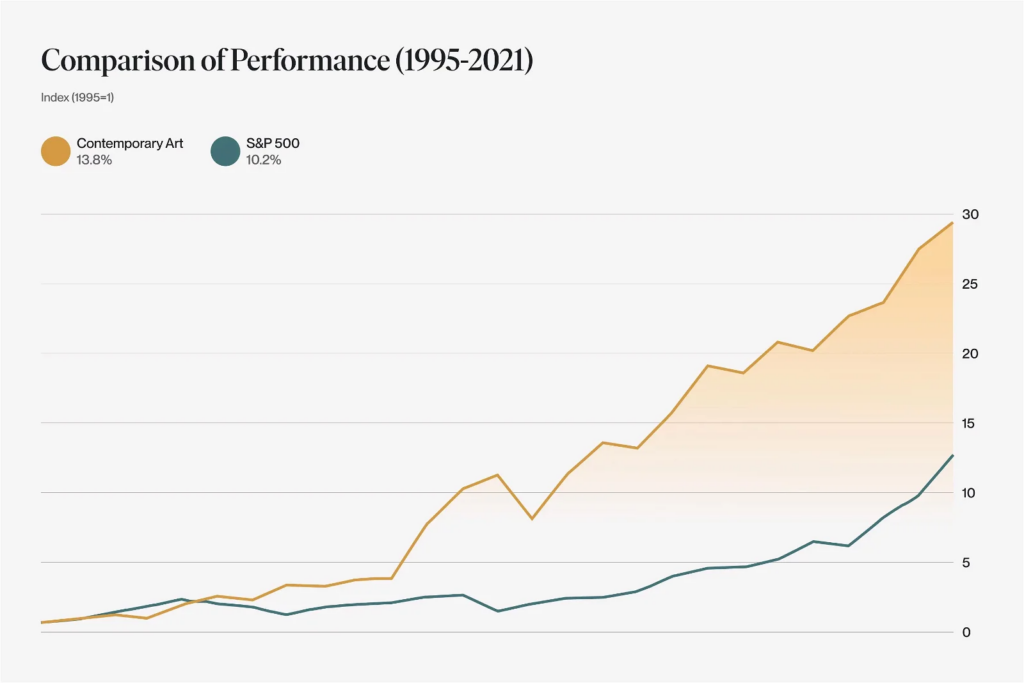

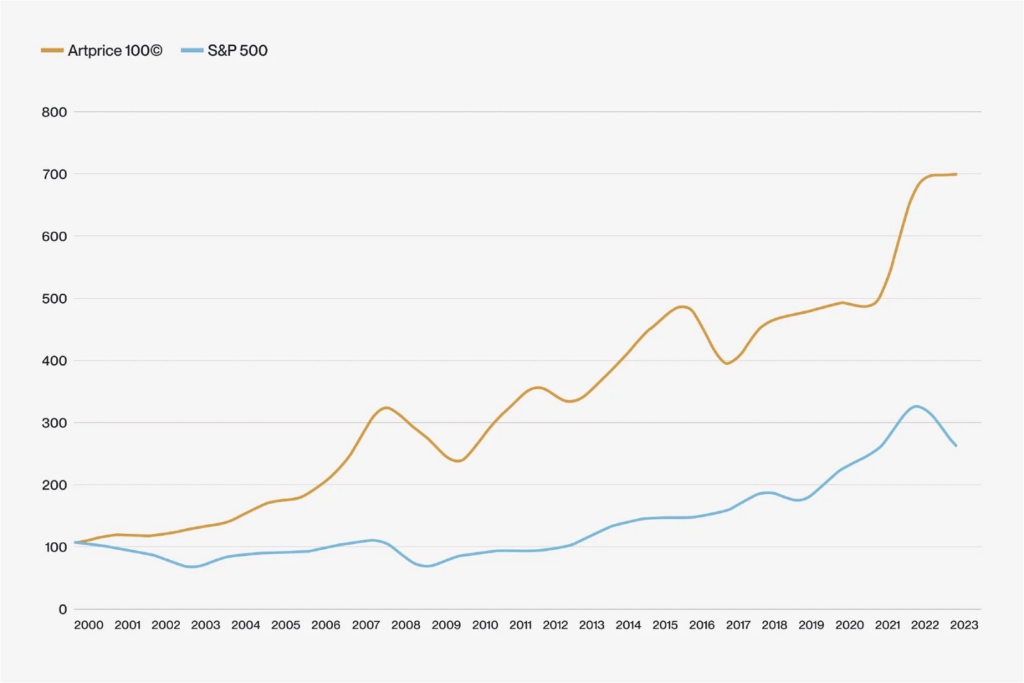

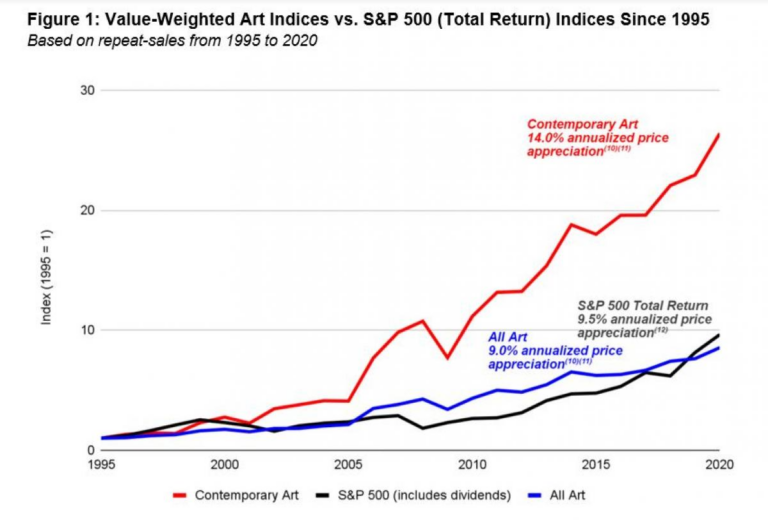

One of the biggest advantages of art as a viable investment for you is that the returns on certain art pieces outperform traditional stocks and bonds.

2. The Value Proposition of Fine Art

One of the most compelling reasons for you to invest in fine art is its longevity and preservation of value.

Unlike stocks or bonds, which can lose value rapidly, art tends to appreciate over time.

This is due to its inherent rarity and the continuous demand for high-quality pieces.

Art can be passed down through generations, maintaining or even increasing in value.

For example, the works of old masters like Rembrandt and Vermeer have not only been retained but also significantly increased in value over the centuries.

2.1. Comparison with Other Tangible Assets Like Gold and Real Estate

A common question of most alternative investors is “Why shouldn’t I invest in Gold or Real Estate instead of art?”

When you compare fine art to other tangible assets, such as gold and real estate, it presents unique advantages.

Gold is often seen as a safe haven during economic uncertainty, but it doesn’t offer the same aesthetic enjoyment or cultural value as art.

Real estate can provide you with rental income and capital appreciation, but it comes with maintenance costs and market volatility.

Fine art, on the other hand, combines aesthetic appeal with potential financial returns, often without the same level of ongoing expenses.

Also, your investment in art doesn’t depreciate in the same way physical property can.

2.2 Low Correlation with Traditional Markets

Fine art’s low correlation with traditional financial markets makes it a valuable asset for you that can help maintain your portfolio stability during economic downturns.

While stocks and bonds are susceptible to market volatility and economic cycles, the art market often remains resilient.

This stability can provide a hedge against financial market risks, preserving wealth when other investments might falter.

3. Understanding the Art Market

The art market is divided into primary and secondary sectors. Here are the key differences between the two that you must be aware of before investing:

3.1. Primary vs. Secondary Market

The primary market refers to the initial sale of an artwork, typically conducted by galleries representing artists.

This is where new works are introduced to collectors and investors.

The secondary market, on the other hand, involves the resale of artworks, often through auctions or private sales.

This market is where established works change hands, and it plays a crucial role in determining the value of art pieces over time.

You can check The Christie’s Art Market 2021 report for various insights into primary and secondary markets and the key players involved.

3.2. Key Players: Galleries, Auction Houses, Private Dealers

Several key players operate within the art market – you need to be aware of before you invest in art. These are:

Galleries: They often represent artists and provide a platform for them to sell their work.

Auction houses: Sotheby’s and Christie’s facilitate high-profile sales and set price benchmarks.

Private dealers and advisors: These also play a significant role, offering you personalized services on every aspect of investment in art.

Each player has a unique influence on the market, contributing to its overall dynamics and value determination.

3.3 Market Trends and Insights

Understanding historical performance data is essential for diversifying your portfolio and making informed investment decisions in the art market.

Historically, art has shown strong appreciation, particularly in certain categories like contemporary and post-war art.

For instance, the Mei Moses All Art Index, which tracks art sales data, has often outperformed the S&P 500.

This can help you identify potential trends and opportunities for your art investments.

The Key Takeaways from the 2021 Art Market Report outlines significant trends and future predictions for the art market.

4. Types of Fine Art Investments

There are various types of art categories that you can invest in to diversify your portfolio. This helps you with better returns and acts as a hedge against inflation and market volatility. Some of the major categories you can consider for your art investment are:

4.1. Paintings

Paintings are one of the most popular categories in fine art investment, known for their historical significance and potential for high returns.

Iconic pieces by artists like Van Gogh or Picasso have fetched record prices at auctions. Investing in paintings can be rewarding, especially if you acquire works from well-established artists.

4.2. Sculptures

You can also consider investing in sculptures that have a three-dimensional appeal.

Works by artists like Auguste Rodin or contemporary sculptors command high prices.

When you invest in sculptures you have to consider a lot of factors such as the material, size, and the artist’s prominence.

4.3. Photography and Digital Art

In addition to painting and sculptures, you can also consider photography and digital art for your investment.

These are gaining a lot of traction as investment categories.

With the rise of NFTs, digital art has opened new avenues for investing.

Photography by renowned artists like Ansel Adams and Cindy Sherman has also shown strong appreciation.

As these categories are becoming increasingly significant in the art market, they offer you a great investment opportunity with diversification.

Also, unlike other tangible assets, art can be appreciated significantly over time.

The UBS Report on Art as an Investment highlights how well-preserved artworks can maintain and even increase their value.

4.4. Notable Artists and Their Market Impact

Established artists like Pablo Picasso and Andy Warhol have left a lasting impact on the art market.

Their works are highly sought after, often selling for millions at auction.

Your investment in art by these masters can be a secure choice, given their proven track record of appreciation.

4.5. Emerging Artists and Their Investment Potential

Emerging artists also present a unique investment opportunity for you.

While riskier, investing in promising new artists can yield significant returns.

For this, you need to identify talent early, such as artists recognized at prestigious art fairs or biennials.

You can either monitor trends or take expert recommendations to make informed decisions in art investment.

5. How to Invest in Fine Art?

These are the various ways you can invest in fine art:

5.1. Galleries and Auctions

Purchasing art directly from galleries or auctions is a traditional and straightforward method.

Galleries offer a curated selection and expert advice, while auctions provide opportunities to acquire high-value pieces.

5.2. Private Sales

Private sales offer you a more discreet and personalized approach to acquiring art.

These transactions often occur through dealers, providing you an opportunity to negotiate terms directly.

Private sales can be advantageous for you in acquiring rare or high-value pieces not available on the open market.

5.3. Art Funds and Fractional Ownership

Art funds pool money from investors like you to purchase and manage art collections.

These funds are managed by experts who buy, hold, and sell artworks to generate returns.

Investing in art funds can be a way to gain exposure to the art market without the need to buy individual pieces.

5.4. Fractional Ownership Platforms and Their Benefits

Fractional ownership platforms allow you to buy shares in high-value artworks.

Platforms like Masterworks offer fractional ownership, enabling you to invest in pieces that would otherwise be out of reach.

5.3 Online Marketplaces and Platforms

Online marketplaces offer you the convenience and access to a global market.

You can consider platforms like Artsy and Saatchi Art that provide extensive catalogs, artist information, and transparent pricing.

6. Risk associated with Market Volatility and Illiquidity in the Art Market

One of the primary challenges that you may find with your art investment is the illiquidity of the market.

Unlike stocks or bonds, which can be quickly sold on exchanges, art pieces often take time to sell, sometimes months or even years.

This lack of liquidity means you need to be prepared to hold onto your artwork for a longer period.

This aspect can be particularly challenging if you need to liquidate assets quickly.

Artnet’s Analysis on Market Volatility discusses how external factors like the COVID-19 pandemic impact the art market.

6.1. Price Fluctuations and Market Sentiment

Art prices can be highly volatile, influenced by trends, artist reputations, and broader market sentiments.

A piece by an emerging artist that you have invested in might suddenly skyrocket in value if the artist gains significant recognition.

Conversely, if an artist falls out of favor, their works and your assets can depreciate.

This volatility makes it crucial for you to stay informed about market trends and artist developments.

You need to regularly follow art market reports and consult with art advisors to navigate these fluctuations and make more informed investment decisions.

7. Storage, Insurance, and Maintenance Costs

Proper storage is critical to preserving the value of your art investment.

Artworks are susceptible to damage from environmental factors such as light, temperature, and humidity.

Ensure that your pieces are stored in climate-controlled environments can prevent deterioration.

For instance, paintings should be kept away from direct sunlight and in conditions where temperature and humidity are stable.

You should be investing in professional storage solutions, such as art storage facilities, which can provide the necessary protection and peace of mind.

7.1. Insurance Coverage Options

Insurance is another vital component of art investment.

Given the high value and irreplaceable nature of art, having adequate insurance coverage protects you against potential losses from theft, damage, or natural disasters.

Policies can vary, so it’s essential to choose one that covers all potential risks.

Consulting with insurers who specialize in art insurance can help you find a policy that best suits your collection’s needs.

Regularly updating the insurance value as the art appreciates is also crucial to ensure comprehensive coverage.

Chubb’s Guide on Insuring Fine Art provides comprehensive information on insurance options and best practices.

8. Successful Art Investments

Here are some of the notable art investments and the fabulous returns they fetched for their buyers:

8.1. High-Profile Art Sales and Their Returns

High-profile art sales often capture headlines due to their staggering returns.

For example, in 1987, Vincent van Gogh’s “Irises” sold for $53.9 million, a significant increase from its previous sale at $84,000 in 1947.

Such sales highlight the potential for substantial returns in the art market.

These cases often involve works by renowned artists with established market value, underscoring the importance of investing in quality pieces.

While all your investments may not yield such high returns, these examples show the potential financial rewards of art investment.

8.2. Case Studies of Individual Investors

Individual investors have also seen significant returns from art investments.

Take the case of a couple who purchased a painting by Jean-Michel Basquiat for $19,000 in 1983.

In 2017, they sold it for $110.5 million, showcasing the impressive appreciation art can achieve.

The Jean-Michel Basquiat’s record-breaking auction showcases the potential returns on art investments.

These case studies also illustrate the importance of recognizing potential early and the value of holding onto pieces for long-term gains.

They also highlight the benefits of researching artists and trends thoroughly before you make a purchase.

8.3. Lessons Learned from Art Investment Failures

Art investment is, however, not without its pitfalls.

One notable example is the collapse of the Knoedler Gallery in New York, which sold forged paintings for years.

Investors who bought these forgeries faced significant financial losses and legal battles.

This case emphasizes the importance of due diligence and working with reputable galleries and dealers.

Another common misstep is overpaying for art based on hype rather than intrinsic value, leading to potential financial disappointment.

8.4. Strategies to Avoid Common Pitfalls

To avoid common pitfalls in art investment, you should conduct thorough research on artists and artworks.

Verify provenance and authenticity through multiple sources, and consider professional appraisals.

Diversifying your art portfolio can also mitigate risks, much like diversifying a traditional investment portfolio.

Consult with art advisors or financial advisors specializing in alternative investments can provide valuable insights and help you navigate the complexities of the art market.

Conclusion

Investing in fine art offers unique opportunities for diversification, stability, and potentially high returns.

However, it requires a strategic approach and a willingness to engage deeply with the art world.

Consult with an alternative investment advisor or a financial advisor to get tailored advice that can help you navigate this complex market.

By integrating these insights into your investment strategy, you can effectively leverage the value of fine art to diversify and enhance your portfolio.

FAQs

Q: What is art investment and how does it work?

A: Art investment involves purchasing artworks with the expectation that their value will appreciate over time, providing financial returns when sold.

Q: Why is diversification important in an investment portfolio?

A: Diversification reduces your risk by spreading investments across different asset classes, minimizing the impact of poor performance in any single investment.

Q: How can I start investing in fine art?

A: You can start by researching and purchasing art through galleries, auctions, private sales, art funds, or online marketplaces.

Q: What factors influence the value of fine art?

A: The value of fine art is influenced by the artist’s reputation, provenance, condition, rarity, and current market demand.

Q: How can I ensure the authenticity of an artwork before purchasing?

A: Authenticity can be verified through provenance documentation, expert appraisals, and scientific tests.

Q: What are the risks associated with investing in art?

A: Risks include market volatility, illiquidity, potential forgery, and high costs of storage, insurance, and maintenance.

Q: How do NFTs impact the art investment market?

A: NFTs provide a digital method to verify provenance and ownership, increasing transparency and security in art transactions.

How To Invest In Art? Why Art Is A Good Investment In 2024?

As we enter 2024, more people are realizing the benefits of investing in art. Although art isn’t easily turned into cash, it can be a wise investment when done right. This article explores why art is a good investment, offering advice for beginners on getting started. We’ll also cover what to consider when buying art and how to get the best price.

Why is art a valuable investment?

A long-term reliable investment

Art proves to be a stable investment because its value tends to remain constant over time, unlike stocks or other assets that fluctuate with the market. This stability was evident during the 2020 pandemic, where art values stayed steady while other markets experienced significant ups and downs. The resilience of investment-grade art is attributed to its independence from external events, contributing to a gradual increase in value over the years.

While art is a reliable long-term asset, it’s essential to note that it’s non-liquid. Unlike stocks that can be quickly converted to cash, selling art involves steps like appraisal and collaboration with auction houses or art consultants, making the process time-consuming. Many art investors include art collections in a diversified portfolio and as part of their estate planning for future generations.

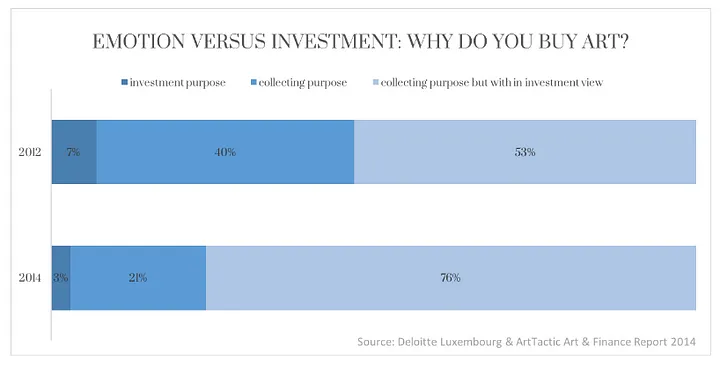

Passion & prestige

Investing in art becomes more appealing when you have a genuine interest in it. When your investment aligns with your passion, you’re motivated to thoroughly research and understand the subject. If you’re fascinated by a specific artist or historical period, engaging with auction houses, consulting art advisors, and discovering rare pieces for your collection can be a rich learning experience. Moreover, owning an art collection carries a unique prestige not found in other asset classes, making it a noteworthy conversation starter at social gatherings and dinner parties.

Diversification of assets

As mentioned earlier, including art in your investment portfolio is beneficial because it diversifies your holdings. A diverse portfolio, with a mix of different assets, helps reduce risk and adds an element of interest to your overall investment strategy.

What to know before investing in art

Before diversifying your portfolio with artwork, consider the following points:

Small portfolio share

Art should only represent a small portion of your overall investment portfolio. It’s more like an extra, not a primary asset. While you might see some profits, relying on art for substantial returns is unlikely.

Realism in returns

Think of art investment as supplementary, similar to real estate. Don’t depend on it for consistent income. Also, be mindful of taxes on any gains, as the IRS treats art as a collectible.

Non-liquid nature

Fine art is a non-liquid or illiquid asset. Unlike stocks or savings accounts that can quickly generate cash, selling art takes time. This aspect should be considered in your overall asset allocation strategy.

Challenges of selling

Selling art, while possible, is not a quick process. Auction houses, the primary selling avenue, often charge substantial fees. Additionally, with art prices fluctuating, there are no guarantees that selling will result in a profit.

When should you invest in art?

Investing in art involves a strategic approach, with the general advice being to buy when prices are low and sell when they are high. This strategy is apparent in the art world, particularly with contemporary art. Emerging artists, early in their careers, are more affordable but also pose a higher risk. Collectors invest in these “emerging artists” with the hope that their value will rise over time, similar to the early supporters of artists like Basquiat, who have seen significant returns.

For those seeking a less risky investment, “established” or “mid-career” artists are a viable option. Although they come with a higher price tag, these artists have already made a mark in the art world, showing consistent sales and yearly returns. Examples include artists like Banksy and Damien Hirst, considered established figures.

At the top tier are “Blue Chip” artists, the giants of the art world like Monet, Picasso, and Cezanne. While requiring a substantial upfront investment, the value of Blue Chip artists is highly assured. Their works are showcased in prestigious museums, and their sales prices are well-documented by indexes such as Artprice100, measuring the top-performing artists at auction within the last 5 years.

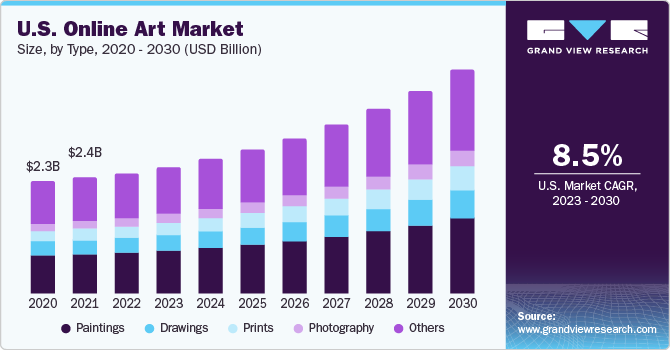

The art market in 2024: Key trends

1. The prints and multiples market is showing strong resilience

In 2023, the art market had fewer total sales, but more items were sold, especially in prints and multiples. This category, boosted by affordable artworks, had an 18% sales increase. In 2024, auction estimates are likely to be more realistic as the market adopts reasonable pricing.

2. Dominance of online sales

Despite a dip in figures, online sales maintained their significance in 2023, paralleling the overall decline in auction sales. These online platforms, catering to the lower price segment, are likely to remain a crucial entry point for diverse buyers in 2024.

3. Art and tech revolution

Anticipate a transformative shift in the art-buying landscape in 2024 as art and technology converge. This integration is set to redefine art acquisitions, offering improved transparency in managing and valuing collections. Increased adoption of the digital art-buying market is expected to reshape business practices in art investments.

4. Rise of private sales

Following a trend observed in 2023, private sales are expected to gain influence in 2024. Single-owner auctions faced varying degrees of success, leading to a predicted shift towards increased reliance on private transactions. This transition aims to mitigate risks, especially during economic volatility.

5. Dynamics of market segments

The future of the primary market, art fairs, and ultra-contemporary artists remains uncertain. The secondary market and established blue chip artists are expected to thrive. Larger galleries may strengthen their success by acquiring artworks and estates from well-established blue chip artists and moderately established emerging talents.

What to look for when buying art

Navigating the diverse art world requires narrowing your focus by selecting a specific genre or time period of interest. To aid in your search, consider collaborating with an art advisor or an art-focused investment company. These professionals can assist in determining the fair market value of art pieces, ensuring a wise investment.

Once you’ve identified your area of interest, be clear on the type of art you’re acquiring:

- Originals: One-of-a-kind pieces carry the highest price but offer the potential for significant returns.

- Prints or copies: More affordable, but less likely to yield substantial profits. High-quality prints, like giclées, closely resemble the original and may be more expensive. Limited editions of prints tend to hold more value.

Reproductions:

Mass-produced copies lacking a limited run. They are the most affordable but are also the least likely to appreciate in value.

Regardless of your choice, prioritize quality and condition. For substantial investments, consider investing in an appraisal to ensure you make informed decisions about the artworks you acquire.

Where to look for art

Exploring various avenues can help you invest in art, with different platforms catering to diverse preferences:

- Museums and art galleries: Museums and galleries are excellent places to explore and invest in art. Art galleries often specialize in works by established and emerging artists, offering curated selections for purchase.

- Online art marketplaces: Platforms like Saatchi Art, Artsy, and Artfinder provide opportunities to browse and buy art online from a wide range of artists and galleries. Online investment options, such as Masterworks, allow you to buy shares of art under expert guidance.

- Auction houses: Auction houses like Christie’s and Sotheby’s auction high-end art pieces, providing a chance to bid on artworks in a competitive environment. Be mindful of buyer’s premiums in addition to the auction price.

- Art fairs: Art fairs gather galleries and artists worldwide, showcasing artworks for sale. Local art fairs offer opportunities to purchase art from emerging or local artists.

- Direct sales from artists: Many artists sell their works directly through personal websites or social media platforms.

Is Art (still) a good investment in 2024?

The Federal Reserve’s elusive stance on potential interest rate decreases in 2024 is causing uncertainty and erratic behavior in traditional markets.

At the end of 2023, there was a notable surge in stock prices, particularly in tech and AI stocks. This surge was fueled by the anticipation that the U.S. Federal Reserve might lower interest rates in the early half of 2024.

However, the release of the Meeting Minutes from the Bank’s December interest rate committee meeting has tempered these expectations. The Minutes indicated an “unusually elevated degree of uncertainty” regarding future policy decisions. Some members suggested maintaining higher fund rates if inflation persists, while others proposed the possibility of further hikes, contingent on evolving conditions.

This news has not been well-received by the markets, contrary to their expectations. The use of cautious language by the Reserve Bank has unsettled investors, evident in the downturn of stocks in the initial days of the new year, following the rally at the end of 2023.

Yes, Art is a good investment in 2024!

Amidst the current uncertainty, alternative assets are gaining appeal as safe havens for parking cash. This shift is driven by the fact that alternative assets often exhibit a lower correlation with major economic events and stimuli, including policy announcements from entities like the Federal Reserve. This stands in contrast to traditional assets like stocks and bonds, which can be more directly influenced by such events. Investors are increasingly drawn to alternative assets as a means of diversification and risk mitigation in the face of unpredictability in traditional markets.

Investing in Artwork: Your Complete Guide to Maximizing Returns

Did you know that the global art market reached a staggering $64.1 billion in 2023? Art investment has become increasingly popular among investors seeking diversification of their portfolio and potential high returns.

Key Takeaways

- Discover the untapped potential of the global art market

- Learn how to seize opportunities for lucrative returns

- Dive deep into the world of art investment

- Equip yourself with the knowledge and strategies to excel in the art market

Art investment isn’t just about financial gains or exploring an alternative and high-return investment. It is also about strategically building wealth for the future. From timeless masterpieces to cutting-edge contemporary works, the art market offers a wealth of opportunities for investors.

Let us look at the various intricacies of investing in artwork that can help you achieve both financial success and artistic fulfillment. Diversify your portfolio and indulge your passion for creativity, while maximizing your returns.

Stats and Facts on Investing in Artwork

Many recent reports suggest that the average annual return on investment for art has outperformed many traditional asset classes, including stocks and bonds.

Global Art Market Size (2023) | $64.1 billion |

Average Annual Return on Investment in Art (5 years) | 9.80% |

Top Auction Sale in Art History (As of 2023) | $450.3 million (Leonardo da Vinci’s “Salvator Mundi”) |

Percentage of Ultra-High Net Worth Individuals Investing in Art (2023) | 84% |

Number of Art Transactions Worldwide (2023) | Over 40 million |

Leading Art Market by Sales (As of 2023) | United States |

Average Hold Time for Art Investment | 7-10 years |

Number of Art Fairs Worldwide (2023) | Over 300 |

What is Artwork Investment?

Wondering about what exactly is artwork investment? Simply put, investing in artwork involves buying pieces of art with the expectation of generating a financial return in the future. Whether you purchase paintings, sculptures, or other forms of art, the goal is to build wealth as your alternative investment appreciates.

Factors Influencing the Value of Artwork

The value of artwork is influenced by various factors. Understanding these factors can help you make informed investment decisions and capitalize on opportunities in the art market. Some of these are:

Artist’s Reputation

The reputation and prestige of the artist play a significant role in determining the value of an artwork. Generally, the artwork of established and renowned artists commands higher prices.

Take the example of just four top artists along with notable artworks:

Artist | Painting | Price (USD) | Year |

Pablo Picasso | Les Femmes d’Alger | $179.4 million | 2015 |

Vincent van Gogh | Portrait of Dr. Gachet | $82.5 million | 1990 |

Leonardo da Vinci | Salvator Mundi | $450.3 million | 2017 |

Michelangelo | Statue of David | Variable | Variable |

Of these, the “Statue of David” by Michelangelo does not have a specific price or year of sale. It is a priceless masterpiece housed in the Galleria dell’Accademia in Florence, Italy.

ProvenanceThe documented history of ownership, known as provenance, can affect the value of artwork. Pieces with a well-documented provenance, owned by notable collectors or institutions, may fetch higher prices.

Artistic Significance

The artistic significance of the artwork, including its style, technique, and historical importance, can influence its value. Masterpieces or works that represent significant artistic movements tend to be more valuable.

Condition

The condition of the artwork, including factors such as preservation, restoration, and overall state of preservation, also impacts its value. You’ll find that well-preserved artworks in excellent condition typically command higher prices.

Rarity

Is the artwork you are buying rare? The rarity of the artwork, with factors such as scarcity, uniqueness, and limited edition status, can also affect its value. Rare or one-of-a-kind pieces are often more valuable to collectors and command a premium price.

Market Demand

The demand for an artwork within the art market can also influence its value. Artworks that are in high demand among collectors or have recently gained popularity may fetch a higher price.

Economic Factors

The overall market trends, interest rates, and investor sentiment also impact the value of artwork. Economic downturns or periods of uncertainty may lead to fluctuations in art prices.

Subject Matter

The subject matter depicted in the artwork also affects its value. Certain themes or subjects by certain artists are more sought after by collectors. Similarly, artworks with universal appeal or cultural significance command higher prices.

Exhibition History

The exhibition history of the artwork also contributes to its value. Artworks with a notable exhibition history such as displays in prestigious galleries, museums, or exhibitions are more valuable to collectors.

Authentication

The authentication and certification of the artwork by recognized experts or institutions greatly impact its value. Authenticated artworks are often considered more valuable and desirable by collectors. They can fetch a premium or high price for the seller.

Forms of Artwork Investments

Traditional Art Forms

Traditional art forms such as paintings and sculptures have long been favored by investors for their perceptible beauty and historical significance. Masterpieces of renowned artists like Picasso, Claude Monet, and da Vinci have historically commanded astronomical prices at auctions and galleries.

Contemporary Art

Contemporary art includes a wide range of styles and mediums that are currently popular. They offer you an opportunity to find the latest trends and invest in the art of emerging artists. Examples of this are abstract paintings and mixed-media installations, which provide unique investment opportunities.

Emerging Artists and Markets

Investing in emerging artists and markets can be a lucrative strategy if you are an investor willing to take calculated risks. Keep an eye on up-and-coming talent from emerging art hubs around the world. You are sure to find good investment opportunities among the emerging artists that are gaining international recognition.

Some of the emerging artists that a reputable site like Sotheby’s lists are: Shara Hughes, Hilary Pecis, Issy Wood, Tomokazu Matsuyama, Xinyi Cheng, Salman Toor, and Rafa Macarrón.

Art Funds and Investment Vehicles

For investors looking for diversification and professional management, art funds and investment vehicles provide access to diversified portfolios of artworks. These funds pool capital from multiple investors around the world.

The funds are used to acquire and manage a portfolio of art assets. This provides you exposure to the art market with reduced risk and administrative burden.

Benefits of Investing in Artwork

Portfolio Diversification

Art is different from stocks, bonds, and other forms of investments. When you invest in art, it doesn’t usually go up or down at the same time as those other investment instruments.

This means that if you have some art in your investment portfolio, it can help lower the chances of losing money if the stock market goes down. Investing in art can help spread out your risks and make your investments safer.

Potential for High Returns

While past performance is not indicative of future results, art investment has the potential to deliver attractive returns over the long term. This is especially true for well-curated collections.

Tangible and Aesthetic Value

Unlike stocks and bonds, which exist purely as financial instruments, artworks have intrinsic value as objects of beauty and cultural significance. They provide aesthetic enjoyment and emotional satisfaction to their owners.

Hedge Against Inflation

Art is a reliable hedge against inflation. It preserves its value and often appreciates over time, alongside economic expansion and increasing prices.

As a tangible asset, art offers investors a haven against the erosive effects of inflation, providing stability and potential for growth in uncertain economic environments.

Enjoyment and Passion for Art

Beyond financial considerations, investing in artwork allows you to indulge your passion for art. You can immerse yourself in the creative process, fostering a deeper appreciation for culture and beauty.

Risk and Challenges of Art Investment

Market Volatility and Unpredictability

The art market can be highly volatile and unpredictable, with prices influenced by factors such as changing tastes, economic conditions, and geopolitical events. It is also subject to fluctuations in demand, taste, and economic conditions.

Art prices can be influenced by various factors such as changes in consumer preferences or shifts in market sentiment. As a result, art investments can be susceptible to price volatility, with their value experiencing significant ups and downs over time.

Illiquidity and Long-Term Commitment

Unlike stocks and bonds, which can be bought and sold with ease, artworks are relatively illiquid assets. They require a long-term investment horizon and commitment to realize returns. Also, they cannot be easily bought and sold on public exchanges.

The process of buying and selling artworks can be time-consuming and complex, with transactions often taking months or even years to complete. This lack of liquidity can pose challenges for you if you need to access your capital quickly.

It can also restrict you from adjusting your investment portfolio in response to changing market conditions.

Authenticity and Provenance Issues

Authenticity and source are critical considerations in art investment. This is because forgeries and disputed sources significantly impact the value and marketability of artworks.

Take the case of the “Salvator Mundi” painting attributed to Leonardo da Vinci. In 2017, the painting sold for a record-breaking $450 million at auction, making it the most expensive artwork ever sold.

Credit: Corbis via Getty Images

However, questions arose regarding its authenticity and source. These uncertainties significantly impacted the painting’s value and marketability. This only highlights the critical role that authenticity and source play in art investment.

Storage and Maintenance Costs

Owning art works requires additional costs such as storage, insurance, and maintenance. This can erode returns and increase the overall cost of ownership. Properly storing and preserving artworks is essential to maintaining their value and ensuring their long-term appreciation.

Regulatory Risks

The art market is largely unregulated compared to other financial markets, leaving investors vulnerable to regulatory risks. The lack of oversight and transparency in the art market can create opportunities for fraudulent activities, insider trading, and market manipulation.

In addition, regulatory changes or interventions by government authorities can impact the art market and investor confidence.

Learn more about the regulatory risks associated with art investment and how they may impact your investment decisions here.

Conclusion

Investing in artwork offers a unique opportunity to diversify your portfolio, generate potential high returns, and engage with the world of art and culture.

Understanding the factors influencing the value of an artwork, exploring different forms of art investments, and carefully managing risks can help maximize your chances of success in the art market.

You can also consult an art investment advisor company or a financial advisor to discuss your investment goals. They can help you develop a personalized strategy that aligns with your needs and risk tolerance.

FAQs

Q: Is artwork a good investment?

A: Yes, artwork can be a good investment option for diversifying your portfolio and achieving higher returns. However, like any investment, it comes with various risks. You need to do thorough research and understand the art market before you invest in it.

Q: What is the best artwork to invest in?

A: The “best” artwork to invest in depends on various factors such as your investment goals, risk tolerance, and market trends. It’s essential to conduct research, considering factors like artist reputation, provenance, and market demand. You can also seek advice from art investment professionals.

Q: How to invest in artwork?

A: Investing in artwork involves researching the art market, understanding factors influencing artwork value, and developing an investment strategy. You can invest directly by purchasing artwork or indirectly through art funds or investment vehicles. Consulting art investment advisors or financial professionals can also provide valuable guidance.

Investing in Fine Art

Art as an Investment Makes Sense But for Whom? And How?

The following synopsis explains fine art as an alternative financial asset. It delves into the intricacies of art valuation, which is influenced by both subjective aesthetic factors and objective financial considerations. The aim is to assess art’s viability as a financial investment by comparing its performance with traditional financial assets.

Unique Features of the Art Market: The Role and Risks of Auctions

Art valuation is complex, influenced by both tangible financial value and intangible factors like historical significance and personal taste. This dual nature of art valuation differentiates it from other, more straightforward, financial assets.

A key aspect of the art market is the role of auctions. Auctions provide a transparent setting for pricing art, making them crucial for understanding market trends and valuations. However, while auctions provide the only publicly available valuation data points, there are data distortions.

Fine art auctions, due to their relatively low regulatory oversight compared to other financial markets, can be susceptible to self-dealing practices. Fine art auctions can sometimes be a bit like the “Wild West” due to less strict rules compared to other financial markets. This can open the door to self-dealing, where those involved might look out for their own interests more than they should. Here’s what that can look like:

- Price Manipulation: Auction houses or insiders may artificially inflate prices through shill bidding, where fake bids are placed, by undisclosed agreements between sellers and bidders, to drive up the price. Such manipulation can misrepresent the true market value of the artwork.

In my 33-year history of collecting art, for both passion and investment, I know of several instances where sellers that owned multiple pieces of an artist employed someone to bid for their auction item with the proceeds returning to the same seller minus the auction house’s standard 20% commission (yikes!). As a result, a seller could artificially inflate the value of their existing inventory, and even obtain loans based on appraisals that reflected the inflated value created by the shill bidding.

- Insiders Playing Favorites: People employed at the auction houses may have their own stakes in some artworks, which can lead them to push certain pieces or clients unfairly.

- Playing the Market: Some folks treat art more like a quick money-making game, buying and reselling fast for profit, without really caring about the art itself. This can make the market unpredictable for artists and/or serious collectors.

- Behind-the-Scenes Deals: Secret agreements about prices or guarantees between buyers, sellers, or the auction house can impair the fairness of the auction.

- Art Market Speculation: Auctions may be used for speculative trading, where art is bought and quickly resold for profit, often disregarding the artistic value. This speculation can create bubbles and an unstable market, affecting artists and genuine collectors.

- Money Laundering: It wasn’t until the 2001 passing of the Patriot Act legislation that auction houses were also required to implement robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures. But they only started really adhering to these requirements a few years ago. Prior, buying fine art, where a painting that can fit into your briefcase could cost $2 million, was a prime method for criminals and foreign governments to ‘launder’ criminal revenue.

So, while not all art auctions have these issues, the potential for such shenanigans shows why much more transparency would keep the playing field level for investors and collectors alike while benefiting the creators of the art.

“Outlook” by Julie Curtiss. 500% appreciation since 2019

Exploring the Art World as an Investment Opportunity

Did you know that investing in art isn’t just about owning beautiful pieces? It’s a whole financial adventure! Early on, experts like Baumol thought that art didn’t make as much money as, say, government bonds. But more recent studies show a more colorful picture – sometimes, art investments can really shine!

Art vs. The Stock Market: An Interesting Comparison

Researchers have been comparing art to big financial players like the S&P 500. Guess what? Art and the stock market don’t always dance to the same tune, which means art could add a nice twist to your investment portfolio.

How Do We Put a Price Tag on Art?

This is where it gets really interesting. Many writers try to figure out what art is worth. They use something called the hedonic price index, which looks at things like who made the art, what it’s made of, and how big it is. To make their points, the authors gather data from sources, such as artnet.com, which keeps track of famous artists’ auction sales.

What Did They Find Out?

- Roller Coaster Returns: Sometimes, art can outperform other investments or indices, like the S&P 500, but hold on tight – it can be a risky ride!

- Art and Stocks – A Gentle Connection: Art and stock market returns have a bit of a connection, but it’s not super strong. So, investing in art might add a little spice to your portfolio, but it’s not a total game-changer.

- Comparing Risks: Using a fancy model called the Capital Asset Pricing Model (CAPM), art may be a bit safer than stocks in some ways, but generally, they both tend to be positively correlated.

Wrapping It Up

The big takeaway? Art can be a great investment with some pretty impressive returns. But it’s not always a smooth journey, and there are many things to consider, like personal tastes and market trends. The paper suggests we need more research, especially looking at different types of art and more up-to-date data.

“Art is your wealth on the wall.”

– Larry Gagosian, Gagosian Gallery

© 2024 New Money Insider. All Rights Reserved.