How To Invest In Art? Why Art Is A Good Investment In 2024?

READING NOW

As we enter 2024, more people are realizing the benefits of investing in art. Although art isn’t easily turned into cash, it can be a wise investment when done right. This article explores why art is a good investment, offering advice for beginners on getting started. We’ll also cover what to consider when buying art and how to get the best price.

Why is art a valuable investment?

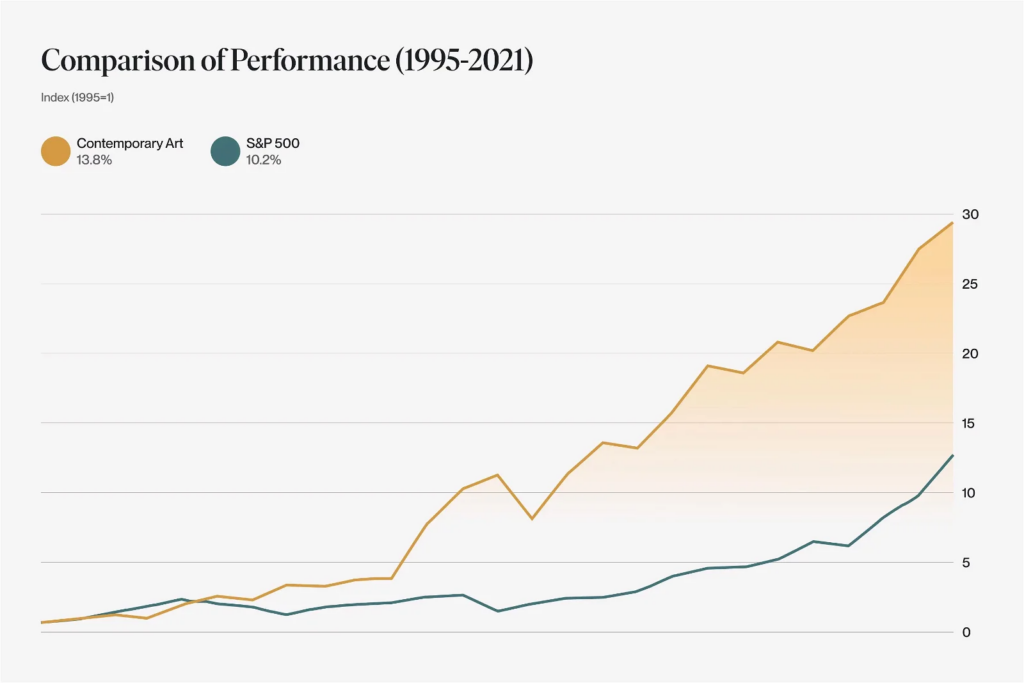

A long-term reliable investment

Art proves to be a stable investment because its value tends to remain constant over time, unlike stocks or other assets that fluctuate with the market. This stability was evident during the 2020 pandemic, where art values stayed steady while other markets experienced significant ups and downs. The resilience of investment-grade art is attributed to its independence from external events, contributing to a gradual increase in value over the years.

While art is a reliable long-term asset, it’s essential to note that it’s non-liquid. Unlike stocks that can be quickly converted to cash, selling art involves steps like appraisal and collaboration with auction houses or art consultants, making the process time-consuming. Many art investors include art collections in a diversified portfolio and as part of their estate planning for future generations.

Passion & prestige

Investing in art becomes more appealing when you have a genuine interest in it. When your investment aligns with your passion, you’re motivated to thoroughly research and understand the subject. If you’re fascinated by a specific artist or historical period, engaging with auction houses, consulting art advisors, and discovering rare pieces for your collection can be a rich learning experience. Moreover, owning an art collection carries a unique prestige not found in other asset classes, making it a noteworthy conversation starter at social gatherings and dinner parties.

Diversification of assets

As mentioned earlier, including art in your investment portfolio is beneficial because it diversifies your holdings. A diverse portfolio, with a mix of different assets, helps reduce risk and adds an element of interest to your overall investment strategy.

What to know before investing in art

Before diversifying your portfolio with artwork, consider the following points:

Small portfolio share

Art should only represent a small portion of your overall investment portfolio. It’s more like an extra, not a primary asset. While you might see some profits, relying on art for substantial returns is unlikely.

Realism in returns

Think of art investment as supplementary, similar to real estate. Don’t depend on it for consistent income. Also, be mindful of taxes on any gains, as the IRS treats art as a collectible.

Non-liquid nature

Fine art is a non-liquid or illiquid asset. Unlike stocks or savings accounts that can quickly generate cash, selling art takes time. This aspect should be considered in your overall asset allocation strategy.

Challenges of selling

Selling art, while possible, is not a quick process. Auction houses, the primary selling avenue, often charge substantial fees. Additionally, with art prices fluctuating, there are no guarantees that selling will result in a profit.

When should you invest in art?

Investing in art involves a strategic approach, with the general advice being to buy when prices are low and sell when they are high. This strategy is apparent in the art world, particularly with contemporary art. Emerging artists, early in their careers, are more affordable but also pose a higher risk. Collectors invest in these “emerging artists” with the hope that their value will rise over time, similar to the early supporters of artists like Basquiat, who have seen significant returns.

For those seeking a less risky investment, “established” or “mid-career” artists are a viable option. Although they come with a higher price tag, these artists have already made a mark in the art world, showing consistent sales and yearly returns. Examples include artists like Banksy and Damien Hirst, considered established figures.

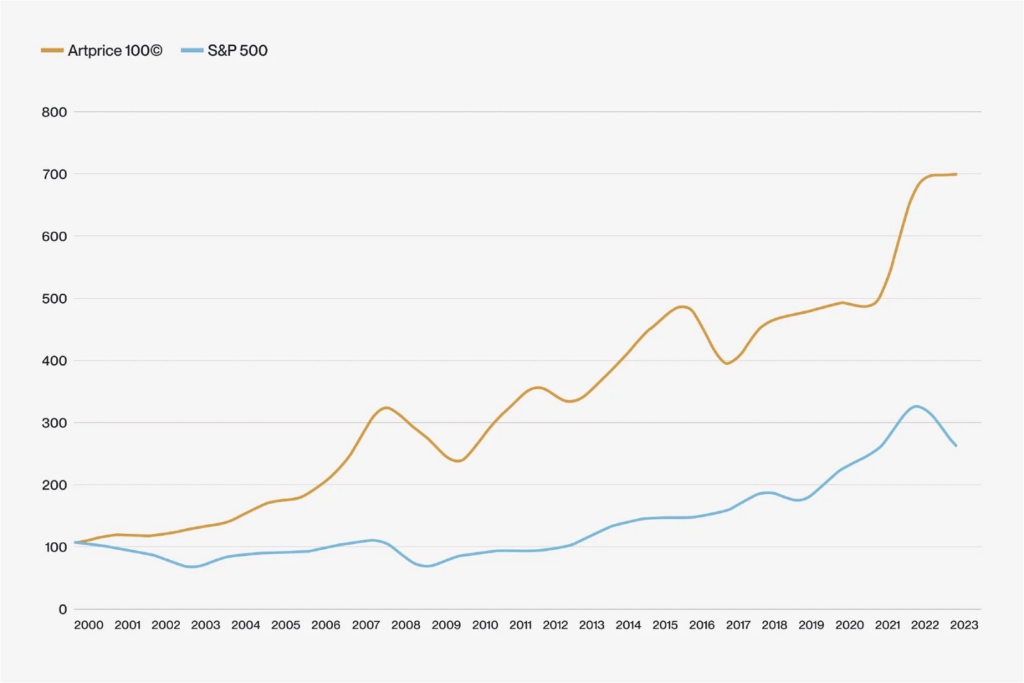

At the top tier are “Blue Chip” artists, the giants of the art world like Monet, Picasso, and Cezanne. While requiring a substantial upfront investment, the value of Blue Chip artists is highly assured. Their works are showcased in prestigious museums, and their sales prices are well-documented by indexes such as Artprice100, measuring the top-performing artists at auction within the last 5 years.

The art market in 2024: Key trends

1. The prints and multiples market is showing strong resilience

In 2023, the art market had fewer total sales, but more items were sold, especially in prints and multiples. This category, boosted by affordable artworks, had an 18% sales increase. In 2024, auction estimates are likely to be more realistic as the market adopts reasonable pricing.

2. Dominance of online sales

Despite a dip in figures, online sales maintained their significance in 2023, paralleling the overall decline in auction sales. These online platforms, catering to the lower price segment, are likely to remain a crucial entry point for diverse buyers in 2024.

3. Art and tech revolution

Anticipate a transformative shift in the art-buying landscape in 2024 as art and technology converge. This integration is set to redefine art acquisitions, offering improved transparency in managing and valuing collections. Increased adoption of the digital art-buying market is expected to reshape business practices in art investments.

4. Rise of private sales

Following a trend observed in 2023, private sales are expected to gain influence in 2024. Single-owner auctions faced varying degrees of success, leading to a predicted shift towards increased reliance on private transactions. This transition aims to mitigate risks, especially during economic volatility.

5. Dynamics of market segments

The future of the primary market, art fairs, and ultra-contemporary artists remains uncertain. The secondary market and established blue chip artists are expected to thrive. Larger galleries may strengthen their success by acquiring artworks and estates from well-established blue chip artists and moderately established emerging talents.

What to look for when buying art

Navigating the diverse art world requires narrowing your focus by selecting a specific genre or time period of interest. To aid in your search, consider collaborating with an art advisor or an art-focused investment company. These professionals can assist in determining the fair market value of art pieces, ensuring a wise investment.

Once you’ve identified your area of interest, be clear on the type of art you’re acquiring:

- Originals: One-of-a-kind pieces carry the highest price but offer the potential for significant returns.

- Prints or copies: More affordable, but less likely to yield substantial profits. High-quality prints, like giclées, closely resemble the original and may be more expensive. Limited editions of prints tend to hold more value.

Reproductions:

Mass-produced copies lacking a limited run. They are the most affordable but are also the least likely to appreciate in value.

Regardless of your choice, prioritize quality and condition. For substantial investments, consider investing in an appraisal to ensure you make informed decisions about the artworks you acquire.

Where to look for art

Exploring various avenues can help you invest in art, with different platforms catering to diverse preferences:

- Museums and art galleries: Museums and galleries are excellent places to explore and invest in art. Art galleries often specialize in works by established and emerging artists, offering curated selections for purchase.

- Online art marketplaces: Platforms like Saatchi Art, Artsy, and Artfinder provide opportunities to browse and buy art online from a wide range of artists and galleries. Online investment options, such as Masterworks, allow you to buy shares of art under expert guidance.

- Auction houses: Auction houses like Christie’s and Sotheby’s auction high-end art pieces, providing a chance to bid on artworks in a competitive environment. Be mindful of buyer’s premiums in addition to the auction price.

- Art fairs: Art fairs gather galleries and artists worldwide, showcasing artworks for sale. Local art fairs offer opportunities to purchase art from emerging or local artists.

- Direct sales from artists: Many artists sell their works directly through personal websites or social media platforms.

Is Art (still) a good investment in 2024?

The Federal Reserve’s elusive stance on potential interest rate decreases in 2024 is causing uncertainty and erratic behavior in traditional markets.

At the end of 2023, there was a notable surge in stock prices, particularly in tech and AI stocks. This surge was fueled by the anticipation that the U.S. Federal Reserve might lower interest rates in the early half of 2024.

However, the release of the Meeting Minutes from the Bank’s December interest rate committee meeting has tempered these expectations. The Minutes indicated an “unusually elevated degree of uncertainty” regarding future policy decisions. Some members suggested maintaining higher fund rates if inflation persists, while others proposed the possibility of further hikes, contingent on evolving conditions.

This news has not been well-received by the markets, contrary to their expectations. The use of cautious language by the Reserve Bank has unsettled investors, evident in the downturn of stocks in the initial days of the new year, following the rally at the end of 2023.

Yes, Art is a good investment in 2024!

Amidst the current uncertainty, alternative assets are gaining appeal as safe havens for parking cash. This shift is driven by the fact that alternative assets often exhibit a lower correlation with major economic events and stimuli, including policy announcements from entities like the Federal Reserve. This stands in contrast to traditional assets like stocks and bonds, which can be more directly influenced by such events. Investors are increasingly drawn to alternative assets as a means of diversification and risk mitigation in the face of unpredictability in traditional markets.

Source: https://hedonova.io/resources/blog/how-to-invest-in-art-why-art-is-a-good-investment-in-2024

© 2024 New Money Insider. All Rights Reserved.